Comparing 4 vendors in Industrial Data Management Startups across 0 criteria.

Industrial data management encompasses the structured collection, storage, processing, and analysis of data generated from industrial activities to drive efficiency, informed decision-making, and regulatory compliance. This process integrates technologies such as IoT sensors, data acquisition (DAQ) systems, cloud computing, and AI-powered analytics to monitor equipment, optimize production, and support predictive maintenance strategies. With real-time data processing and automation, it enhances operational visibility, minimizes downtime, and boosts product quality across industries, including manufacturing, energy, BFSI, and healthcare.

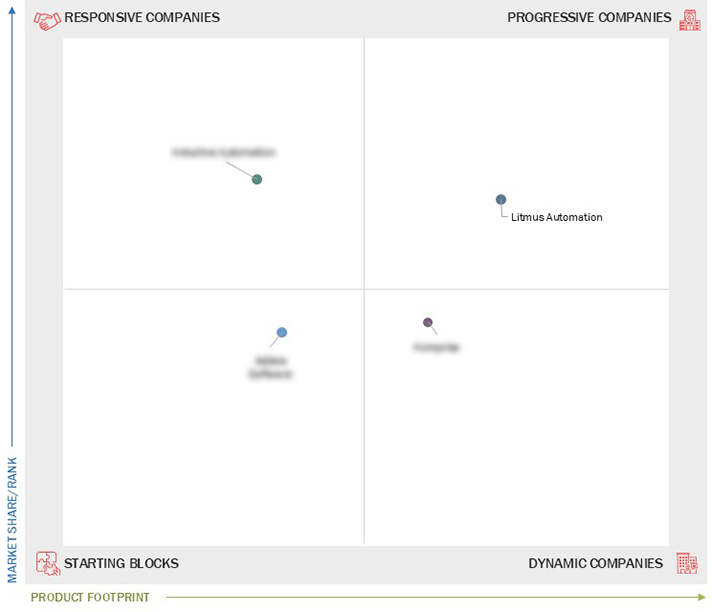

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Expanding unstructured data

2.2.1.2 Increasing cyber threats in industrial environments

2.2.1.3 Growing popularity of IOT in industrial environments

2.2.2 Restraints

2.2.2.1 Complexities associated with integrating industrial data management solutions into existing infrastructure

2.2.2.2 Significant investments in hardware

2.2.3 Opportunities

2.2.3.1 Convergence of information technology and operational technology

2.2.3.2 Increasing adoption of cloud computing in industrial applications

2.2.4 Challenges

2.2.4.1 Ensuring high-quality and accurate data

2.2.4.2 Lack of standardiztion in industrial data management

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario and Trends

4.1 Litmus Automation

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Inductive automation

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Komprise

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Astera Software

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

Astera Software

Astera Software

Jun 2023

Jun 2023