Comparing 14 vendors in Application Lifecycle Management Startups across 0 criteria.

The Application Lifecycle Management (ALM) market is rapidly growing as businesses seek efficient, end-to-end software management solutions. Driven by the need for automation, collaboration, and streamlined development, ALM tools support the entire software lifecycle—from development to deployment and maintenance. The market is increasingly shaped by agile methodologies that promote faster, iterative workflows. Key revenue comes from innovation-driven regions such as North America, Europe, and Asia Pacific.

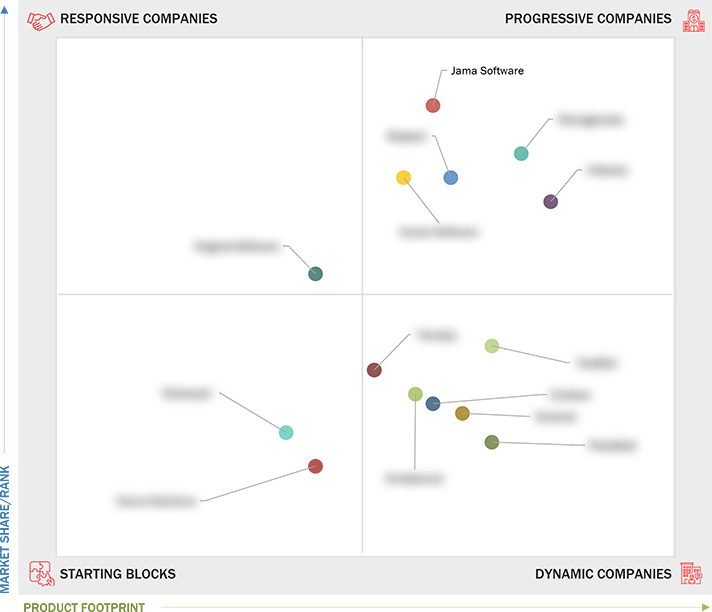

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Improved customer engagement with omnichannel self-service options

2.2.1.2. Maximizing agent efficiency through AI integration

2.2.1.3 Enhancing efficiency and satisfaction with intelligent routing

2.2.2 Restraints

2.2.2.1 Mitigating deepfake threats in customer service

2.2.3 Opportunities

2.2.3.1 Transforming customer service with generative AI innovations

2.2.3.2 Empowering proactive customer service with AI solutions

2.2.4 Challenges

2.2.4.1 Threats of job displacements in customer service

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win, 2020–2024

3.3 Revenue Analysis, 2022–2024

3.4 Market Share Analysis, 2024

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2024

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

4.1 Jama Software

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 MicroGenesis

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Reqtest

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Inflectra

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Kovair Software

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 Original Software

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Novalys

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 TestRail

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 Enalean

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 Orcanos

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 Practitest

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 Nimblework

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 TechExcel

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 Visure Solutions

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

Inflectra Corporation

Inflectra Corporation

Jan 2026

Jan 2026