Comparing 16 vendors in Software Defined Vehicle across 0 criteria.

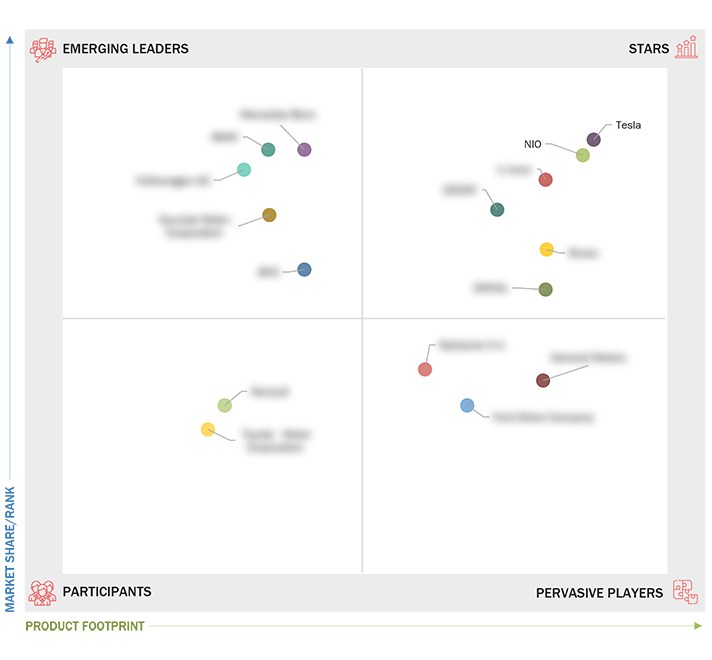

The Software Defined Vehicle Companies Quadrant is a comprehensive industry analysis that provides valuable insights into the global market for Software Defined Vehicle. This quadrant offers a detailed evaluation of key market players, technological advancements, product innovations, and industry trends. MarketsandMarkets 360 Quadrants evaluated over 40 companies of which the Top 16 Software Defined Vehicle Companies were categorized and recognized as the quadrant leaders.

Market Leadership Quadrant

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

2.1 DRIVERS

2.1.1 Reduced recall and manufacturing costs

2.1.2 Personalized client engagement

2.1.3 Integration of ADAS digital cockpits

2.1.4 Increasing adoption of 5G technology

2.2 RESTRAINTS

2.2.1 Limited over-the-air updates

2.2.2 Increase in risk of cyberattacks in SDVs

2.3 OPPORTUNITIES

2.3.1 Remote diagnostics

2.3.2 Pay-per-use mobility

2.3.3 SDV platform monetization

2.3.4 Digital twin for emergency repair

2.4 CHALLENGES

2.4.1 Complex software updates and security patching

2.4.2 Risk of data breach

2.5 ECOSYSTEM ANALYSIS

2.5.1 OEMS

2.5.2 TIER 1 HARDWARE PROVIDERS

2.5.3 TIER 2 PLAYERS

2.5.4 CHIP PROVIDERS

2.5.5 SOFTWARE PROVIDERS

2.5.6 CLOUD PROVIDERS

3.1 INTRODUCTION

3.2 KEY PLAYER STRATEGIES

3.3 MARKET SHARE ANALYSIS, 2023

3.4 REVENUE ANALYSIS, 2019–2023

3.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

3.5.1 STARS

3.5.2 EMERGING LEADERS

3.5.3 PERVASIVE PLAYERS

3.5.4 PARTICIPANTS

3.6 COMPANY FOOTPRINT: KEY PLAYERS, 2023

3.6.1 Company footprint

3.6.2 Vehicle type footprint

3.6.3 Region footprint

3.7 COMPETITIVE SCENARIOS AND TRENDS

3.7.1 PRODUCT LAUNCHES

3.7.2 DEALS

4.1 KEY PLAYERS

4.1.1 TESLA

4.1.1.1 Business overview

4.1.1.2 Products offered

4.1.1.3 Recent developments

4.1.1.4 MnM view

4.1.2 LI AUTO INC.

4.1.2.1 Business overview

4.1.2.2 Products offered

4.1.2.3 Recent developments

4.1.2.4 MnM view

4.1.3 ZEEKR

4.1.3.1 Business overview

4.1.3.2 Products offered

4.1.3.3 Recent developments

4.1.3.4 MnM view

4.1.4 XPENG INC.

4.1.4.1 Business overview

4.1.4.2 Products offered

4.1.4.3 Recent developments

4.1.4.4 MnM view

4.1.5 NIO

4.1.5.1 Business overview

4.1.5.2 Products offered

4.1.5.3 Recent developments

4.1.5.4 MnM view

4.1.6 RIVIAN

4.1.6.1 Business overview

4.1.6.2 Products offered

4.1.6.3 Recent developments

4.1.6.4 MnM view

4.2 KEY OEMS SHIFTING TO SDV

4.2.1 VOLKSWAGEN AG

4.2.1.1 Business overview

4.2.1.2 Products offered

4.2.1.3 Recent developments

4.2.2 HYUNDAI MOTOR CORPORATION

4.2.2.1 Business overview

4.2.2.2 Products offered

4.2.2.3 Recent developments

4.2.3 FORD MOTOR COMPANY

4.2.3.1 Business overview

4.2.3.2 Products offered

4.2.3.3 Recent developments

4.2.4 GENERAL MOTORS

4.2.4.1 Business overview

4.2.4.2 Products offered

4.2.4.3 Recent developments

4.2.5 RENAULT GROUP

4.2.5.1 Business overview

4.2.5.2 Products offered

4.2.5.3 Recent developments

4.2.6 TOYOTA MOTOR CORPORATION

4.2.6.1 Business overview

4.2.6.2 Products offered

4.2.6.3 Recent developments

4.2.7 STELLANTIS

4.2.7.1 Business overview

4.2.7.2 Products offered

4.2.7.3 Recent developments

4.2.8 MERCEDES-BENZ AG

4.2.8.1 Business overview

4.2.8.2 Products offered

4.2.8.3 Recent developments

4.2.9 BYD

4.2.9.1 Business overview

4.2.9.2 Products offered

4.2.9.3 Recent developments

4.2.10 BMW

4.2.10.1 Business overview

4.2.10.2 Products offered

4.2.10.3 Recent developments

BimmerLife

BimmerLife

Jan 2026

Jan 2026