Comparing 18 vendors in Legal AI Software Startups across 103 criteria.

The legal AI software market is rapidly evolving, driven by advances in technologies like natural language processing, machine learning, and generative AI. These tools are improving legal efficiency by automating routine tasks, streamlining research, and enhancing compliance and risk management. Key growth drivers include rising eDiscovery needs, expanding NLP use in legal operations, and supportive government initiatives to improve judicial processes. The market involves a range of stakeholders, including platform and contract management providers, law firms, and corporate legal teams.

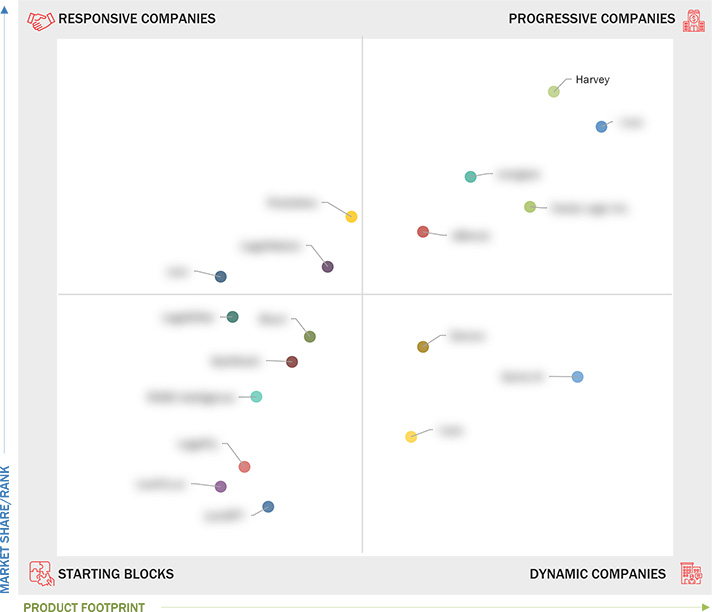

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered

1.4 Currency Considered

1.5 Stakeholders

1.6 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Significant increase in eDiscovery requirements

2.2.1.2 Surge in NLP adoption in legal operations

2.2.1.3 Government support for judicial efficiency

2.2.1.4 Proliferation of AI-driven knowledge management systems

2.2.2 Restraints

2.2.2.1 Ethical concerns over AI decision-making

2.2.2.2 Lack of skilled AI talent in legal sector

2.2.3 Opportunities

2.2.3.1 Emergence of virtual hearings and online dispute resolution

2.2.3.2 Use of real-time sentiment analysis in courtrooms

2.2.3.3 Expansion of AI-driven arbitration platforms

2.2.4 Challenges

2.2.4.1 Adapting AI to non-standardized legal processes

2.2.4.2 Standardizing AI for litigation-specific applications

2.3 Evolution

2.4 Ecosystem Analysis

2.4.1 Gen AI Legal Tools

2.4.2 Traditional (Other AI) Legal Tools

2.4.3 Deployment Mode

2.4.4 Legal Application

2.4.5 Technology

2.5 Supply Chain Analysis

2.6 Investment and Funding Scenario

2.7 Impact of Generative AI on Legal AI Software Market

2.7.1 Top Use Cases and Market Potential

2.7.1.1 Key Use Cases

2.7.1.1.1 Enhanced legal research efficiency

2.7.1.1.2 Automated document drafting

2.7.1.1.3 Smart contract management

2.7.1.1.4 Predictive case analytics

2.7.1.1.5 Client interaction automation

2.7.1.1.6 Risk management and compliance monitoring

2.8 Technology Analysis

2.8.1 Key Technologies

2.8.1.1 Natural language processing (NLP)

2.8.1.2 Machine learning (ML)

2.8.1.3 Generative AI models

2.8.1.4 Optical character recognition (OCR)

2.8.1.5 Knowledge graphs

2.8.2 Complementary Technologies

2.8.2.1 Blockchain

2.8.2.2 Robotic process automation (RPA)

2.8.2.3 Document management systems (DMS)

2.8.2.4 Cloud computing

2.8.2.5 Smart contracts

2.8.3 Adjacent Technologies

2.8.3.1 Application programming interfaces (APIs)

2.8.3.2 eDiscovery tools

2.8.3.3 Virtual assistants

2.8.3.4 Identity and access management (IAM)

2.9 Patent Analysis

2.9.1 Methodology

2.9.2 Patents Filed, By Document Type

2.9.3 Innovations and Patent Applications

2.10 Key Conferences and Events, 2025–2026

2.11 Porter’s Five Forces Analysis

2.11.1 Threat of New Entrants

2.11.2 Threat of Substitutes

2.11.3 Bargaining Power of Suppliers

2.11.4 Bargaining Power of Buyers

2.11.5 Intensity of Competition Rivalry

2.12 Trends/Disruptions Impacting Customer Business

3.1 Overview

3.2 Key Players Strategies/Right to Win, 2022–2024

3.3 Revenue Analysis, 2020–2024

3.4 Market Share Analysis, 2024

3.4.1 Market Share of Key Players Offering Legal AI Software

3.4.1.1 Market ranking analysis

3.5 Product Comparison

3.5.1 Azure OpenAI Services (Microsoft)

3.5.2 IBM Watson Discovery (IBM)

3.5.3 Lexis+ AI (LexisNexis)

3.5.4 Westlaw (Thomson Reuters)

3.5.5 Amazon OpenSearch Service (AWS)

3.6 Company Valuation and Financial Metrics

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2024

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches and Enhancements

3.8.2 Deals

4.1 NEOTA

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 JURO

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 POCKETLAW

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 SPELLBOOK

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 BLUEJ

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 LEGALSIFTER

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 LAWGEEX

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 ROSS INTELLIGENCE

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 VLEX

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 GENIE AI

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 HARVEY

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 DARROW

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 LEYA

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 EBREVIA

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

4.15 LAWGPT

4.15.1 Business overview

4.15.2 Products/Solutions/Services offered

4.15.3 Recent developments

4.16 LEGALMATION

4.16.1 Business overview

4.16.2 Products/Solutions/Services offered

4.16.3 Recent developments

4.17 LAWPRO.AI

4.17.1 Business overview

4.17.2 Products/Solutions/Services offered

4.17.3 Recent developments

4.18 LEGALFLY

4.18.1 Business overview

4.18.2 Products/Solutions/Services offered

4.18.3 Recent developments

Autotalk

Autotalk

Aug 2025

Aug 2025