Comparing 3 vendors in Physical Security Startups across 0 criteria.

The physical security market is evolving through the integration of cybersecurity, driven by technological advancements and interconnected systems. Traditional measures like locks and cameras have expanded into digital access controls and networked surveillance. The rise of IoT and cloud solutions has introduced new vulnerabilities, prompting a unified approach to protect assets and data. Enterprises, especially smaller ones, face challenges in balancing cost and security. The market is shaped by trends in remote work, regulatory demands, and AI-driven defense strategies.

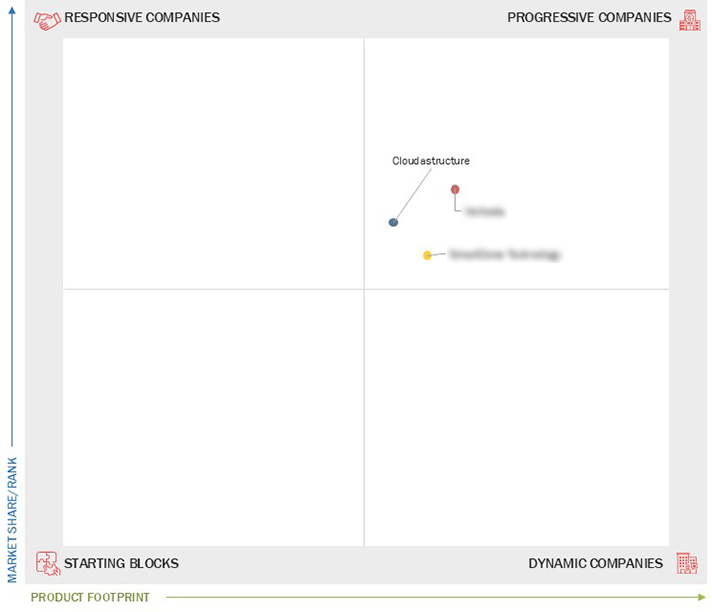

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Market Segmentation & Regions Covered

1.3.2 Years Considered

1.4 Currency Considered

1.5 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing Demand for Public Safety and Asset Protection

2.2.1.2 Expansion of Smart Cities and Critical Infrastructure

2.2.1.3 Rising Instances of Malicious Activities and Security Breaches to Physical Systems

2.2.1.4 Growing use of IP-based Cameras for Video Surveillance

2.2.1.5 Increasing Cyber Threats to Physical Security Systems

2.2.2 Restraints

2.2.2.1 Privacy Concerns Related to Surveillance and Biometric Data

2.2.2.2 Limited Budget Allocation, Especially in Public Sector an SMES

2.2.2.3 Considerable False Alarm Rates

2.2.3 Opportunities

2.2.3.1 Rising Deployment of AI and Machine Learning in Surveillance and Threat Detection

2.2.3.2 Adoption of Unified Security Platforms for Centralized Command and Control

2.2.3.3 Digital Transformation Enabled By Video Security Systems

2.2.3.4 Adoption of IOT-based Security Systems with Cloud Computing Platforms

2.2.4 Challenges

2.2.4.1 Balancing Security Needs with Privacy and Compliance Regulations

2.2.4.2 Resistance to Change from Traditional to Digital Or AI- enhanced Systems

2.2.4.3 High Installation and Maintenance Costs for SMES

2.2.4.4 Integration of Logical and Physical Components of Security Systems

2.3 Value Chain Analysis

2.3.1 Component Suppliers/r&d

2.3.2 Planning and Design

2.3.3 Implementation & Installation

2.3.4 System Integrators

2.3.5 Distribution

2.3.6 End Users

2.3.7 Post-sales Services

2.4 Ecosystem Analysis

2.5 Impact of Generative AI on Physical Security Market

2.5.1 Generative AI

2.5.2 Top use Cases and Market Potential in Physical Security Market

2.5.3 Impact of Generative AI on Interconnected and Adjacent Ecosystems

2.5.3.1 Video Surveillance Systems

2.5.3.2 Intelligent Perimeter and Facility Control

2.5.3.3 IOT & Sensor Networks

2.5.3.4 Cloud-based Security Platforms

2.5.3.5 Artificial Intelligence (AI) & Machine Learning (ML)

2.6 Porter’s Five Forces Analysis

2.6.1 Threat of New Entrants

2.6.2 Bargaining Power of Suppliers

2.6.3 Bargaining Power of Buyers

2.6.4 Threat of Substitutes

2.6.5 Intensity of Competitive Rivalry

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.1.1 AI/ML

2.7.1.2 Smart Devices

2.7.1.3 Wireless Security Systems

2.7.1.4 Contactless Biometrics

2.7.2 Complementary Technologies

2.7.2.1 Thermal Imaging and Infrared Sensors

2.7.2.2 Drones and Autonomous Patrol Robots

2.7.3 Adjacent Technologies

2.7.3.1 Blockchain

2.7.3.2 IOT

2.7.3.3 Robotic Process Automation (RPA)

2.8 Patent Analysis

2.9 Impact of US Trump Tariff on Physical Security Market

2.9.1 Introduction

2.9.2 Key Tariff Rates

2.9.3 Price Impact Analysis

2.9.4 Key Impact on Various Regions/countries

2.9.4.1 North America

2.9.4.2 Europe

2.9.4.3 Asia Pacific

2.9.5 Impact on End-use Industries

2.10 Trends/disruptions Impacting Customer Business

2.11 Physical Security Market: Business Models

2.12 Investment and Funding Scenario

2.13 Key Conferences & Events in 2025-26

3.1 Key Player Strategies/right to Win, 2022–2024

3.2 Revenue Analysis, 2020–2024

3.3 Market Share Analysis, 2024

3.4 Brand Comparison

3.4.1 Johnson Controls

3.4.2 Bosch Building Technologies

3.4.3 Honeywell

3.4.4 ADT

3.4.5 Cisco

3.5 Company Valuation and Financial Metrics

3.5.1 Company Valuation, 2024

3.5.2 Financial Metrics Using EV/ebidta

3.6 Company Evaluation Matrix: Startups/smes, 2024

3.6.1 Progressive Companies

3.6.2 Responsive Companies

3.6.3 Dynamic Companies

3.6.4 Starting Blocks

3.6.5 Competitive Benchmarking: Startups/smes, 2024

3.6.5.1 Detailed List of Key Startups/smes

3.6.5.2 Competitive Benchmarking of Key Startups/smes

3.7 Competitive Scenario

3.7.1 Product Launches & Enhancements

3.7.2 Deals

4.1 SMARTCONE TECHNOLOGIES

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 VERKADA

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 CLOUDASTRUCTURE

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

The Manila Times

The Manila Times

Jan 2026

Jan 2026