Comparing 9 vendors in Data Center Solutions Startups across 0 criteria.

Data integration in the data center solutions market is becoming increasingly vital as organizations adopt hybrid and cloud-native infrastructures. The focus is on unifying data across diverse systems to enable real-time analytics, AI workloads, and operational automation. Vendors are enhancing their platforms with features like event-driven architectures, metadata intelligence, and secure data sharing. Strategic moves such as partnerships, acquisitions, and product innovations are shaping the competitive landscape. As enterprises prioritize scalability, sustainability, and intelligent data management, data integration emerges as a core enabler of digital transformation and infrastructure modernization.

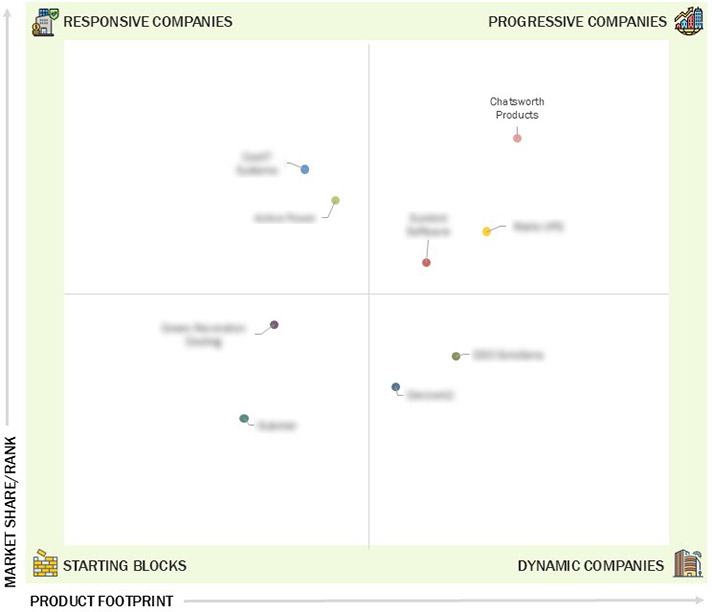

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

1.6 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 AI/HPC compute boom to drive highdensity infrastructure

upgrades

2.2.1.2 Hyperscale Capex super-cycle to accelerate infrastructure

spend

2.2.1.3 Regulatory & ESG mandates to drive power and cooling

modernization

2.2.2 Restraints

2.2.2.1 Extended lead times for critical electrical & mechanical

equipment to disrupt build timelines and capex planning

2.2.2.2 Land Use and permitting bottlenecks to affect equipment

lead times

2.2.3 Opportunities

2.2.3.1 Retrofitting legacy data centers to meet AI-driven density

demands

2.2.3.2 Rise of liquid cooling in AI-driven data center

infrastructure to meet next-gen density requirements

2.2.4 Challenges

2.2.4.1 Skilled labor shortage to threaten project delivery

timelines and long-term operational efficiency

2.2.4.2 Grid capacity & power scarcity to limit facility deployment

2.3 Ecosystem Analysis

2.4 Supply Chain Analysis

2.5 Patent Analysis

2.5.1 List of Major Patents

2.6 Technology Analysis

2.6.1 Key Technology

2.6.1.1 Direct-to-Chip Cooling

2.6.1.2 Remote monitoring and data center infrastructure management

2.6.1.3 Aiops & Digital Twins

2.6.1.4 High-density GPUS

2.6.2 Complimentary Technology

2.6.2.1 Lithium-ion & next-gen battery energy storage UPS

2.6.2.2 Software-defined Networking

2.6.2.3 Hyper-converged Infrastructure

2.6.2.4 Modular Power

2.6.3 Adjacent Technologies

2.6.3.1 Small modular nuclear reactors

2.6.3.2 Direct-Air-Capture & Carbon-Removal Co-location

2.6.3.3 Private 5G/6G & Edge Connectivity

2.6.3.4 Grid-interactive Data Centers

2.7 Porter’s Five Forces Analysis

2.7.1 Threat of New Entrants

2.7.2 Threat of Substitutes

2.7.3 Bargaining Power of Suppliers

2.7.4 Bargaining Power of Buyers

2.7.5 Intensity of Competitive Rivalry

2.8 Key Conferences and Events, 2025

2.9 Trends/Disruptions Impacting Customer Business

2.10 Business Model Analysis

2.10.1 Direct OEM Sales Model

2.10.2 Channel/Partner-Driven Sales Model

2.10.3 Infrastructure-as-a-Solution (IAAS)/Opex-Based Model

2.10.4 Modular & Prefabricated Solutions Model

2.11 Investment & Funding Scenario

2.12 Impact of AI/Gen AI in Data Center Solutions Market

2.12.1 Top Use Cases and Market Potential

2.12.1.1 Key Use cases

2.12.2 Vendor Initiative

2.12.2.1 Vertiv

2.12.2.2 DELL TECHNOLOGIES

2.13 Impact of US Tariff–Data Center Solutions Market

2.13.1 Introduction

2.13.2 Key Tariff Rates

2.13.3 Price Impact Analysis

2.13.3.1 Strategic Shifts and Emerging Trends – Data Center

Solutions Market

2.13.4 Impact on Country/Region

2.13.4.1 US

2.13.4.2 China

2.13.4.3 Europe

2.13.4.4 Asia Pacific (excluding China)

2.13.5 Impact on Data Center Types

2.13.5.1 Hyperscalers

2.13.5.2 Colocation Service Providers

2.13.5.3 Enterprises

3.1 Introduction

3.2 Key Players’ Strategies/Right to Win

3.3 Revenue Analysis, 2020–2024

3.4 Market Share Analysis, 2024

3.5 Brand/Product Comparison

3.6 Company Evaluation Matrix: Startups/SMEs, 2024

3.6.1 Progressive Companies

3.6.2 Responsive Companies

3.6.3 Dynamic Companies

3.6.4 Starting Blocks

3.6.5 Competitive Benchmarking: Startup/SMEs, 2024

3.6.5.1 Detailed list of key startups/SMEs

3.6.5.2 Competitive benchmarking of startups/SMEs

3.7 Company Valuation and Financial Metrics of Key Vendors

3.7.1 Company Valuation of Key Vendors

3.7.2 Financial Metrics of Key Vendors

3.8 Competitive Scenario and Trends

3.8.1 Product Launches

3.8.2 Deals

4.1 CHATSWORTH PRODUCTS

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 DEVICE 42

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 SUNBIRD SOFTWARE

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 COOLIT SYSTEM

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 SUBMER

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 ACTIVE POWER

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 GREEN REVOLUTION COOLING

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 RIELLO UPS

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 DDC SOLUTIONS

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

Data Center Frontier

Data Center Frontier

Jul 2025

Jul 2025