Comparing 12 vendors in Embodied AI Startups across 0 criteria.

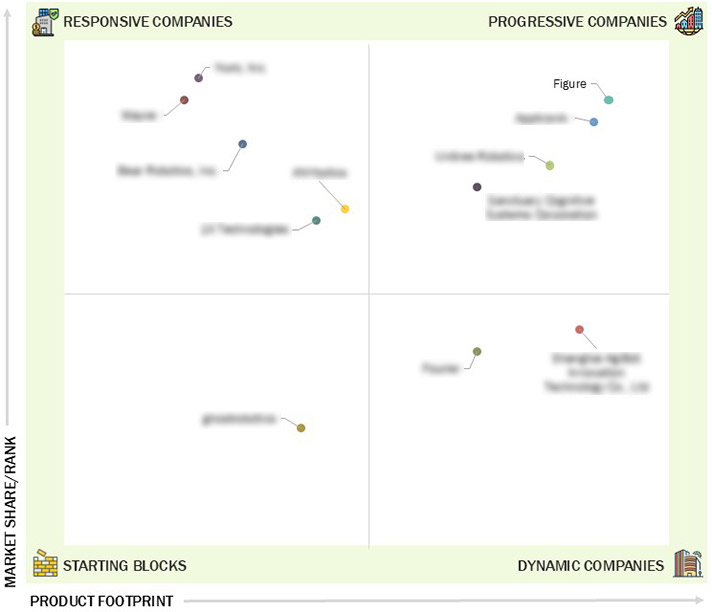

The embodied AI market is rapidly evolving, driven by a diverse mix of startups and established players developing intelligent physical systems like robots and autonomous platforms. Companies are categorized into progressive, responsive, dynamic, and emerging groups based on their product innovation, market strategies, and geographic reach. Key players focus on expanding their portfolios through partnerships, acquisitions, and R&D investments. This competitive landscape reflects a fragmented yet innovation-rich ecosystem, with startups playing a crucial role in shaping future applications across industries.

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Units Considered

1.6 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Advancements in robotics and AI integration to enhance

machine autonomy

2.2.1.2 Increasing demand for human-robot interaction

2.2.1.3 Growth of smart assistants and service robots in consumer

markets

2.2.1.4 Real-world mobility with embodied AI in autonomous systems

2.2.2 Restraints

2.2.2.1 Ethical dilemmas in human-robot interactions

2.2.2.2 Privacy concerns in public and private environments

2.2.3 Opportunities

2.2.3.1 Expanding applications in healthcare and elderly care

2.2.3.2 Transforming industrial automation with embodied AI and

collaborative robots

2.2.3.3 Learning and well-being through educational and social

robots

2.2.3.4 Advancements in military capabilities using embodied AI in

tactical operations

2.2.4 Challenges

2.2.4.1 Data scarcity in collecting real-world training sets

2.2.4.2 Fragmentation in standardized platforms and protocols

2.3 Trends/Disruptions Impacting Customers’ Businesses

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario, 2021–2025

2.7 Porter’s Five Forces Analysis

2.7.1 Intensity of Competitive Rivalry

2.7.2 Bargaining Power of Suppliers

2.7.3 Bargaining Power of Buyers

2.7.4 Threat of Substitutes

2.7.5 Threat of New Entrants

2.8 Patent Analysis

2.9 Technology Analysis

2.9.1 Key Technologies

2.9.1.1 Simultaneous Localization and Mapping (SLAM)

2.9.1.2 Reinforcement Learning (RL)

2.9.1.3 Sensor Fusion

2.9.1.4 Computer Vision

2.9.1.5 Natural Language Processing (NLP)

2.9.2 Complementary Technologies

2.9.2.1 Cloud Robotics Platforms

2.9.2.2 Human-Machine Interfaces (HMIs)

2.9.2.3 Simulation & Digital Twins

2.9.3 Adjacent Technologies

2.9.3.1 Neuromorphic Computing

2.9.3.2 AR/VR (Augmented & Virtual Reality)

2.10 Key Conferences and Events, 2025–2026

2.11 Impact of US Tariffs—Embodied AI Market

2.11.1 Introduction

2.11.2 Key Tariff Rates

2.11.3 Price Impact Analysis

2.11.4 Impact on Countries/Regions

2.11.4.1 US

2.11.4.2 Europe

2.11.4.3 Asia Pacific

2.11.5 Impact on End-Use Industries

2.11.5.1 Healthcare

2.11.5.2 Automation & manufacturing

2.11.5.3 Automotive

2.11.5.4 Logistics & supply chain

2.11.5.5 Defense & security

2.11.6 Retail

2.11.7 Education

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2022–2025

3.3 Revenue Analysis, 2021–2024

3.4 Market Share Analysis, 2024

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix for Embodied AI: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2024

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches & Enhancements

3.8.2 Deals

4.1 FIGURE

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 SANCTUARY COGNITIVE SYSTEMS CORPORATION

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 1X TECHNOLOGIES

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 SHANGHAI AGIBOT INNOVATION TECHNOLOGY CO., LTD.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 ANYBOTICS

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 GHOSTROBOTICS

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 BEAR ROBOTICS, INC.

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 APPTRONIK

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 NURO, INC.

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 UNITREE ROBOTICS

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 WAYVE

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 FOURIER

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

Interesting Engineering

Interesting Engineering

Dec 2025

Dec 2025