Comparing 21 vendors in Post-Quantum Cryptography Startups across 0 criteria.

The post-quantum cryptography (PQC) market is rapidly emerging as organizations prepare for the advent of quantum computing, which threatens traditional cryptographic systems like RSA and ECC. PQC solutions aim to secure sensitive data against future quantum attacks, addressing concerns such as the “Harvest Now, Decrypt Later” (HNDL) threat. Enterprises across sectors—including finance, healthcare, and government—are increasingly investing in quantum-safe encryption to protect long-term data integrity. The market growth is driven by regulatory pressures, rising cybersecurity awareness, and the need to modernize cryptographic infrastructure. Key technologies include lattice-based, hash-based, and code-based cryptographic algorithms. With increasing research, development, and pilot implementations, the PQC market is expected to see significant adoption over the next decade. Overall, post-quantum cryptography is becoming a critical component of future-ready cybersecurity strategies.

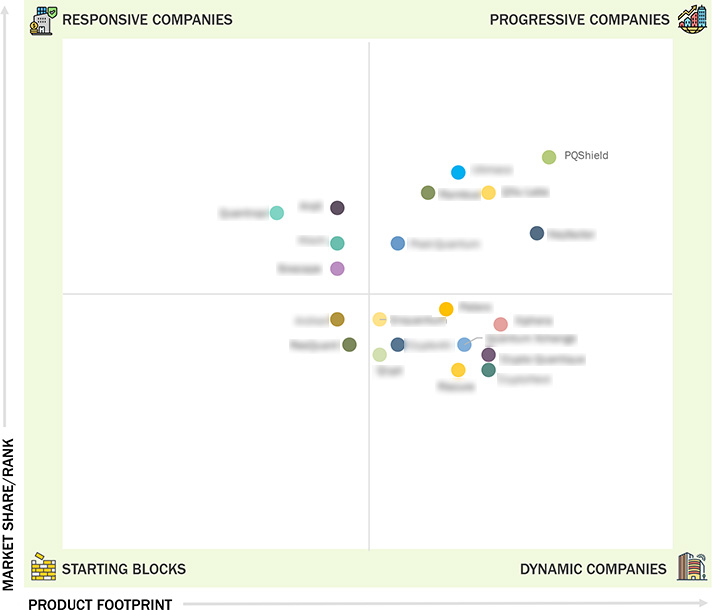

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered

1.4 Currency Considered

1.5 Stakeholders

1.6 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Integration of Innovative Cryptographic Algorithms

2.2.1.2 Hybrid PQC Mechanisms

2.2.1.3 Growing Awareness of Cybersecurity and Data Privacy

2.2.1.4 Driving Awareness toward Quantum Computing Threat

2.2.1.5 Rising Demand for Optimized PQC Implementations to Handle

Global Encryption Workloads

2.2.1.6 Collaboration between Academia, Industry, and Government on

PQC Adoption

2.2.2 Restraints

2.2.2.1 High Implementation Costs in Post-Quantum Cryptography

Market

2.2.2.2 Lack of Standardized Algorithms

2.2.3 Opportunities

2.2.3.1 PQC Integration in Blockchain Networks

2.2.3.2 Advancements in High-performance Computing Architecture

2.2.3.3 Early Development of New Products and Services to Provide

Competitive Edge

2.2.3.4 Government and Defense Contracts

2.2.3.5 Migration to Post-Quantum Cryptography

2.2.4 Challenges

2.2.4.1 Significantly Large Key Size and Implications on

Performance

2.2.4.2 Implementation Challenges

2.2.4.3 Lack of Skilled Workforce

2.2.4.4 Vulnerabilities Due to Advancements in Quantum Technology

2.3 Impact of Generative AI on Post-Quantum Cryptography Market

2.3.1 Top Use Cases and Market Potential

2.3.1.1 Key Use Cases

2.3.2 Impact of Gen AI on Interconnected and Adjacent Ecosystems

2.3.2.1 Quantum Computing

2.3.2.2 Quantum Key Distribution (QKD)

2.3.2.3 Hardware Security Modules (HSMs)

2.3.2.4 Cloud Security

2.3.2.5 Digital Signatures

2.3.2.6 Identity and Access Management (IAM)

2.4 Value Chain Analysis

2.4.1 Technology Infrastructure Providers

2.4.2 Post-Quantum Cryptography Providers

2.4.3 Application Developers

2.4.4 System Integrators

2.4.5 Verticals

2.5 Ecosystem Analysis

2.6 Porter’s Five Forces Model Analysis

2.6.1 Threat of New Entrants

2.6.2 Threat of Substitutes

2.6.3 Bargaining Power of Suppliers

2.6.4 Bargaining Power of Buyers

2.6.5 Intensity of Competitive Rivalry

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.1.1 Lattice-based Cryptography

