Comparing 4 vendors in Fiber Optic Components startups across 0 criteria.

The fiber optic components market is an evolving sector, defined by its critical role in transmitting information through glass or plastic fibers over substantial distances, primarily characterized by its superior data transmission capabilities compared to traditional electric cables. These components are pivotal for a variety of applications, including telecommunications, datacenters, distributed sensing, and lighting. The demand for fiber optic components is being propelled by the increasing deployment of data centers, rising internet penetration, and escalating data traffic which necessitates superior bandwidth solutions. Furthermore, fiber optic technology is increasingly vital in communication sectors due to its resilience to electromagnetic interference and its ability to transmit data securely and efficiently. The market's expansion is complemented by advancements in technologies such as 5G networks and the integration of AI and IoT, which are set to revolutionize data transmission capabilities. Emerging economies are seeing considerable developments in telecommunication infrastructure, fostering a conducive environment for the market’s growth. However, the market faces challenges such as optical network security threats and the high costs associated with the installation of fiber optics in diverse terrains. Despite these, the market is poised for substantial growth, reflected in its projected valuation increase from USD 32.69 billion in 2024 to USD 58.65 billion by 2030.

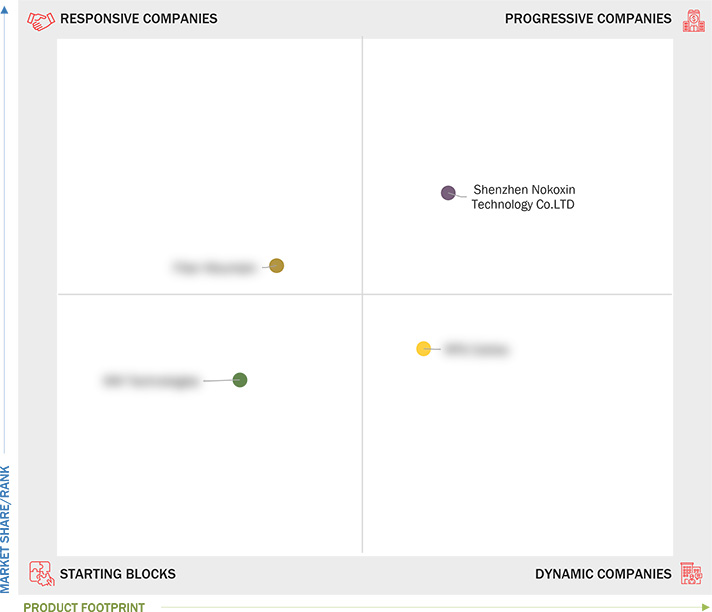

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.1.1.1 Increasing deployment of data centers

2.1.1.2 Growing internet penetration and data traffic

2.1.1.3 Rising demand for bandwidth

2.2.2 Restraints

2.2.2.1 Prone to physical damage and transmission loss

2.2.3 Opportunities

2.2.3.1 Increasing adoption of fiber optic components in the digital signage market

2.2.3.2 Rising demand for fiber optics due to reliability

2.2.3.3 Expansion of telecom infrastructure in developing economies

2.2.4 Challenges

2.2.4.1 Threat to optical network security

2.2.4.2 High cost of installation and difficulty in installing in different terrains

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

4.1 Fiber Mountain

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 MW Technologies

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 RPG Cables

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Shenzhen Nokoxin Technology Co.LTD

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

Yahoo Finance

Yahoo Finance

Nov 2023

Nov 2023