Comparing 8 vendors in Industrial Edge startups across 0 criteria.

The industrial edge market is rapidly evolving, driven by technological advancements and growing industry demands. Its growth is primarily fueled by the need for real-time data processing and on-site decision-making. Edge technology is transforming industrial operations by enabling faster, more secure, and autonomous systems that integrate on-premises infrastructure with cloud capabilities. The deployment of 5G networks further boosts this market by providing ultra-low latency and high bandwidth, enhancing machine-to-machine communication and overall connectivity.

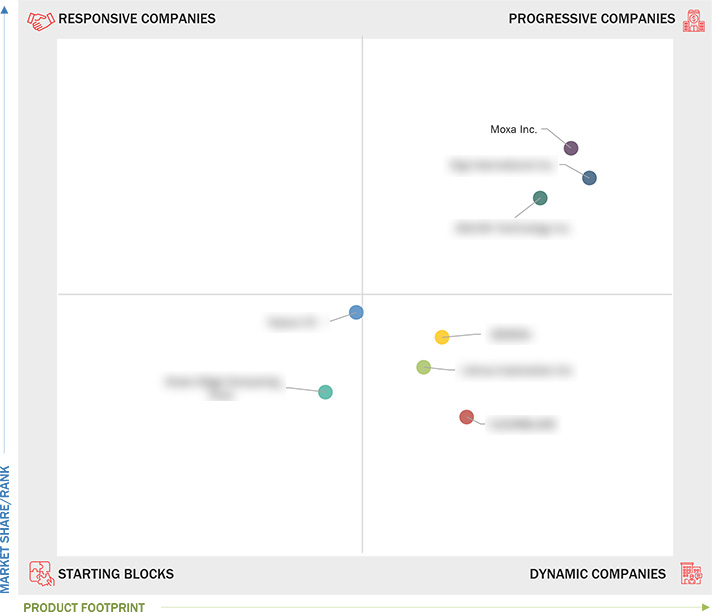

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 5G network rollout

2.2.1.2 Reduced latency and bandwidth costs

2.2.1.3 Demand for real-time decision-making in process industries

2.2.1.4 Enhanced resilience and continuity

2.2.1.5 Surge in IoT adoption

2.2.2 Restraints

2.2.2.1 Complex infrastructure requirements

2.2.2.2 Interoperability issues

2.2.3 Opportunities

2.2.3.1 Expansion of smart manufacturing

2.2.3.2 Growth of autonomous systems

2.2.3.3 Scalable and flexible architectures

2.2.4 Challenges

2.2.4.1 Latency variability

2.2.4.2 Cybersecurity concerns

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

4.1 Moxa Inc.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Digi International Inc.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 ADLINK Technology Inc.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Litmus Automation Inc

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 ZEDEDA

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 CLEARBLADE

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Vapour IO

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Green Edge Computing Corp.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

DataCenterNews Asia Pacific

DataCenterNews Asia Pacific

Jan 2026

Jan 2026