Comparing 6 vendors in Crystal Oscillator Startups across 0 criteria.

The global crystal oscillator market has witnessed steady growth and technological advancements, underpinning numerous sectors such as telecommunications, automotive, consumer electronics, and aerospace and defense. These electronic devices utilize the mechanical resonance of vibrating crystals, primarily quartz, to generate precise frequency signals. Their ability to provide stable and accurate clock signals is crucial for applications in modern electronic devices, contributing to their widespread adoption across industries.

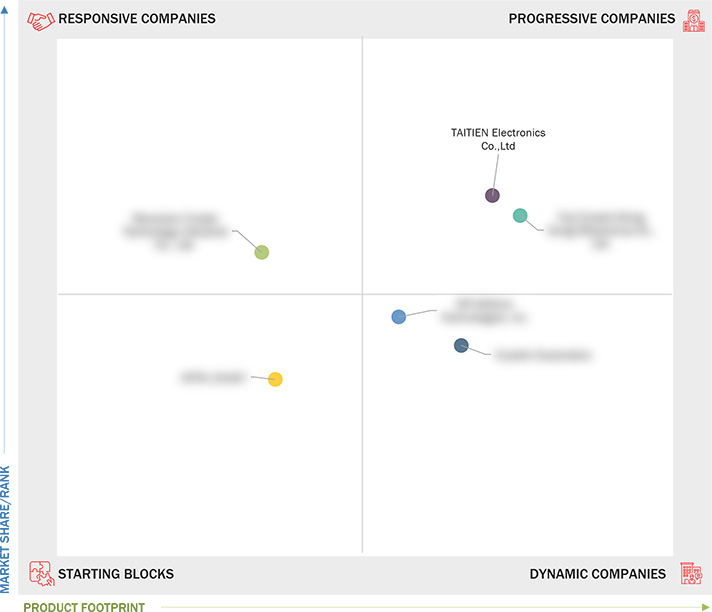

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing adoption of crystal oscillators in aerospace & defense applications

2.2.1.2 Growing use of crystal oscillators in automotive sector

2.2.1.3 Surging implementation of crystal oscillators in consumer electronics

2.2.1.4 Rising deployment of crystal oscillators in 5G and 6G networks

2.2.2 Restraints

2.2.2.1 Availability of cost-effective and more reliable alternative technologies

2.2.3 Opportunities

2.2.3.1 Growing demand for miniature electronic devices with improved performance

2.2.3.2 Increasing adoption of advanced automotive electronics

2.2.4 Challenges

2.2.4.1 Frequency drift issues in crystal oscillators after extended use

2.3 Value Chain Analysis

2.4 Ecosystem Analysis

2.5 Investment and Funding Scenario

2.6 Trends/Disruptions Impacting Customer Business

2.7 Impact of AI on Crystal Oscillator Market

2.8 Technology Analysis

2.8.1 Key Technologies

2.8.1.1 MEMS-based oscillator

2.8.2 Complementary Technologies

2.8.2.1 Hybrid microcircuit technology

2.8.3 Adjacent Technologies

2.8.3.1 Green crystal technology

2.9 Patent Analysis

2.10 Trade Analysis

2.10.1 Import Data (HS Code 854160)

2.10.2 Export Data (HS Code 854160)

2.11 Porter’s Five Forces Analysis

2.11.1 Bargaining Power of Suppliers

2.11.2 Bargaining Power of Buyers

2.11.3 Threat of New Entrants

2.11.4 Threat of Substitutes

2.11.5 Intensity of Competitive Rivalry

2.12 Key Conferences and Events, 2025

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2021–2024

3.3 Revenue Analysis of Top 3 Players, 2019–2023

3.4 Market Share Analysis, 2023

3.5 Company Valuation and Financial Metrics, 2024

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2024

3.7.5.1 Detailed list of startups/SMEs

3.7.5.2 Competitive benchmarking of startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Expansions

4.1 MTI-MILLIREN TECHNOLOGIES, INC.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 FUJI CRYSTAL (HONG KONG) ELECTRONICS CO., LTD.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 SHENZHEN CRYSTAL TECHNOLOGY INDUSTRIAL CO., LTD.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 AXTAL GMBH

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 TAITIEN ELECTRONICS CO., LTD

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 CRYSTEK CORPORATION

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments