Comparing 9 vendors in Industrial Metrology Startups across 0 criteria.

The landscape of industrial metrology is undergoing a transformative shift, driven by the growing demand for high-precision measurement systems across various global industries. As manufacturing processes become increasingly complex, the need for accurate, reliable, and efficient metrology solutions has never been more pronounced. At the heart of this transformation are advances in technology and the increased adoption of digital solutions that enhance measurement accuracy, data integration, and automation capabilities. The integration of IoT sensors into metrology solutions and the rising focus on quality control in precision manufacturing are pivotal market drivers.

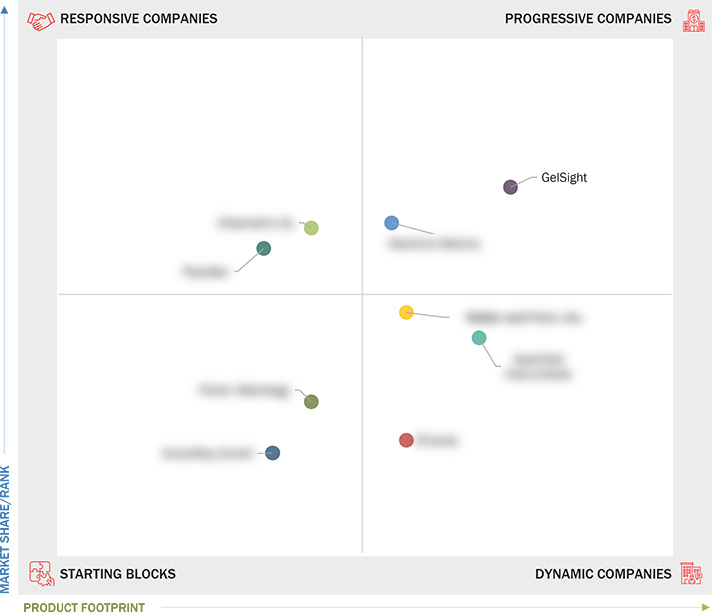

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing R&D investment in 3D metrology

2.2.1.2 Rising integration of IoT sensors into industrial metrology solutions

2.2.1.3 Growing focus on quality control and inspection in precision manufacturing

2.2.1.4 Mounting deployment of autonomous driving technologies

2.2.2 Restraints

2.2.2.1 Limited technical knowledge regarding integration of industrial metrology with robots and 3D models

2.2.2.2 Concerns regarding big data handling and manufacturing unit configuration

2.2.3 Opportunities

2.2.3.1 Growing emphasis on quality control and regulatory compliance in food industry

2.2.3.2 Increasing adoption of cloud-based, IIoT, and AI technologies to store and analyze metrological data

2.2.4 Challenges

2.2.4.1 Growing concern about cybersecurity

2.2.4.2 Shortage of easy-to-use 3D metrology software solutions

2.3 Supply Chain Analysis

2.4 Porter’s Five Forces Analysis

2.4.1 Threat of New Entrants

2.4.2 Threat of Substitutes

2.4.3 Bargaining Power of Buyers

2.4.4 Bargaining Power of Suppliers

2.4.5 Intensity of Competitive Rivalry

2.5 Investment and Funding Scenario

2.6 Trade Analysis

2.7 Ecosystem Analysis

2.8 Trends/Disruptions Impacting Customer Business

2.9 Patent Analysis

2.10 Technology Analysis

2.10.1 Key Technologies

2.10.1.1 Optical metrology

2.10.2 Complementary Technologies

2.10.2.1 Digital twin

2.10.2.2 Industrial Internet of Things (IIoT)

2.10.3 Adjacent Technologies

2.10.3.1 Artificial intelligence (AI) and machine learning (ML)

2.10.3.2 Edge computing

2.11 Key Conferences and Events, 2025–2026

2.12 Impact of AI/Gen AI on Industrial Metrology Market

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2020–2025

3.3 Market Share Analysis, 2024

3.4 Revenue Analysis, 2022–2024

3.5 Company Valuation and Financial Metrics, 2025

3.6 Brand Comparison

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2024

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Other Developments

4.1 CHIPMETRIC OY

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 FOURJAW

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 POLLEN METROLOGY

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 SMARTRAY GMBH

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 GELSIGHT

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 MACHINE METRICS

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 MATTER AND FORM, INC.

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 NEARFIELD INSTRUMENTS

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 SILVERAY

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

Metrology and Quality News

Metrology and Quality News

Jan 2026

Jan 2026