Comparing 15 vendors in Testing, Inspection, and Certification (TIC) across 0 criteria.

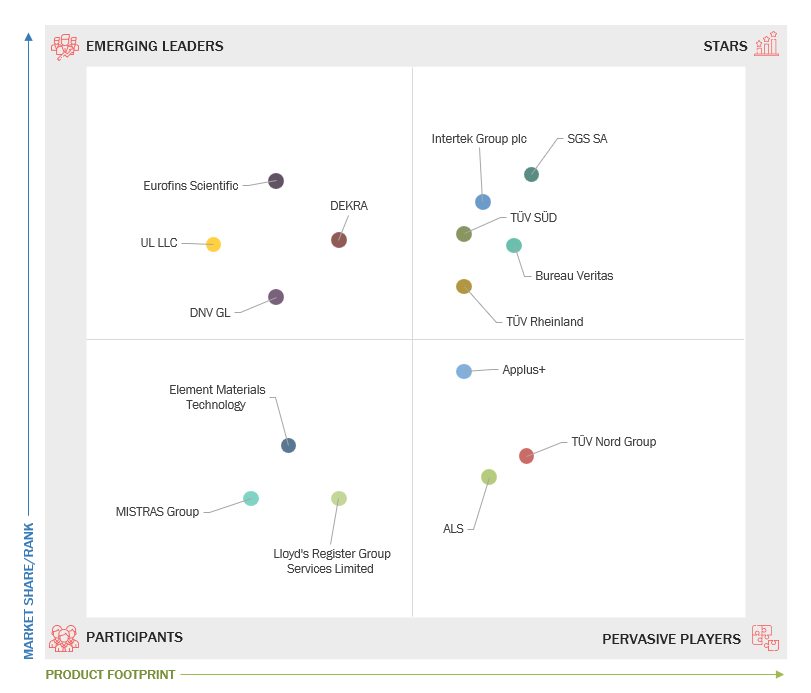

The Testing, Inspection and Certification (TIC) Companies Quadrant is a comprehensive industry analysis that provides valuable insights into the global market for Testing, Inspection and Certification (TIC). This quadrant offers a detailed evaluation of key market players, technological advancements, product innovations, and emerging trends shaping the industry. MarketsandMarkets 360 Quadrants evaluated over 100 companies, of which the Top 15 Testing, Inspection and Certification (TIC) Companies were categorized and recognized as the quadrant leaders.

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Limitations

1.6 Stakeholders

1.7 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Enforcement of stringent guidelines to ensure high product

quality

2.2.1.2 Rising adoption of connected technologies to improve

manufacturing

2.2.1.3 Expansion of consumer markets in developing countries

2.2.1.4 Proliferation of counterfeit and fraudulent products

2.2.2 Restraints

2.2.2.1 Lack of uniformity in global TIC standards

2.2.2.2 High cost of TIC services due to varying standards and

regulations across geographies

2.2.3 Opportunities

2.2.3.1 Emphasis on achieving net-zero emissions

2.2.4 Challenges

2.2.4.1 Disrupted supply chains due to geopolitical tensions

2.3 Trends/Disruptions Impacting Customer Business

2.4 Supply Chain Analysis

2.5 Ecosystem Analysis

2.6 Technology Analysis

2.6.1 Key Technologies

2.6.1.1 Advanced non-destructive testing

2.6.1.2 Automated optical inspection (AOI) systems

2.6.1.3 Calibration and precision measurement systems

2.6.2 Complementary Technologies

2.6.2.1 IoT-enabled testing devices

2.6.2.2 Cloud-based and certification management platforms

2.6.3 Adjacent Technologies

2.6.3.1 Robotics for automated inspection and testing

2.6.3.2 Digital twin technology for virtual testing and simulation

2.7 Patent Analysis

2.8 Trade Analysis

2.8.1 Import Data (HS Code 9030)

2.8.2 Export Data (HS Code 9030)

2.9 Key Conferences and Events, 2025–2026

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2021–2025

3.3 Revenue Analysis, 2021–2024

3.4 Market Share Analysis, 2024

3.5 Company Valuation and Financial Metrics, 2025

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Key Players, 2024

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.7.5 Company Footprint: Key Players, 2024

3.7.5.1 Company footprint

3.7.5.2 Region footprint

3.7.5.3 Source footprint

3.7.5.4 Service type footprint

3.7.5.5 Application footprint

3.8 Competitive Scenario

3.8.1 Solution/Service Launches

3.8.2 Deals

3.8.3 Expansions

3.8.4 Other Developments

4.1 SGS SA

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 BUREAU VERITAS

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 INTERTEK GROUP PLC

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 TÜV RHEINLAND

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 TÜV SÜD

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 DEKRA

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 EUROFINS SCIENTIFIC

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 DNV GL

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 APPLUS+

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 TÜV NORD GROUP

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 UL LLC

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 ELEMENT MATERIALS TECHNOLOGY

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 ALS

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 MISTRAS GROUP

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

4.15 LLOYD’S REGISTER GROUP SERVICES LIMITED

4.15.1 Business overview

4.15.2 Products/Solutions/Services offered

4.15.3 Recent developments

AD HOC NEWS

AD HOC NEWS

Jan 2026

Jan 2026