Comparing 12 vendors in Natural Disaster Management Startups across 0 criteria.

The natural disaster management market is evolving due to advancements in IoT, AI, and other technologies, which are transforming disaster preparedness and response. Government initiatives and regulatory changes are driving the adoption of more proactive systems, with tools like geographic information systems, AI analytics, and remote sensing enhancing early warning and crisis management. However, challenges such as data integration, interoperability issues, and a shortage of skilled professionals remain significant obstacles. Rapid urbanization and climate change further increases the vulnerability to natural disasters.

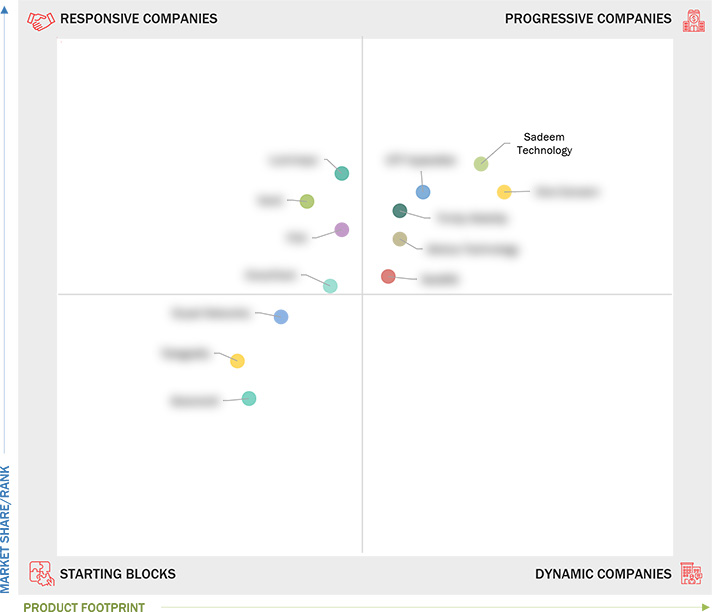

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Segmentation

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Escalating frequency and intensity of climate-related disasters

2.2.1.2 Technological advancements in IoT and AI

2.2.1.3 Increased government initiatives and regulatory frameworks

2.2.2 Restraints

2.2.2.1 Funding limitations in emerging economies

2.2.2.2 Interoperability and data integration issues

2.2.2.3 Lack of skilled personnel and training

2.2.3 Opportunities

2.2.3.1 Expansion of remote sensing and satellite technologies

2.2.3.2 Development of AI-powered predictive analytics

2.2.3.3 Growth of public-private partnerships

2.2.4 Challenges

2.2.4.1 Cybersecurity vulnerabilities

2.2.4.2 Data privacy and ethical concerns

2.2.4.3 Rapid urbanization and natural land encroachment

2.3 Evolution of Natural Disaster Management

2.4 Ecosystem Analysis

2.6 Supply Chain Analysis

2.9 Technology Analysis

2.9.1 Key Technologies

2.9.1.1 Geographic information systems (GIS)

2.9.1.2 Internet of Things (IoT)

2.9.1.3 Artificial intelligence & machine learning (AI/ML)

2.9.1.4 Emergency response systems

2.9.1.5 Remote sensing

2.9.1.6 Early warning systems

2.9.2 Complementary Technologies

2.9.2.1 Edge computing

2.9.2.2 Big data and analytics

2.9.2.3 5G

2.9.2.4 Cloud computing

2.9.3 Adjacent Technologies

2.9.3.1 Robotics

2.9.3.2 Wearable technology

2.9.3.3 Blockchain

2.10 Patent Analysis

2.10.1 Methodology

2.11 Porter’s Five Forces Analysis

2.11.1 Threat of New Entrants

2.11.2 Threat of Substitutes

2.11.3 Bargaining Power of Buyers

2.11.4 Bargaining Power of Suppliers

2.11.5 Intensity of Competitive Rivalry

2.13 Trends/Disruptions Impacting Customer Business

2.14 Key Conferences and Events, 2025–2026

2.15 Technology Roadmap for Natural Disaster Management Market

2.15.1 Natural Disaster Management Technology Roadmap Till 2030

2.15.1.1 Short-term roadmap (2024–2026)

2.15.1.2 Mid-term roadmap (2026–2028)

2.15.1.3 Long-term roadmap (2028–2030)

2.16 Best Practices for Natural Disaster Management

2.17 Current and Emerging Business Models

2.18 Tools, Frameworks, and Techniques Used in Natural Disaster Management

2.19 Trade Analysis

2.19.1 Export Scenario of Beacons and Other Floating Structures

2.19.2 Import Scenario of Beacons and Other Floating Structures

2.20 Investment and Funding Scenario

2.21 Impact of AI/Generative AI on Natural Disaster Management Market

2.21.1 Use Cases of Generative AI in Natural Disaster Management

3.1 Introduction

3.2 Key Player Strategies/Right to Win, 2020–2024

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Market Ranking Analysis

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches/Developments

3.8.2 Deals

3.9 Product Comparison

3.10 Company Valuation and Financial Metrics

4.1 SADEEM TECHNOLOGY

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 LUMINEYE

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 VENTI LLC

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 ONE CONCERN

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 TRINITY MOBILITY

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 F24

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 ALERTUS TECHNOLOGY

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 ORORATECH

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 DRYAD NETWORKS

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 GEOSIG

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 TELEGRAFIA

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 SEISMICAI

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 OTT HYDROMET

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

iotinsider

iotinsider

Mar 2025

Mar 2025