Comparing 12 vendors in Digital Railway Startups across 0 criteria.

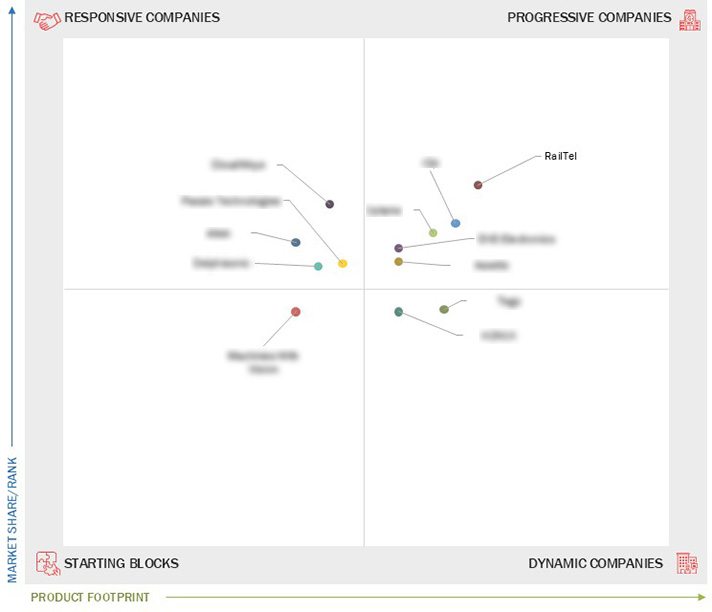

The digital railway market is evolving rapidly, with startups and SMEs playing a pivotal role in shaping its future. Companies are categorized based on their innovation, market presence, and strategic growth. Progressive firms like Uptake and RailTel focus on tailored solutions and infrastructure development. Responsive players such as CloudMoyo and Aitek emphasize innovation and deployment. KONUX stands out as a dynamic company with strong partnerships, while Machines With Vision is in the early stages, aiming to grow through acquisitions and integrated offerings. Each contributes uniquely to advancing digital railway technologies.

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Surge in passenger numbers over the past few years

2.2.1.2 Rising adoption of IoT in railways

2.2.1.3 Advancements in communication technology

2.2.2 Restraints

2.2.2.1 Lack of robust railway infrastructure in underdeveloped countries

2.2.2.2 High initial cost of deployment

2.2.3 Opportunities

2.2.3.1 Rising need for advanced transportation infrastructure

2.2.3.2 Autonomous train to be significant opportunity for digital railway solution providers

2.2.3.3 Emerging trend of smart cities

2.2.4 Challenges

2.2.4.1 Increased threat of cyberattacks as railway system becomes digital

2.2.4.2 Lack of IT infrastructure and skilled personnel

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

4.1 Aitek

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Assetic

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 CLOUDMOYO

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Delphisonicare

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 EKE-Electronics

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 KONUX

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 MACHINES WITH VISION

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Passio Technologies

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 R2P

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 RAILTEL CORPORATION OF INDIA LIMITED

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 TEGO

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 UPTAKE

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

CloudMoyo

CloudMoyo

Feb 2026

Feb 2026