Comparing 14 vendors in Edge AI Hardware Startups across 0 criteria.

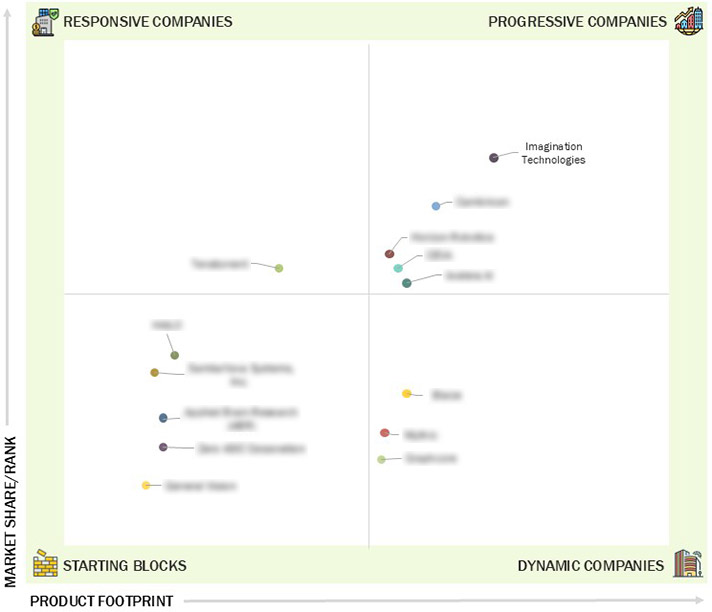

The edge AI hardware market is evolving with a diverse mix of startups and SMEs offering innovative solutions across industries. Companies are categorized based on their strategic maturity, ranging from progressive firms with strong product portfolios to dynamic players leveraging partnerships and responsive vendors focused on expansion. Some are still in early stages, working to establish traction. The market emphasizes inference capabilities, device versatility, and vertical-specific applications, reflecting a growing demand for efficient, adaptable AI hardware at the edge..

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Inclusions and Exclusions

1.3.2 Markets Covered and Regional Scope

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Need for real-time data processing and reduced cloud

dependency

2.2.1.2 Development of dedicated AI processing units for edge

device applications

2.2.1.3 Necessity to optimize data management and reduce cloud

infrastructure load

2.2.2 Restraints

2.2.2.1 Complexities associated with network implementation

2.2.3 Opportunities

2.2.3.1 Advancements in edge AI hardware through generative AI

workload optimization

2.2.3.2 Development of on-device visual processors for next-

generation mobile AI applications

2.2.3.3 Growing integration of edge computing across robotics,

automotive, and industrial sectors

2.2.3.4 Opportunities in ultra-low latency AI applications with

5G-powered edge infrastructure

2.2.4 Challenges

2.2.4.1 Balancing performance and power consumption in edge AI

systems

2.2.4.2 Developing cohesive edge AI standards across diverse

industry requirements

2.2.4.3 Shortage of skilled workforce

2.3 Supply Chain Analysis

2.4 Trends/Disruptions Impacting Customer Business

2.5 Ecosystem Analysis

2.6 Porter’s Five Forces Analysis

2.6.1 Threat of New Entrants

2.6.2 Threat of Substitutes

2.6.3 Bargaining Power of Suppliers

2.6.4 Bargaining Power of Buyers

2.6.5 Intensity of Competitive Rivalry

2.7 Investment and Funding Scenario

2.8 Technology Analysis

2.8.1 Key Technologies

2.8.1.1 Fog computing

2.8.2 Complementary Technologies

2.8.2.1 Generative AI

2.8.3 Adjacent Technologies

2.8.3.1 Blockchain

2.9 Patent Analysis

2.10 Key Conferences and Events, 2025–2026

2.11 AI Impact on Market

2.12 US Tariff Impact on Market

2.12.1 Introduction

2.12.2 Key Tariff Rates

2.12.3 Price Impact Analysis

2.12.4 Most-Impacted Regions/Countries

2.12.4.1 US

2.12.4.2 Europe

2.12.4.3 Asia Pacific

2.12.5 Vertical-Level Impact

3.1 Overview

3.2 Key Player Strategies/Right to Win, January 2020–May 2025

3.3 Revenue Analysis, 2020–2024

3.4 Market Share Analysis, 2024

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2024

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMES

3.8 Competitive Scenario

3.8.1 Product Launches/Enhancements

3.8.2 Deals

3.8.3 Other Developments

4.1 AXELERA AI

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 IMAGINATION TECHNOLOGIES

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 CAMBRICON

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 TENSTORRENT

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 BLAIZE

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 GENERAL VISION INC.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 MYTHIC

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 ZERO ASIC CORPORATION

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 APPLIED BRAIN RESEARCH (ABR)

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 HORIZON ROBOTICS

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 CEVA, INC.

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 GRAPHCORE

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 SAMBANOVA SYSTEMS, INC.

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 HAILO

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

Applied Brain Research Inc.

Applied Brain Research Inc.

Jan 2026

Jan 2026