Comparing 5 vendors in Telecom Cloud Startups across 0 criteria.

The telecom cloud market is rapidly evolving as enterprises seek scalable, flexible, and cost-effective solutions to manage data and operations. Driven by technologies like AI, ML, 5G, and IoT, telecom providers are shifting from traditional infrastructure to cloud-based models. This transformation enhances business efficiency, supports strategic decision-making, and reduces operational complexities. Cloud services offer benefits such as improved productivity, faster time-to-market, and better control over applications, making them integral to modern telecom strategies focused on innovation and customer satisfaction.

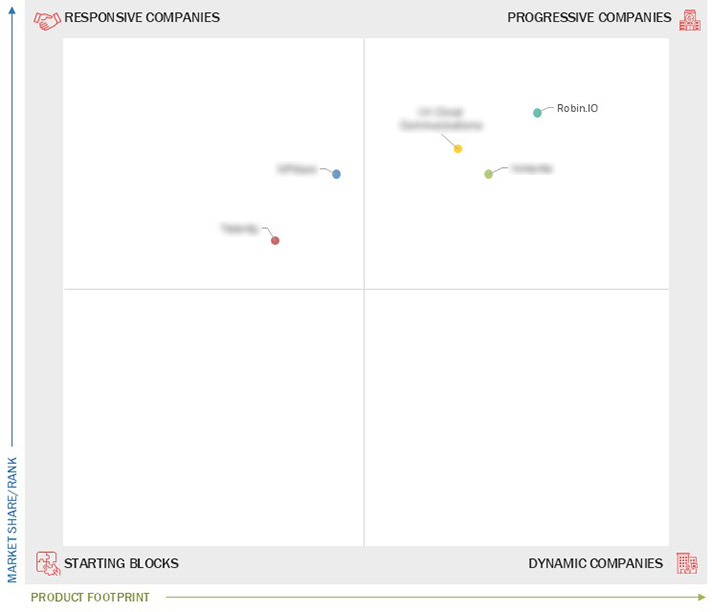

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Limitations

1.6 Stakeholders

1.7 Summary of Changes

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Limitations

1.6 Stakeholders

1.7 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Emergence of 5G standard and IoT usage catalyze demand for telecom

2.2.1.2 Growth witnessed by cloud-native environment

2.2.1.3 Surge in 5G paving eMBB, mMTC, and URLLC

2.2.1.4 Reduction of OPEX and CAPEX using telecom cloud

2.2.2 Restraints

2.2.2.1 Portability and interoperability issues

2.2.2.2 Rising number of cyberattacks

2.2.3 Opportunities

2.2.3.1 Demand for Open RAN and private 5G network

2.2.3.2 Demand for SDN and NFV-based cloud-native solutions to replace traditional networking model

2.2.4 Challenges

2.2.4.1 Risk of information loss

2.2.4.2 Stringent government regulations

2.2.4.3 Complexities related to operating environment

2.3 Brief History of Telecom Cloud

2.4 Ecosystem Analysis

2.5 Industry Use Cases

2.5.1 Use Case 1: Globe Telecom Automated Business through Google Cloud

2.5.2 Use Case 2: Deutsche Telekom Partnered with Vmware to Support ITs Network Transformation

2.5.3 Use Case 3: Google Helped Wind Tre Manage ITs Large Volume of Data

2.5.4 Use Case 4: Amazon Helped Verizon with ITs 5G Network Rollout

2.5.5 Use Case 5: Red Hat Helped Etisalat with ITs Network Transformation

2.6 Supply Chain Analysis

2.6.1 Network Providers and Hardware Providers

2.6.2 Cloud Computing Service Providers

2.6.3 Platform, Solution, and Service Providers

2.6.4 End Users (Telecom Operators)

2.7 Technology Analysis

2.7.1 Introduction

2.7.2 Key Technologies

2.7.2.1 Artificial Intelligence (AI)

2.7.2.2 Machine Learning (ML)

2.7.2.3 Internet of Things (IoT)

2.7.2.4 Digital Twin

2.7.3 Adjacent Technologies

2.7.3.1 Augmented Reality (AR)/ Virtual Reality (VR)

2.7.3.2 Edge Computing

2.7.4 Complementary Technologies

2.7.4.1 Cloud Computing

2.7.4.2 Cybersecurity

2.7.4.3 Big Data Analytics

2.7.4.4 Blockchain

2.8 Patent Analysis

2.8.1 Methodology

2.8.2 Telecom Cloud Market: Key Patents

2.9 Trends/Disruptions Impacting Customer Business

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

2.11 Key Conferences and Events in 2025–2026

2.12 Technology Roadmap for Telecom Cloud Market

2.12.1 Telecom Cloud Roadmap Till 2030

2.12.1.1 Short-term roadmap

2.12.1.2 Mid-term roadmap

2.12.1.3 Long-term roadmap

2.13 Impact of AI/Generative AI on Telecom Cloud Market

2.13.1 Use Cases of Generative AI in Telecom Cloud

2.14 Investment and Funding Scenario, 2024

2.15 Best Practices in Telecom Cloud Market

2.16 Impact of 2025 Us Tariff–Telecom Cloud Market

2.16.1 Introduction

2.16.2 Key Tariff Rates

2.16.3 Price Impact Analysis

2.16.3.1 Strategic Shifts and Emerging Trends

2.16.4 Impact on Country/Region

2.16.4.1 US

2.16.4.2 China

2.16.4.3 Europe

2.16.4.4 Asia Pacific (excluding China)

2.16.5 Impact on End-Use Industry

2.16.5.1 Telecommunication Service Providers (CSPs/Telcos)

3.1 Introduction

3.2 Key Strengths/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

4.1 Inmanta

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 NFWARE

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Robin.IO

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 TELENITY

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 UK Cloud Communications

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

einpresswire

einpresswire

Jan 2025

Jan 2025