Comparing 9 vendors in Smart Lighting Startups across 0 criteria.

The smart lighting industry is poised at the intersection of technological innovation and sustainability, addressing the increasing need for dynamic, efficient, and responsive lighting solutions across various domains. As urban areas burgeon, cities are becoming smarter, incorporating integrated technologies that optimize electricity consumption and promote energy efficiency. This transformation is largely driven by smart city initiatives globally, which are creating vast opportunities for technology firms, service providers, and utility companies.

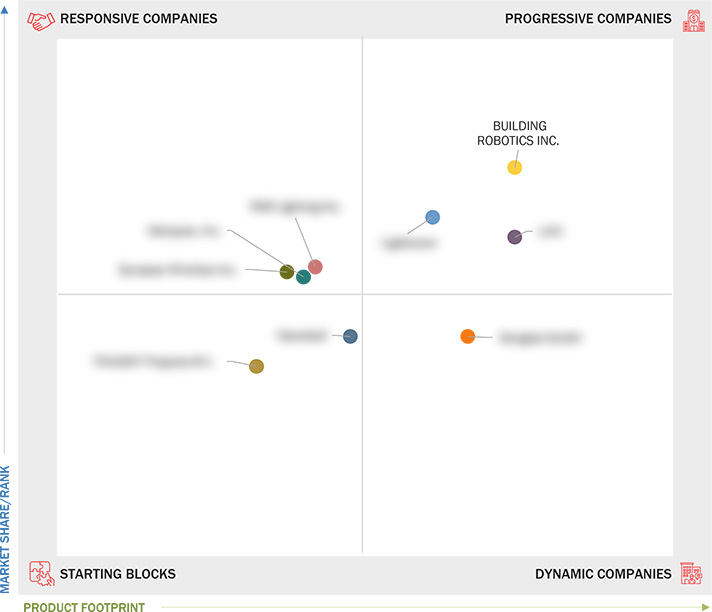

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Inclusions & Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.3.5 Unit Considered

1.4 Limitations

1.5 Stakeholders

1.6 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising Smart City Initiatives Globally

2.2.1.2 Advancements in Artificial Intelligence (AI) and Edge Computing Technologies

2.2.1.3 Establishment of Standard and Digital Protocols By Authorized Bodies

2.2.1.4 Growing Demand for Internet of Things (IoT)-Integrated Smart Lighting Solutions

2.2.1.5 Rising Adoption of LED Lights and Luminaires in Outdoor Applications

2.2.1.6 Increasing Incorporation of Data Analytics Into Smart Lighting

2.2.2 Restraints

2.2.2.1 Cybersecurity Concerns Associated with Internet-Connected Lighting Systems

2.2.2.2 Difficulties Associated with Retrofitting of Traditional Lighting Infrastructure

2.2.3 Opportunities

2.2.3.1 Development of Solar-Powered and Hybrid Smart Lighting Solutions

2.2.3.2 Emerging Smart Office and Smart Retail Trends

2.2.3.3 Rising Adoption of Human-Centric Lighting Solutions

2.2.3.4 Growing Adoption of Power Over Ethernet (POE)-Based Lighting Solutions in Commercial and Healthcare Applications

2.2.3.5 Increasing Demand for Personalized Lighting Control Solutions

2.2.4 Challenges

2.2.4.1 High Upfront Costs of Equipment and Accessories

2.2.4.2 Interoperability and Compatibility Issues

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.1.1 Internet of Things (IoT)

2.7.1.2 Communication Protocols

2.7.1.3 Smart Sensors

2.7.2 Complementary Technologies

2.7.2.1 Artificial Intelligence (AI) and Machine Learning (ML)

2.7.2.2 Light Fidelity (LI-FI)

2.7.2.3 Geofencing Technology

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.9.1 Import Scenario (HS Code 9405)

2.9.2 Export Scenario (HS Code 9405)

2.10 Key Conferences and Events, 2025–2026

2.11 Porter’s Five Forces Analysis

2.11.1 Intensity of Competitive Rivalry

2.11.2 Threat of New Entrants

2.11.3 Threat of Substitutes

2.11.4 Bargaining Power of Buyers

2.11.5 Bargaining Power of Suppliers

2.12 Impact of AI/Gen AI on Smart Lighting Market

3.1 Overview

3.2 Key Player Strategies/Right to Win, January 2021–January 2025

3.3 Revenue Analysis, 2020–2024

3.4 Market Share Analysis, 2024

3.5 Company Valuation and Financial Metrics

3.5.1 Company Valuation

3.5.2 Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2024

3.7.5.1 Detailed List of Startups/SMEs

3.7.5.2 Competitive Benchmarking of Key Startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches/Developments

3.8.2 Deals

3.8.3 Expansions

4.1 RAB LIGHTING INC.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 UBICQUIA, INC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 SYNAPSE WIRELESS INC.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 LIGHTWAVE

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 BUILDING ROBOTICS INC. (SIEMENS COMPANY)

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 LIFX

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 SENGLED GMBH

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 TVILIGHT PROJECTS B.V.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 NANOLEAF

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

The Fast Mode

The Fast Mode

Feb 2026

Feb 2026