Comparing 7 vendors in Cloud Computing Startups across 0 criteria.

Cloud computing is transforming the education sector by offering scalable, flexible, and cost-effective solutions. It enables institutions to streamline academic processes, reduce infrastructure costs, and support remote learning. Services like SaaS, PaaS, and IaaS allow for efficient management of resources and improved accessibility for students and staff. Cloud adoption is driven by the need for centralized systems, reduced administrative burden, and enhanced learning experiences. Institutions are leveraging cloud technologies to expand their reach, improve operational efficiency, and meet evolving educational demands.

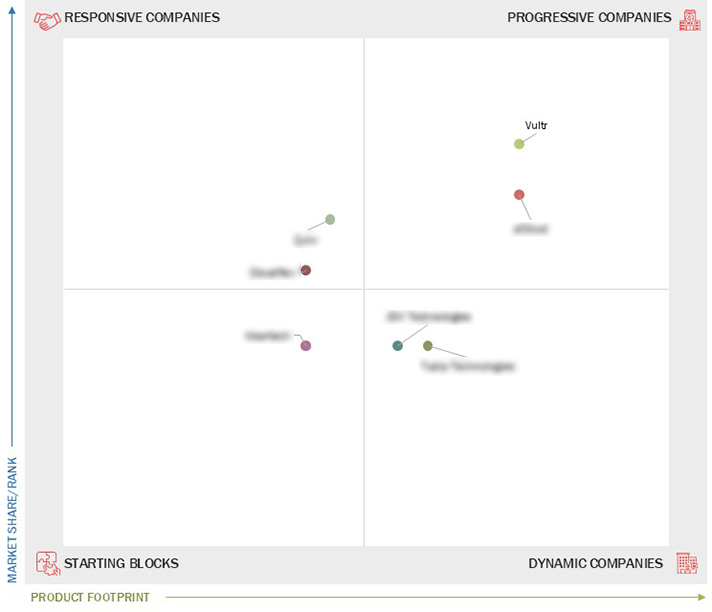

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

1.6 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Operational resilience & digital sovereignty imperative

2.2.1.2 Rising demand for AI

2.2.1.3 Accelerated spending on cloud

2.2.1.4 Personalized customer experience

2.2.1.5 Need for disaster recovery and contingency plans

2.2.2 Restraints

2.2.2.1 Trust deficit in cloud adoption extends beyond basic

security

2.2.2.2 Lack of technical knowledge and expertise

2.2.2.3 Data security and privacy concerns

2.2.3 Opportunities

2.2.3.1 Intelligent infusion of AI and ML unlocks greater cloud

value

2.2.3.2 Adoption of IoT and connected devices

2.2.3.3 Increasing government initiatives

2.2.4 Challenges

2.2.4.1 Multi-cloud complexity and integration challenges hinder

seamless cloud operations

2.2.4.2 Risk of vendor lock-in

2.2.4.3 High complexity due to adoption of multi-cloud model

2.3 Supply Chain Analysis

2.4 Ecosystem Analysis

2.5 Porter’s Five Forces Analysis

2.5.1 Threat of New Entrants

2.5.2 Threat of Substitutes

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.6 Technology Analysis

2.6.1 Key Technologies

2.6.1.1 Containerization

2.6.1.2 Virtualization

2.6.1.3 Orchestration

2.6.1.4 Software-defined Networking (SDN) & Network Functions

Virtualization (NFV)

2.6.2 Complementary Technologies

2.6.2.1 Internet of Things (IoT)

2.6.2.2 Cybersecurity & Compliance

2.6.2.3 DevOps & CI/CD

2.6.2.4 Artificial Intelligence (AI) & Machine Learning (ML)

2.6.2.5 Big Data & Data Analytics

2.6.2.6 Edge computing

2.6.2.7 Industry cloud

2.6.2.8 Green cloud computing

2.7 Patent Analysis

2.8 Trends/Disruptions Impacting Customer Business

2.9 Key Conferences and Events, 2025–2026

2.10 Business Model Analysis

2.10.1 Pay-as-You-Go

2.10.2 Subscription Model

2.10.3 Freemium

2.10.4 Custom Pricing Agreement

2.11 Investment Landscape and Funding Scenario

2.12 Major Use Cases & Workloads of Cloud Computing

2.12.1 Compute Intensive

2.12.1.1 High Performance Computing (HPC)

2.12.1.2 Artificial Intelligence (AI) & Machine Learning (ML)

2.12.1.3 Video Rendering

2.12.1.4 Simulation

2.12.2 Data Intensive

2.12.2.1 Big Data Analytics

2.12.2.2 Data WarehoUsing

2.12.2.3 Real-time Streaming & IoT Data

2.12.3 Application Workloads

2.12.3.1 SaaS Migration & App Modernization

2.12.4 Development & Devops

2.12.4.1 Continuous Integration (CI)/ Continuous Delivery (CD)

2.12.4.2 Application Testing

2.12.4.3 Infrastructure as Code (IaC)

2.12.4.4 DevSecOps

2.12.5 Backup, Disaster Recovery, and Archiving

2.12.5.1 Cloud Backup

2.12.5.2 Disaster Recovery (DR)

2.12.5.3 Archiving

2.13 Industry Cloud/Vertical SaaS

2.13.1 Healthcare & Life Sciences SaaS

2.13.2 Bfsi SaaS

2.13.3 Manufacturing SaaS

2.13.4 Education SaaS

2.13.5 Retail & E-Commerce SaaS

2.13.6 Government & Public Sector SaaS

2.13.7 Other Vertical SaaS

3.1 Introduction

3.2 Key Players’ Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis, 2024

3.5 Brand/Product Comparison

3.6 Company Evaluation Matrix: Startups/SMEs, 2024

3.6.1 Progressive Companies

3.6.2 Responsive Companies

3.6.3 Dynamic Companies

3.6.4 Starting Blocks

3.6.5 Competitive Benchmarking: Startup/SMEs, 2024

3.6.5.1 Detailed list of key startups/SMEs

3.6.5.2 Competitive benchmarking of startups/ SMEs

3.7 Company Valuation and Financial Metrics of Key Vendors

3.7.1 Company Valuation of Key Vendors

3.7.2 Financial Metrics of Key Vendors

3.8 Competitive Scenario and Trends

3.8.1 Product Launches

3.8.2 Deals

4.1 CLOUDFLEX

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 JDV TECHNOLOGIES

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 PCLOUD

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 TUDIP TECHNOLOGIES

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 VULTR

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 VISARTECH

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 ZYMR

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

einpresswire

einpresswire

Aug 2025

Aug 2025