Comparing 4 vendors in Pressure Washer Startups across 0 criteria.

The pressure washer market comprises businesses engaged in the design, manufacturing, and distribution of high-pressure cleaning equipment. These machines, ranging from compact residential units to heavy-duty industrial systems, use high-pressure water spray to remove dirt, grime, and other contaminants from surfaces such as vehicles, buildings, and pavements. Market growth is driven by rising construction activities, the expansion of car wash facilities, and increasing demand for efficient cleaning solutions across residential, commercial, and industrial sectors.

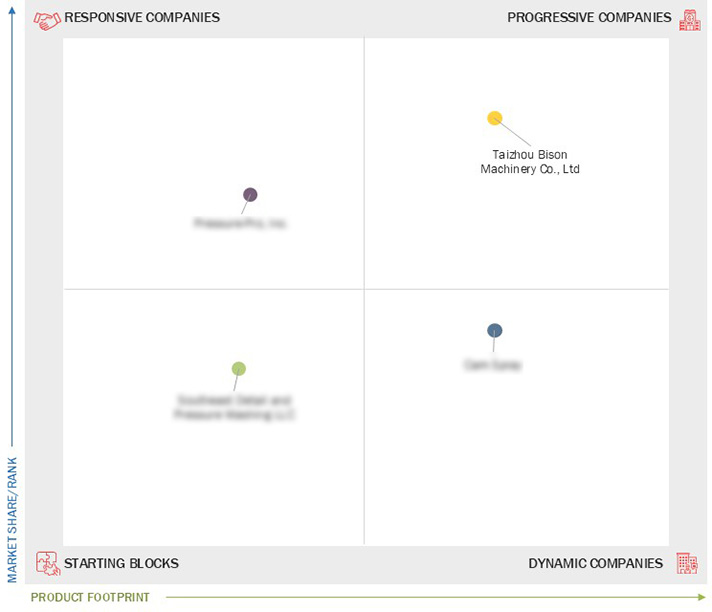

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising demand for outdoor cleaning across residential and commercial sectors

2.2.1.2 Growth in automotive & transportation sector

2.2.1.3 Stringent government regulations on cleanliness and sanitation

2.2.2 Restraints

2.2.2.1 High initial investment and maintaince cost limit market penetration

2.2.2.2 Water consumption and environmental concerns limit widespraed adoption

2.2.3 Opportunities

2.2.3.1 Integration of smart features and battery-operated designs creates new market avenues

2.2.3.2 Urbanization and infrastructure development in emerging economics expand market potential

2.2.4 Challenges

2.2.4.1 Competition from traditional and alternative cleaning technologies hinders market growth

2.2.4.2 Technical limitations restrict use of pressure washers in indoor and sensitive environments

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Acquisitions

3.8.3 Partnerships, Collaborations, Alliances and Joint ventures

4.1 Cam Spray

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Pressure-Pro, Inc.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Southeast Detail and Pressure Washing LLC

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Taizhou Bison Machinery Co., Ltd

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments