Comparing 21 vendors in System-on-Chip across 0 criteria.

The global System‑on‑Chip (SoC) market is experiencing robust growth driven by rising demand for high‑performance, energy‑efficient computing solutions across consumer electronics, automotive, telecommunications, and industrial sectors. SoCs have become foundational to modern devices such as smartphones, tablets, wearables, and IoT endpoints, enabling compact form factors and enhanced processing capabilities. Increasing adoption of 5G connectivity and AI‑enabled applications is accelerating SoC integration with advanced processors, neural accelerators, and communication modules. The automotive industry’s shift toward autonomous driving, advanced driver‑assistance systems (ADAS), and connected vehicle platforms is boosting SoC demand for real‑time processing and sensor fusion.

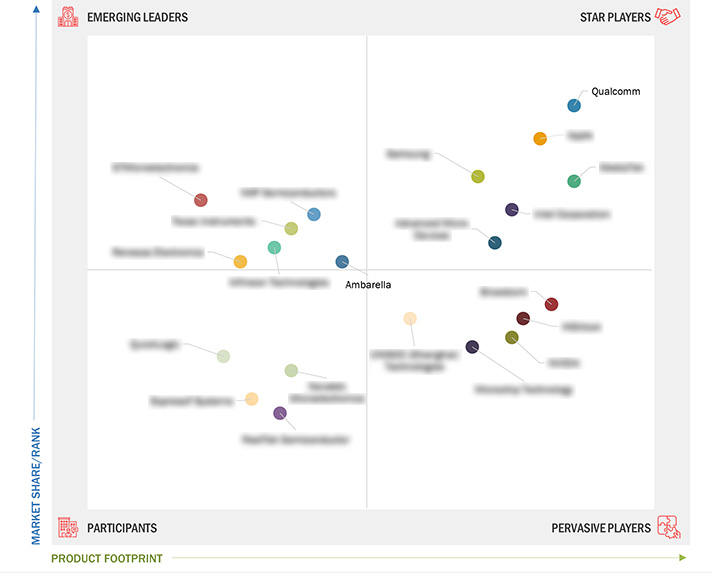

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Growing Trend of SoC in Automotive Industry

2.2.1.2 Surging Adoption of IoT and Connected Devices

2.2.1.3 Proliferation of AI and Machine Learning Technologies to

Drive Demand for SoCs

2.2.2 Restraints

2.2.2.1 High Design and Manufacturing Costs Impede SoC Market

Expansion

2.2.2.2 Power Consumption Issues

2.2.2.3 Smart Home Technology Adoption Propels SoC Market Expansion

2.2.2.4 Rising Demand for SoCs in Industrial Automation and

Robotics Fields

2.2.3 Challenges

2.2.3.1 Talent Shortage Hampers SoC Innovation and Production

2.2.3.2 Rapid Technological Changes Challenge SoC Longevity

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.1.1 Chiplets

2.7.2 Complementary Technologies

2.7.2.1 Advanced Packaging

2.7.3 Adjacent Technologies

2.7.3.1 System in Package (SIP)

2.7.3.2 System-on-module (SOM)

2.8 Patent Analysis

2.8.1 Key Patents

2.9 Trade Analysis

2.9.1 Import Scenario

2.9.2 Export Scenario

2.10 Key Conferences and Events

2.11 Porter’s Five Forces Analysis

2.11.1 Intensity of Competitive Rivalry

2.11.2 Bargaining Power of Suppliers

2.11.3 Bargaining Power of Buyers

2.11.4 Threat of Substitutes

2.11.5 Threat of New Entrants

2.12 Impact of Gen AI on System-on-chip (SoC) Market

2.12.1 Introduction

3.1 Introduction

3.2 Key Player Strategies/Right to Win, 2020–2024

3.3 Revenue Analysis, 2021–2023

3.4 Market Share Analysis, 2023

3.4.1 Smartphone SoC Market Share, 2023

3.4.2 Laptop SoC Market Share, 2023

3.5 Company Valuation and Financial Metrics

3.6 Brand/product Comparison

3.7 Company Evaluation Matrix: Key Players, 2023

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.7.5 Company Footprint: Key Players, 2023

3.7.5.1 Company Footprint

3.7.5.2 Core Count Footprint

3.7.5.3 Core Architecture Footprint

3.7.5.4 Vertical Footprint

3.7.5.5 Region Footprint

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

4.1 QUALCOMM TECHNOLOGIES, INC.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 MEDIATEK INC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 SAMSUNG

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 APPLE INC.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 INTEL CORPORATION

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 ADVANCED MICRO DEVICES, INC.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 NVIDIA CORPORATION

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 BROADCOM

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 HISILICON

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 MICROCHIP TECHNOLOGY INC.

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 UNISOC (SHANGHAI) TECHNOLOGIES CO., LTD.

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 AMBARELLA INTERNATIONAL LP

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 NXP SEMICONDUCTORS

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 INFINEON TECHNOLOGIES AG

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

4.15 TEXAS INSTRUMENTS INCORPORATED

4.15.1 Business overview

4.15.2 Products/Solutions/Services offered

4.15.3 Recent developments

4.16 RENESAS ELECTRONICS CORPORATION

4.16.1 Business overview

4.16.2 Products/Solutions/Services offered

4.16.3 Recent developments

4.17 STMICROELECTRONICS

4.17.1 Business overview

4.17.2 Products/Solutions/Services offered

4.17.3 Recent developments

4.18 QUICKLOGIC CORPORATION

4.18.1 Business overview

4.18.2 Products/Solutions/Services offered

4.18.3 Recent developments

4.19 REALTEK SEMICONDUCTOR CORP.

4.19.1 Business overview

4.19.2 Products/Solutions/Services offered

4.19.3 Recent developments

4.20 NOVATEK MICROELECTRONICS CORP.

4.20.1 Business overview

4.20.2 Products/Solutions/Services offered

4.20.3 Recent developments

4.21 ESPRESSIF SYSTEMS

4.21.1 Business overview

4.21.2 Products/Solutions/Services offered

4.21.3 Recent developments

marketbeat

marketbeat

Feb 2026

Feb 2026