2.7.1.2 Code-based Cryptography

2.7.1.3 Hash-based Cryptography

2.7.1.4 Multivariate Cryptography

2.7.1.5 Symmetric Key Quantum Resistance

2.7.1.6 Isogeny-based Cryptography

2.7.2 Complementary Technologies

2.7.2.1 Quantum-resistant Hardware Accelerators

2.7.2.2 Cloud-based Pqc

2.7.3 Adjacent Technologies

2.7.3.1 Quantum Computing

2.7.3.2 Post-Quantum Cybersecurity

2.8 Trends/Disruptions Impacting Customer Business

2.9 Key Conferences & Events

2.10 Business Model Analysis

2.10.1 Algorithm Development and Licensing in Post-Quantum

Cryptography

2.10.2 Consulting Services

2.10.3 Hardware Solutions

2.10.4 Software Solutions

2.10.5 Cloud-based Services Model

2.10.6 Specialized Security Solutions

2.10.7 Subscription-based Model

2.10.8 Education and Training in Post-Quantum Cryptography Market

2.11 Investment and Funding Scenario

2.12 Impact of US Tariff – Overview

2.12.1 Introduction

2.12.2 Key Tariff Rates

2.12.3 Price Impact Analysis

2.12.4 Impact on Country/Region

2.12.4.1 North America

2.12.4.1.1 United States

2.12.4.1.2 Canada

2.12.4.1.3 Mexico

2.12.4.2 Europe

2.12.4.2.1 Germany

2.12.4.2.2 France

2.12.4.2.3 United Kingdom

2.12.4.3 APAC

2.12.4.3.1 China

2.12.4.3.2 Japan

2.12.4.3.3 India

2.12.5 Industries

3.1 Key Player Strategies/Right to Win

3.2 Revenue Analysis

3.3 Market Share Analysis, 2024

3.4 Brand Comparison

3.5 Company Valuation and Financial Metrics

3.5.1 Company Valuation, 2025

3.5.2 Financial Metrics Using EV/EBITDA, 2025

3.6 Company Evaluation Matrix: Startups/SMEs, 2024

3.6.1 Progressive Companies

3.6.2 Responsive Companies

3.6.3 Dynamic Companies

3.6.4 Starting Blocks

3.6.5 Competitive Benchmarking: Startups/SMEs, 2024

3.6.5.1 Detailed List of Key Startups/SMEs

3.6.5.2 Competitive Benchmarking of Key Startups/SMEs

3.7 Competitive Scenario

3.7.1 Product Launches/Enhancements

3.7.2 Deals

4.1 PQSHIELD

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 RAMBUS

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 ULTIMACO

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 QNU LABS

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 KEYFACTOR

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 POST-QUANTUM

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 KLOCH

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 ARQIT

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 QUANTROPI

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 SIXSCAPE

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 PATERO

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 QUANTUM XCHANGE

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 CRYPTO QUANTIQUE

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 CRYPTO4A

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

4.15 CRYPTONEXT

4.15.1 Business overview

4.15.2 Products/Solutions/Services offered

4.15.3 Recent developments

4.16 QRYPT

4.16.1 Business overview

4.16.2 Products/Solutions/Services offered

4.16.3 Recent developments

4.17 ENQUANTUM

4.17.1 Business overview

4.17.2 Products/Solutions/Services offered

4.17.3 Recent developments

4.18 XIPHERA

4.18.1 Business overview

4.18.2 Products/Solutions/Services offered

4.18.3 Recent developments

4.19 RISCURE

4.19.1 Business overview

4.19.2 Products/Solutions/Services offered

4.19.3 Recent developments

4.20 ARCHON

4.20.1 Business overview

4.20.2 Products/Solutions/Services offered

4.20.3 Recent developments

4.21 RESQUANT

4.21.1 Business overview

4.21.2 Products/Solutions/Services offered

4.21.3 Recent developments

My Everyday Tech

My Everyday Tech

Jan 2025

Jan 2025