Comparing 5 vendors in Renewable Energy Certificate Startups across 0 criteria.

A renewable energy certificate (REC) is a market-based instrument that represents the property rights to the environmental, social, and other non-power attributes of renewable electricity generation. Renewable energy certificates are issued when one megawatt-hour (MWh) of electricity is generated and delivered to the electricity grid from renewable energy resources such as wind energy, solar energy, hydro energy, biomass, biogas, and geothermal energy.

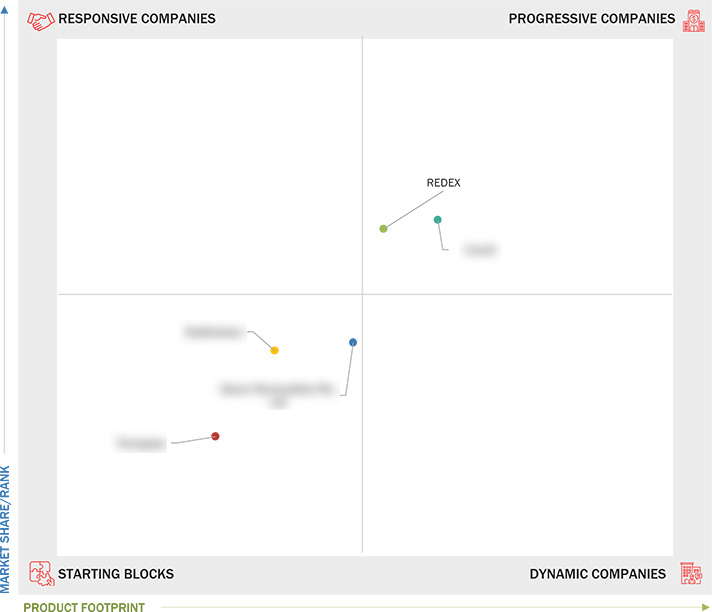

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Government policies and mandates regarding renewable energy targets

2.2.1.2 Corporate strategies and initiatives toward sustainability goals

2.2.1.3 Transition toward renewable energy sources

2.2.1.4 Increasing awareness of climate change

2.2.2 Restraints

2.2.2.1 Fluctuating prices of RECs

2.2.2.2 High transaction costs

2.2.3 Opportunities

2.2.3.1 Increasing investments in clean energy projects

2.2.3.2 Government incentives and financial support programs

2.2.3.3 Elevating demand for solar panels, micro hydropower plants, and micro wind turbines

2.2.4 Challenges

2.2.4.1 Standardization gaps in REC and risks of fraud and duplicate claims

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Others Developments

3.8.4 Expansions

4.1 REDEX

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 CnerG

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Saxon Renewables Pte. Ltd.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 WattCarbon

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Terrapass

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

Electronics360

Electronics360

Oct 2025

Oct 2025