Comparing 5 vendors in Livestock Monitoring Startups across 0 criteria.

The livestock monitoring market is experiencing a significant transformation driven by technological advancements and changing consumer demands. As of 2025, the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) has become a key trend, enabling more precise and data-driven farming practices. This transition is particularly crucial for meeting the growing global demand for meat and dairy products. By utilizing smart wearables and AI-enabled monitoring systems, farmers can now engage in real-time animal health tracking, predictive disease analytics, and efficient resource management. These technologies not only enhance productivity but also ensure higher standards of animal welfare and sustainability in farming practices.

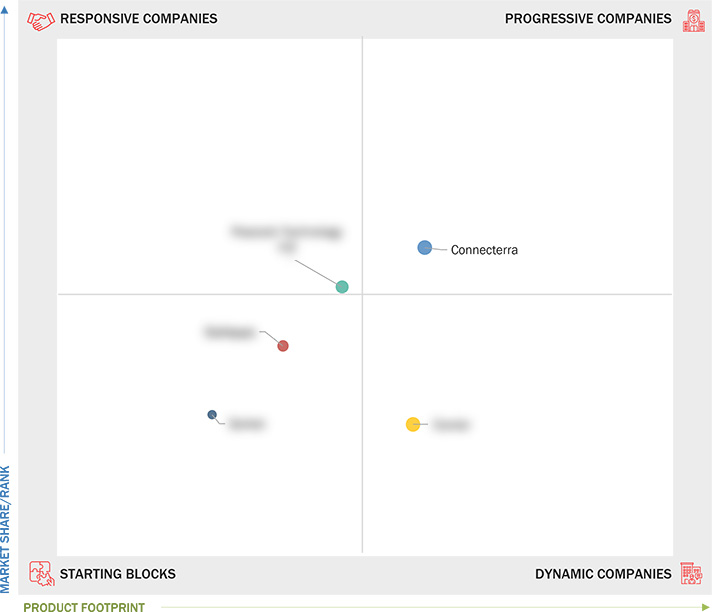

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

1.7 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Growth in meat production

2.2.1.2 Increasing focus on real-time monitoring and early disease detection

2.2.1.3 Integration of AI and IoT

2.2.2 Restraints

2.2.2.1 High initial cost of implementation

2.2.2.2 Limited awareness and technology adoption in developing regions

2.2.3 Opportunities

2.2.3.1 Increasing use of smart wearables for livestock

2.2.3.2 Growing focus on reproductive monitoring and breeding optimization

2.2.3.3 Integration of blockchain technology

2.2.3.4 Rising demand for organic and sustainable livestock practices

2.2.4 Challenges

2.2.4.1 Managing large volumes of data generated from multiple monitoring devices

2.2.4.2 Concerns about environmental impacts associated with livestock farming

2.2.4.3 Trade barriers and government regulations

2.3 Value Chain Analysis

2.4 Ecosystem Analysis

2.5 Investment and Funding Scenario

2.6 Trends and Disruptions Impacting Customer Business

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.1.1 Camera-based systems

2.7.1.2 Automated sorting systems

2.7.2 Complementary Technologies

2.7.2.1 AI and blockchain

2.7.2.2 Agriculture drones

2.7.3 Adjacent Technologies

2.7.3.1 Body condition scoring (BCS) systems

2.8 Porter’s Five Forces Analysis

2.8.1 Threat of New Entrants

2.8.2 Threat of Substitutes

2.8.3 Bargaining Power of Suppliers

2.8.4 Bargaining Power of Buyers

2.8.5 Intensity of Competitive Rivalry

2.9 Trade Analysis

2.9.1 Import Scenario (HS Code 01)

2.9.2 Export Scenario (HS Code 01)

2.9.3 Import Scenario (HS Code 8436)

2.9.4 Export Scenario (HS Code 8436)

2.10 Patent Analysis

2.11 Key Conferences and Events, 2025–2026

2.12 Impact of AI/Gen AI on Livestock Monitoring Market

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2020–2025

3.3 Market Share Analysis, 2024

3.4 Revenue Analysis, 2020–2023

3.5 Company Valuation and Financial Metrics, 2025

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2023

3.7.5.1 Detailed list of startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Expansions

3.8.4 Other Developments

4.1 CONNECTERRA

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 PEACOCK TECHNOLOGY LTD.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 STELLAPPS

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 COWLAR

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 SERKET

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

The Financial Express

The Financial Express

Apr 2025

Apr 2025