Comparing 13 vendors in Smart Railways Startups across 0 criteria.

The smart railways market is evolving rapidly with the integration of advanced technologies to enhance operational efficiency and passenger experience. Traditional railway systems are being upgraded through innovations like predictive analytics, smart ticketing, and real-time passenger information. These improvements are driven by urbanization, sustainability goals, and digital transformation. Technologies such as IoT, AI, cloud computing, and big data are central to this shift, enabling better asset management, route optimization, and safety. The market is also seeing growth in autonomous train development and smart city initiatives.

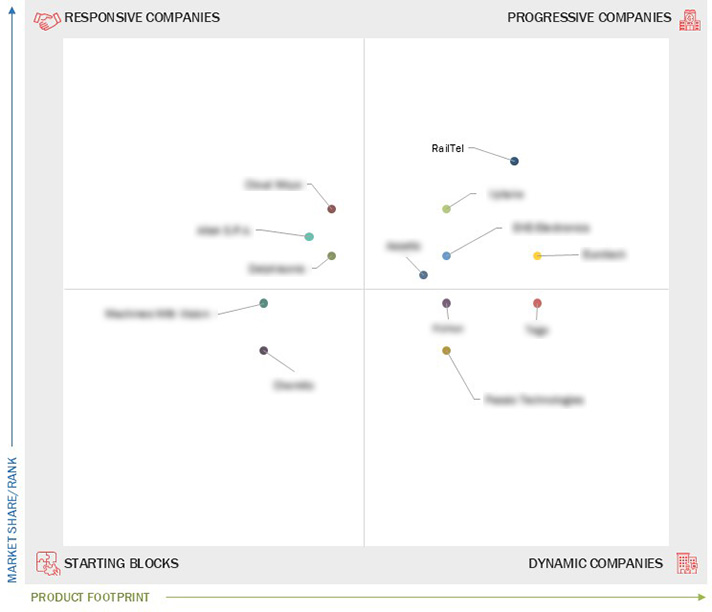

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increase in government initiatives and public-private partnerships

2.2.1.2 Adoption of IoT and other automation technologies to enhance optimization

2.2.1.3 Efficient railway systems

2.2.2 Restraints

2.2.2.1 High initial cost of deployment

2.2.3 Opportunities

2.2.3.1 Increase in globalization and need for advanced transportation infrastructure

2.2.3.2 Increase in the demand for cloud-based services

2.2.4 Challenges

2.2.4.1 Integration complexities with legacy infrastructure

2.2.4.2 Disruption in the logistics and supply chain of IoT devices

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Others

4.1 RAILTEL CORPORATION OF INDIA LIMITED

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 UPTAKE

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 EKE-Electronics

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 EUROTECH

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Assetic

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 Cloud Moyo

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Aitek

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 DELPHISONIC

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 TEGO

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 KONUX

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 Passio Technologies

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 MACHINES WITH VISION

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 Chemito

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

Motorindia

Motorindia

Oct 2024

Oct 2024