Comparing 20 vendors in Insurance Platform Startups across 0 criteria.

The Insurance Platform market is experiencing rapid growth driven by digital transformation, with cloud-based platforms, artificial intelligence (AI), and data analytics reshaping the landscape of underwriting, claims processing, and policy administration. This shift is fueled by the increasing demand for automation and customer-centric solutions. InsurTech startups are introducing innovative, digital-first models that are challenging traditional insurers, forcing them to adopt more flexible, technology-driven platforms to maintain competitiveness. These platforms offer scalability and cost-efficiency, which are critical in achieving enhanced operational efficiencies and improved customer experiences.

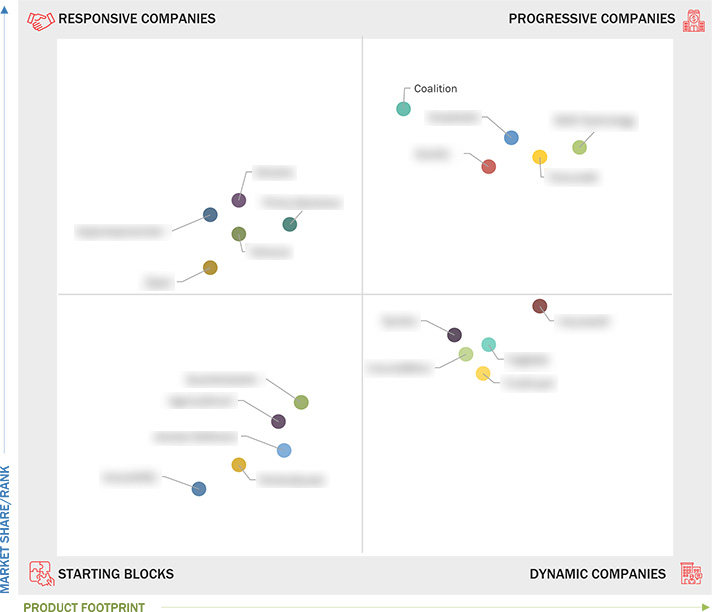

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Digital transformation across insurance value chain

2.2.1.2 Disruption of traditional models by InsurTech startups

2.2.1.3 Complex regulations that drive demand for platforms with built-in compliance and automation

2.2.2 Restraints

2.2.2.1 Legacy system integration leading to implementation delay and added complexity

2.2.2.2 High modernization costs

2.2.2.3 Limited digital literacy among traditional insurers and agents

2.2.3 Opportunities

2.2.3.1 Embedded insurance models for seamless integration via APIs and microservices

2.2.3.2 Rising adoption of usage-based and parametric insurance leading to demand IoT-enabled, real-time platforms

2.2.3.3 Growing demand for digital-first insurance solutions for seamless customer experience

2.2.4 Challenges

2.2.4.1 Cybersecurity risks

2.2.4.2 Market fragmentation, leading to non-standardization

2.2.4.3 Managing diverse data sources while ensuring quality and governance

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches and Enhancements

3.8.2 Deals

4.1 SHIFT TECHNOLOGY

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Ensuredit

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 ONESHIELD

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Coalition

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 SUREIFY

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 SOCOTRA

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 PRIMA SOLUTIONS

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 BRITECORE

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 Hyperexponential

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 ZIPARI

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 Insuresoft

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 Symbo

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 Cogitate

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 TrustLayer

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

4.15 INSUREDMINE

4.15.1 Business overview

4.15.2 Products/Solutions/Services offered

4.15.3 Recent developments

4.16 QUANTEMPLATE

4.16.1 Business overview

4.16.2 Products/Solutions/Services offered

4.16.3 Recent developments

4.17 AgencySmart

4.17.1 Business overview

4.17.2 Products/Solutions/Services offered

4.17.3 Recent developments

4.18 Jenesis Software

4.18.1 Business overview

4.18.2 Products/Solutions/Services offered

4.18.3 Recent developments

4.19 PerfectQuote

4.19.1 Business overview

4.19.2 Products/Solutions/Services offered

4.19.3 Recent developments

4.20 InsuredHQ

4.20.1 Business overview

4.20.2 Products/Solutions/Services offered

4.20.3 Recent developments

The Manila Times

The Manila Times

Nov 2024

Nov 2024