Comparing 5 vendors in Cloud ERP startups across 0 criteria.

The Cloud ERP sector is undergoing significant transformation, driven by technological innovations, industry demands, and an evolving business environment. The 2024 evaluation report highlights how digital transformation is being accelerated through the integration of Artificial Intelligence (AI) and Machine Learning (ML), enabling businesses to make data-driven decisions and optimize operations. Rising investments in cloud services and software provide a solid foundation for continued market growth. Companies are also focusing on process automation and enhancing operational efficiency to stay competitive.

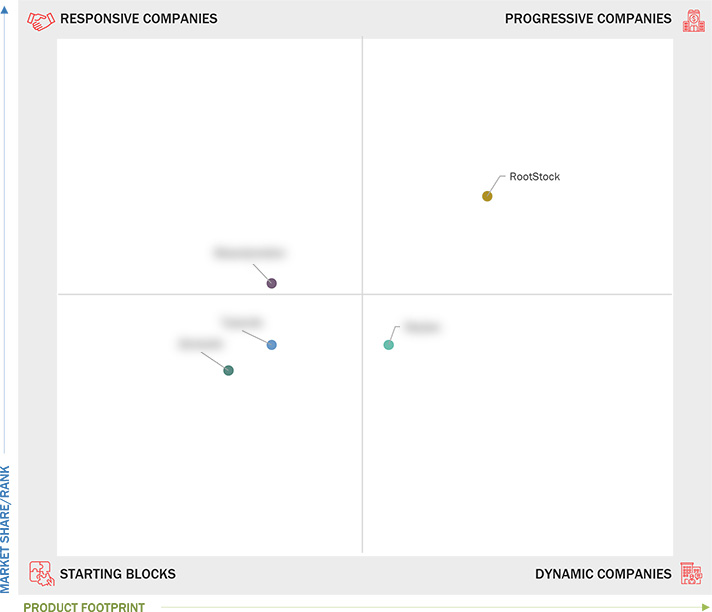

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered

1.4 Currency

1.5 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Fusion of AI and ML within Cloud ERP for informed decision-making

2.2.1.2 Rising spending on cloud-based services/software

2.2.1.3 Increasing focus on business process automation and operational efficiency

2.2.2 Restraints

2.2.2.1 High risk of data security

2.2.2.2 Restricted personalization hinders Cloud ERP growth

2.2.3 Opportunities

2.2.3.1 Growth of mobile and remote workforce demands efficient Cloud ERP solution

2.2.3.2 Growing demand from small and medium enterprises (SMEs)

2.2.4 Challenges

2.2.4.1 Integration challenges with existing legacy systems and processes

2.2.4.2 Complexity of vendor selection and due diligence processes

2.3 Case Study Analysis

2.3.1 Lexington Enhanced Financial Efficiency in Healthcare with Oracle Cloud ERP

2.3.2 Fieldfisher Leveraged Microsoft Dynamic 365 for Business Continuity

2.3.3 Tasi Measurement Standardized Operations with Epicor Kinetic

2.3.4 Boca Terry Improved Productivity and Customer Service with Acumatica ERP

2.3.5 Mlw Foods Achieved 30% Cost Savings with Sage X3 Implementation

2.4 Supply Chain Analysis

2.5 Ecosystem Analysis

2.6 Technology Analysis

2.6.1 Key Technologies

2.6.1.1 AI & ML

2.6.1.2 Multi-tenant & Microservices Architecture

2.6.1.3 Low-code/No-code Development

2.6.1.4 Big Data & Analytics

2.6.2 Complementary Technologies

2.6.2.1 Customer Relationship Management

2.6.2.2 Human Capital Management

2.6.2.3 Manufacturing Execution Systems

2.6.3 Adjacent Technologies

2.6.3.1 Cloud Infrastructure

2.6.3.2 Middleware & APIs

2.6.3.3 Cybersecurity & Identity Management

2.7 Patent Analysis

2.8 Porter’s Five Forces Analysis

2.8.1 Threat of New Entrants

2.8.2 Threat of Substitutes

2.8.3 Bargaining Power of Buyers

2.8.4 Bargaining Power of Suppliers

2.8.5 Intensity of Competitive Rivalry

2.9 Trends and Disruptions Impacting Customers’ Businesses

2.10 Business Model Analysis

2.10.1 Subscription-Based Model

2.10.2 License-Based Model

2.10.3 Freemium Model

2.11 Key Conferences and Events (2024–2025)

2.12 Investment and Funding Scenario

2.13 Impact of AI/Gen AI on Cloud Service Brokerage

2.13.1 Top Clients Adapting Gen AI

2.13.1.1 Microsoft

2.13.1.2 Oracle

3.1 Introduction

3.2 Strategies Adopted By Key Players/Right to Win

3.3 Market Share Analysis

3.4 Revenue Analysis, 2019–2023

3.5 Company Evaluation Matrix: Startups/SMEs, 2023

3.5.1 Progressive Companies

3.5.2 Responsive Companies

3.5.3 Dynamic Companies

3.5.4 Starting Blocks

3.5.5 Competitive Benchmarking: Startups/SMEs, 2023

3.5.5.1 Detailed list of key startups/SMEs

3.5.5.2 Competitive benchmarking of startups/SMEs

3.6 Company Valuation and Financial Metrics of Key Vendors

3.6.1 Company Valuation

3.6.2 Financial Metrics

3.7 Competitive Scenario

3.7.1 Product Launches

3.7.2 Deals

4.1 ROOTSTOCK SOFTWARE

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 ZENSCALE

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 BIZAUTOMATION

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 TYASUITE

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 REYBEX

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

Enterprise Times

Enterprise Times

Dec 2025

Dec 2025