Comparing 11 vendors in Data Center GPU Startups across 0 criteria.

Data center graphics processing units (GPUs) are discrete accelerators that enable and enhance emerging technologies such as artificial intelligence (AI), rendering, analytics, and simulation/modeling. GPUs are widely used in both on-premises and cloud data center environments. Data center GPUs are used alongside CPUs to meet the elevated computational demands of emerging use cases such as AI, analytics, and 3D rendering. The major factors driving the growth of the data center GPU market include the adoption of AI and machine learning, demand for high-performance computing (HPC), and cloud computing expansion.

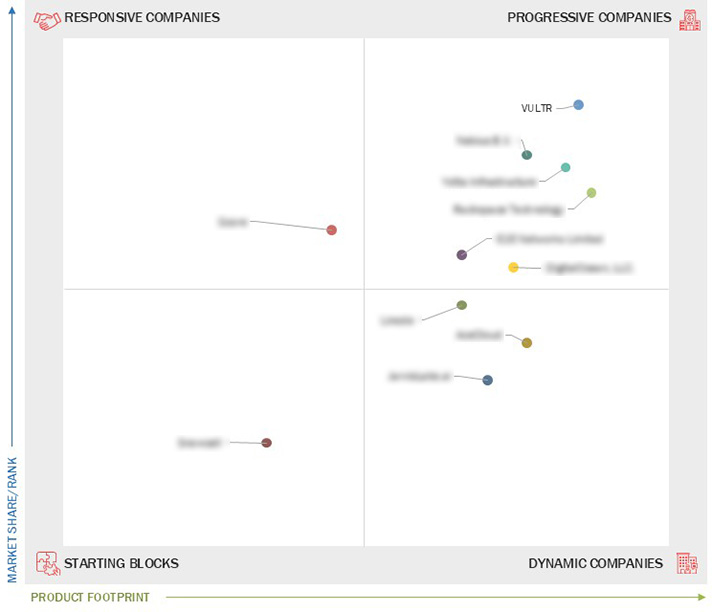

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Growing adoption of AI and machine learning

2.2.1.2 Demand for high-performance computing (HPC)

2.2.1.3 Cloud computing expansion

2.2.2 Restraints

2.2.2.1 High costs of GPUs and infrastructure

2.2.2.2 Short product lifecycle

2.2.3 Opportunities

2.2.3.1 Growth in autonomous systems

2.2.3.2 Emergence of edge computing

2.2.3.3 Advancements in quantum computing synergy

2.2.4 Challenges

2.2.4.1 Existence of alternative technologies

2.2.4.2 Stringent regulatory framework

2.2.4.3 Supply chain disruptions

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

4.1 VULTR

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Yotta Infrastructure

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Snowcell

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Rackspace Technology

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Nebius B.V.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 Linode LLC.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Jarvislabs.ai

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Gcore

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 E2E Networks Limited

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 DigitalOcean, LLC

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 AceCloud

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

marketbeat

marketbeat

Feb 2026

Feb 2026