Comparing 11 vendors in Commercial Security System Startups across 0 criteria.

The commercial security system market is evolving rapidly, driven by growing concerns around safety, infrastructure protection, and smart building integration. It encompasses video surveillance, access control, fire protection, and cybersecurity solutions tailored for commercial spaces. Innovations in biometric authentication, cloud-based platforms, and AI-powered analytics are enhancing threat detection and operational efficiency. The market is also benefiting from smart city initiatives and rising demand for integrated systems that streamline monitoring, automate responses, and ensure regulatory compliance across diverse sectors.

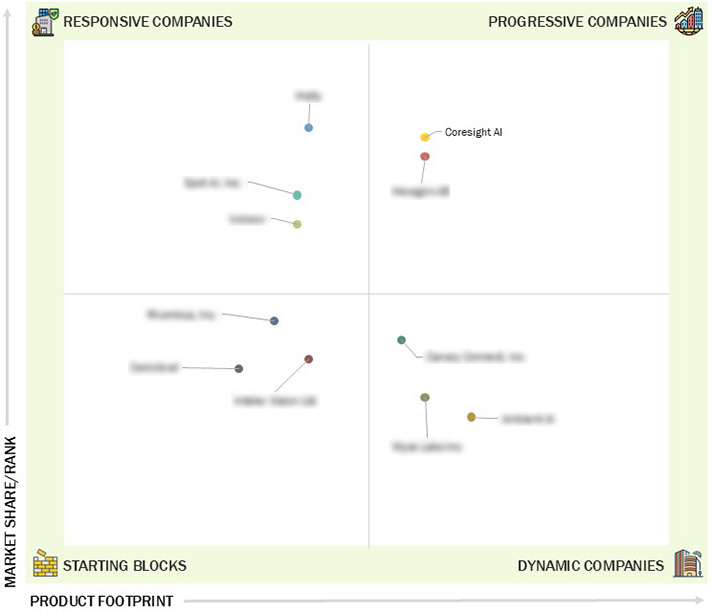

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Inclusions and Exclusions

1.3.2 Markets Covered and Regional Scope

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing terrorism and organized crime

2.2.1.2 Expanding construction industry

2.2.1.3 Increasing Use of IP cameras in security applications

2.2.1.4 Implementation of robust fire protection standards for

effective fire security

2.2.1.5 Growing Use of IoT-based security systems supported by

cloud platforms

2.2.1.6 Reduction in insurance expenses by mitigating security

risks

2.2.1.7 Enabling identification and preparation for potential

environmental disasters

2.2.2 Restraints

2.2.2.1 High setup, maintenance, and ownership costs of commercial

security systems

2.2.2.2 Privacy and security concerns due to potential data

breaches and unauthorized access to sensitive information

2.2.2.3 Reluctance to adopt new technologies hindering

implementation

2.2.3 Opportunities

2.2.3.1 Increasing investments in smart city development and city

surveillance solutions

2.2.3.2 Rising adoption of ACaaS and VSaaS

2.2.3.3 Need to upgrade fire protection-related regulatory

compliances

2.2.3.4 Advancement and adoption of artificial intelligence (AI)

and machine learning

2.2.4 Challenges

2.2.4.1 Cyber threats to commercial security systems

2.2.4.2 Complexity of integrating User interfaces with fire

protection systems

2.2.4.3 Supply chain-related risks of commercial security systems

2.2.4.4 Rapid evolution of technology

2.3 Value Chain Analysis

2.3.1 Research & Development

2.3.2 Solution Manufacturers

2.3.3 System Integrators

2.3.4 End Users

2.3.5 Marketing & Sales

2.4 Ecosystem Analysis

2.5 Investment and Funding Scenario

2.6 Trends/Disruptions Impacting Customer Business

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.1.1 Internet of Things (IoT)

2.7.1.2 Cloud computing

2.7.1.3 Video analytics

2.7.1.4 Cloud-based biometric system

2.7.1.5 Finger-vein recognition

2.7.1.6 Real-time location systems

2.7.1.7 RFID-enabled sensors and robotics

2.7.2 Complementary Technologies

2.7.2.1 Video image smoke and flame detection systems

2.7.2.2 Artificial intelligence

2.7.2.3 Access control systems

2.7.2.4 Cybersecurity solutions

2.7.2.5 Big data analytics

2.7.2.6 Liveness detection

2.7.2.7 Multimodal biometrics

2.7.2.8 Cloud-based RFID

2.7.2.9 RFID in IoT

2.7.2.10 Integration of RFID with blockchain

2.7.3 Adjacent Technologies

2.7.3.1 Cloud-based solutions

2.7.3.2 Drones and aerial surveillance

2.7.3.3 Biometric systems

2.7.3.4 Building management systems

2.7.3.5 Quantum RFID

2.7.3.6 Near-field communication and RFID hybrid solutions

2.7.3.7 Miniaturized and flexible RFID tags

2.7.4 Impact of AI/Gen AI on Commercial Security System Market

2.7.5 Top Use Cases and Market Potential

2.7.5.1 Object detection and tracking

2.7.5.2 Crowd management

2.7.5.3 Incident detection

2.7.5.4 Access control integration

2.7.5.5 Retail analytics

2.7.5.6 Data-driven detection making

2.8 Porter’s Five Forces Analysis

2.8.1 Intensity of Competitive Rivalry

2.8.2 Threat of New Entrants

2.8.3 Threat of Substitutes

2.8.4 Bargaining Power of Buyers

2.8.5 Bargaining Power of Suppliers

2.9 Patent Analysis, 2015–2024

2.10 Key Conferences and Events, 2025–2026

2.11 US Tariff Impact on Commercial Security System Market

2.11.1 Introduction

2.11.2 Key Tariff Rates

2.11.3 Price Impact Analysis

2.11.4 Impact on Key Countries/Regions

2.11.4.1 US

2.11.4.2 Europe

2.11.4.3 Asia Pacific

2.11.5 Impact on End-Use Industries

3.1 Overview

3.2 Key Players’ Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics, 2024

3.6 Brand/Product Comparative Analysis

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2024

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches & Developments

3.8.2 Deals

4.1 IRISITY

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 SPOT AI, INC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 IVIDEON

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 RHOMBUS, INC.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 CAMCLOUD

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 INTELEX VISION LTD

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 CORESIGHT AI

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 HEXAGON AB

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 CANARY CONNECT, INC.

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 AMBIENT AI

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 WYZE LABS INC.

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

AD HOC NEWS

AD HOC NEWS

Jan 2026

Jan 2026