Comparing 9 vendors in Exoskeleton Startups across 0 criteria.

Exoskeletons are wearable robotic systems designed to enhance human capabilities by supporting mobility, reducing fatigue, and aiding rehabilitation. They are increasingly used in healthcare, defense, and industrial sectors to assist with physical tasks and improve endurance. Emerging trends include soft exosuits, AI-based adaptive systems, and ergonomic designs. These innovations are driven by advancements in robotics, material science, and battery technology. The market is expanding due to growing interest in assistive technologies and strategic collaborations across industries.

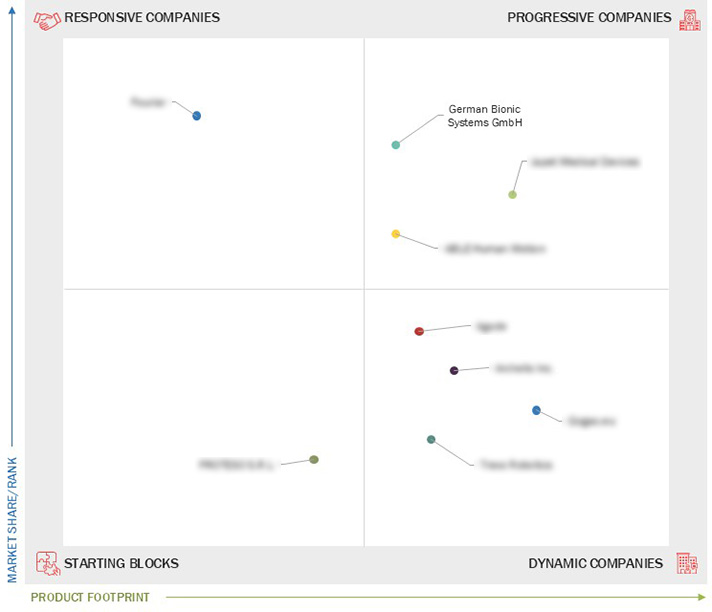

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising demand for robotic rehabilitation solutions from healthcare sector

2.2.1.2 Increased adoption in industrial and manufacturing sectors

2.2.1.3 Increased FDA approvals for medical exoskeletons

2.2.2 Restraints

2.2.2.1 High cost of ownership

2.2.3 Opportunities

2.2.3.1 Integration of exoskeletons with AI and IoT technologies

2.2.3.2 Increasing adoption of exoskeletons in military & defense sector

2.2.4 Challenges

2.2.4.1 Comfort and movement interference for workers

2.2.4.2 Power supply limitations and operational downtime

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Acquisitions

3.8.3 Partnerships, Collaborations, Alliances and Joint Ventures

4.1 German Bionic Systems GmbH

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Japet Medical Devices

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 ABLE Human Motion

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Fourier

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Agade

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 Archelis Inc.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 TREXO ROBOTICS

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Gogao.eu

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 PROTESO S.R.L

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments