Comparing 10 vendors in Anti-Money Laundering (AML) Startups across 0 criteria.

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increased monetary penalties, regulatory sanctions, and reputational loss due to noncompliance with regulations

2.2.1.2 Rise in focus toward digital payments and Internet banking

2.2.1.3 Necessity to create infrastructure with 360 degree view of data in financial landscape

2.2.2 Restraints

2.2.2.1 Increased technological complexities and sophistication of attacks

2.2.2.2 Budgetary issues in developing in-house fraud detection solutions

2.2.3 Opportunities

2.2.3.1 Higher adoption of advanced analytics in AML

2.2.3.2 Integration of AI, ML, and big data technologies in developing AML solutions

2.2.3.3 Adoption of cloud-based AML solutions to combat financial crimes

2.2.3.4 Increased use of AML in real estate sector

2.2.4 Challenges

2.2.4.1 Lack of skilled AML professionals with in depth knowledge

2.2.4.2 Lack of awareness related to government regulations and deployment of AML solutions

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

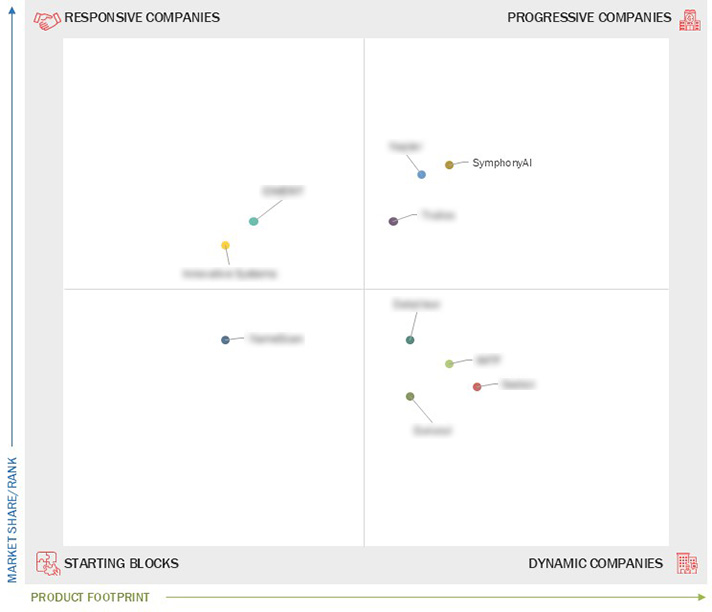

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 New Launches

3.8.2 Deals

4.1 Napier

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 SymphonyAI

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 TRULIOO

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 IDMERIT

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 INNOVATIVE SYSTEMS INC

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 DATAVISOR

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 IMTF

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 SEDICII

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 GURUCUL

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 NameScan

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

Business Wire

Business Wire

Oct 2025

Oct 2025