Comparing 5 vendors in Livestock Identification Startups across 0 criteria.

The livestock identification market has evolved significantly over the years, driven by technological advancements and increasing demand for enhanced traceability in livestock management. This market is primarily characterized by the integration of cutting-edge technologies such as RFID, GPS, AI, and blockchain to optimize herd health, productivity, and traceability

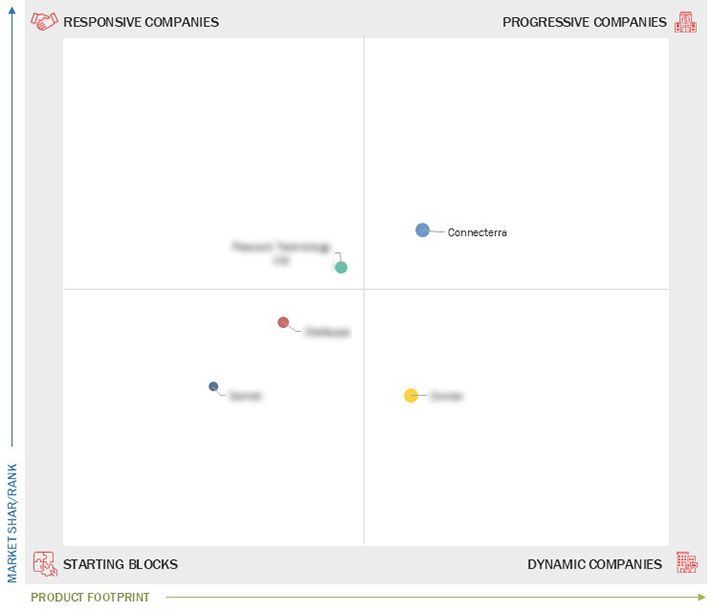

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Years Considered

1.3.3 Inclusions and Exclusions

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing focus of farmers on reducing mortality and optimizing herd health and productivity

2.2.1.2 Rising inclination of livestock industry players toward data-driven decision-making

2.2.1.3 Surging deployment of automated and IoT-enabled livestock identification devices

2.2.1.4 Growing emphasis of livestock farmers on real-time tracking and identification of animals

2.2.2 Restraints

2.2.2.1 Limited adoption among small farmers due to budget constraints

2.2.2.2 Rise of vegan dining trend in Europe

2.2.3 Opportunities

2.2.3.1 Integration of blockchain technology into livestock identification tools

2.2.3.2 Government initiatives encouraging use of livestock identification technology

2.2.3.3 Growing use of livestock identification solutions in developing countries

2.2.4 Challenges

2.2.4.1 Minimizing greenhouse gas emissions from livestock

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.1.1 Radio frequency identification (RFID)

2.7.2 Complementary Technologies

2.7.2.1 AI and blockchain

2.7.2.2 BLE

2.7.2.3 GPS

2.7.2.4 Big data

2.7.3 Adjacent Technologies

2.7.3.1 Tissue sampling

2.8 Patent Analysis

2.9 Trade Analysis

2.9.1 Import Data (HS Code 847190)

2.9.2 Export Data (HS Code 847190)

2.10 Key Conferences and Events, 2025

2.11 Porter’s Five Forces Analysis

2.11.1 Intensity of Competitive Rivalry

2.11.2 Bargaining Power of Suppliers

2.11.3 Bargaining Power of Buyers

2.11.4 Threat of Substitutes

2.11.5 Threat of New Entrants

2.12 Impact of AI/Generative AI on Livestock Identification Market

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2020–2024

3.3 Market Share Analysis, 2024

3.4 Revenue Analysis, 2019–2023

3.5 Company Valuation and Financial Metrics, 2024

3.6 Brand Comparison

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2024

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

4.1 MOOVEMENT

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 IDENTIS

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 SMARTAHC TECHNOLOGY

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 HERDOGG, INC.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 HERDX

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments