Comparing 9 vendors in Energy Harvesting System Startups across 0 criteria.

The energy harvesting systems market is evolving as a pivotal solution in the era of sustainable technology. With increasing concerns over energy efficiency and sustainability, these systems have risen as essential tools to harness ambient energy from sources such as solar, thermal, kinetic, and radio frequency (RF) energy. The demand for these systems stems from their ability to power devices autonomously, significantly reducing reliance on conventional batteries and lowering maintenance costs. This adaptation aligns with global shifts towards eco-friendly solutions, driven by governmental regulations favoring green energy and the burgeoning integration of Internet of Things (IoT) devices in smart homes and automated building systems.

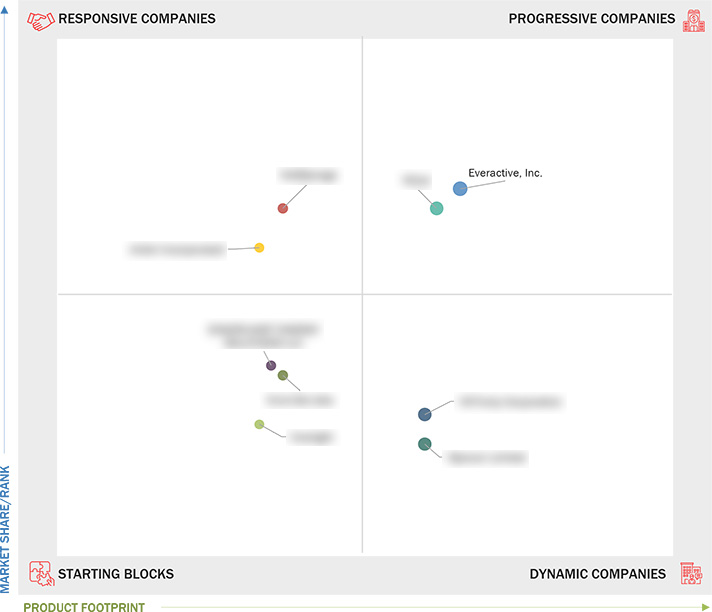

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising demand for energy-efficient and sustainable solutions

2.2.1.2 Integration of IoT devices in building & home automation

2.2.1.3 Government regulations and incentives for green energy

2.2.2 Restraints

2.2.2.1 High initial cost of energy harvesting systems

2.2.2.2 Limited power output and storage challenges

2.2.2.3 Limitations in remotely installed networking modules

2.2.2.4 Geographic and environmental constraints

2.2.3 Opportunities

2.2.3.1 Expansion of smart cities and infrastructure projects

2.2.3.2 Adoption of sensors in wearable electronics

2.2.3.3 Integration of energy harvesting in automotive

2.2.4 Challenges

2.2.4.1 Integration of energy harvesting in automotive

2.2.4.2 Slow adoption in large-scale industrial applications

2.2.4.3 Integration of energy harvesting systems into existing infrastructure

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

4.1 Everactive, Inc.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Wiliot

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 VoltStorage

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 AMBRI INC

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 WITRICITY

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 8power Limited

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 INSOLIGHT

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Enervibe labs

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 ENGOPLANET ENERGY SOLUTIONS LL

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

3DPrint.com

3DPrint.com

Jul 2024

Jul 2024