Comparing 9 vendors in Veterinary Dermatology Startups across 0 criteria.

The Veterinary Dermatology Market is experiencing strong growth, driven by rising awareness of pet health and the global increase in companion animal ownership. This market focuses on innovative treatments and diagnostics for conditions such as parasitic infestations, fungal infections, and allergic dermatitis. The humanization of pets and growing concerns about zoonotic diseases, which often manifest through skin issues, have further highlighted the need for advanced veterinary dermatological care. Additionally, the rise in pet insurance and higher spending on animal healthcare are enabling pet owners to access advanced treatments, supporting continued market expansion.

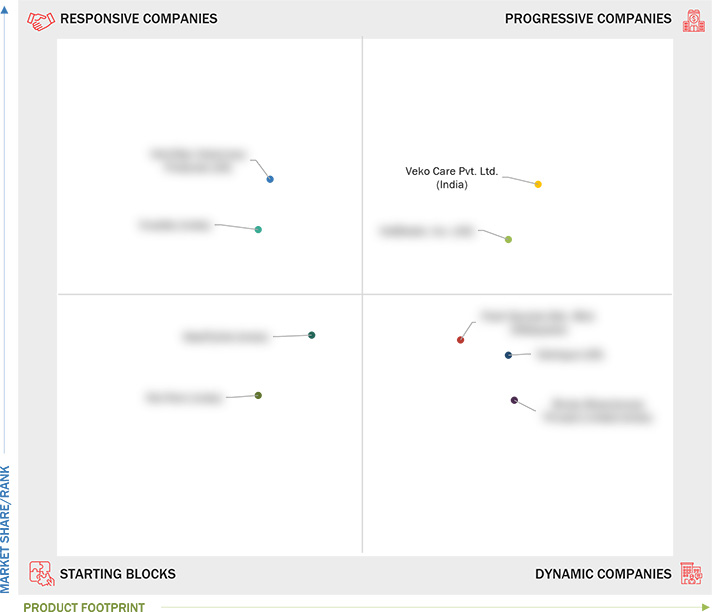

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Years Considered

1.4 Currency Considered

1.5 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Expanding companion animal population and pet ownership

2.2.1.2 Growing concerns about infectious zoonotic diseases

2.2.1.3 Rising awareness initiatives by government and animal

welfare organizations

2.2.1.4 Increasing adoption of pet insurance and high animal

healthcare expenditure

2.2.2 Restraints

2.2.2.1 Rising pet care costs

2.2.2.2 Restrictions on Use of parasiticides for food-producing

animals

2.2.3 Opportunities

2.2.3.1 Technological advancements and product launches

2.2.3.2 High growth potential in emerging economies

2.2.3.3 Surging number of veterinary practitioners in developed

markets

2.2.4 Challenges

2.2.4.1 Growing resistance to parasiticides

2.2.4.2 Diversity in parasite species

2.3 Industry Trends

2.3.1 Rise in Pet Ownership, Humanization of Pets, and Increased Focus

on Pet Wellness Programs

2.3.2 Rising Use of Diagnostics and Wearable Technology for Early

Detection

2.4 Technology Analysis

2.4.1 Key Technologies

2.4.1.1 Topical nanomedicine

2.4.1.2 Biologic therapies

2.4.2 Complementary Technologies

2.4.2.1 Phototherapy

2.4.2.2 Hydrotherapy

2.4.3 Adjacent Technologies

2.4.3.1 Telemedicine platforms

2.4.3.2 Wearable devices

2.5 Porter’s Five Forces Analysis

2.5.1 Competitive Rivalry

2.5.1.1 Established players

2.5.1.2 Continuous innovation

2.5.2 Bargaining Power of Buyers

2.5.2.1 Consolidated veterinary groups

2.5.2.2 Demand for affordable solutions

2.5.3 Bargaining Power of Suppliers

2.5.3.1 Specialized raw materials

2.5.3.2 Quality compliance

2.5.4 Threat of Substitutes

2.5.4.1 Limited alternatives

2.5.4.2 Specialized treatments

2.5.5 Threat of New Entrants

2.5.5.1 High R&D costs

2.5.5.2 Regulatory requirements

2.6 Patent Analysis

2.6.1 Patent Publication Trends for Veterinary Dermatology Market

2.6.2 Insights: Jurisdiction and Top Applicant Analysis

2.7 Trade Analysis

2.7.1 Import and Export Scenario for Veterinary Dermatology Products

2.8 Reimbursement Analysis

2.9 Key Conferences and Events

2.10 Unmet Needs/End User Expectations in Veterinary Dermatology Market

2.11 Impact of Generative Ai on Veterinary Dermatology Market

2.12 Ecosystem Analysis

2.13 Supply Chain Analysis

2.14 Value Chain Analysis

2.15 Adjacent Markets for Veterinary Dermatology Market

2.16 Trends/Disruptions Impacting Customer Business

2.17 Investment and Funding Scenario

3.1 Overview

3.2 Key Player Strategy/Right to Win

3.3 Revenue Analysis of Key Players in Veterinary Dermatology Market

(2020–2024)

3.4 Market Share Analysis, 2024

3.4.1 Ranking of Key Market Players, 2024

3.5 Company Evaluation Matrix: Startups/SMEs, 2024

3.5.1 Progressive Companies

3.5.2 Responsive Companies

3.5.3 Dynamic Companies

3.5.4 Starting Blocks

3.5.5 Competitive Benchmarking: Startups/SMEs, 2024

3.6 Brand/Product Comparison

3.7 R&D Expenditure of Key Players

3.8 Company Valuation and Financial Metrics

3.8.1 Company Valuation

3.8.2 Financial Metrics

3.9 Competitive Scenario

3.9.1 Product Approvals/Launches

3.9.2 Deals

3.9.3 Expansions

3.9.4 Other Developments

4.1 VETRIMAX VETERINARY PRODUCTS (US)

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 VIVALDIS (INDIA)

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 MEDFLYVET (INDIA)

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 PET PERK(INDIA)

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 VEKO CARE PVT. LTD. (INDIA)

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 VETBIOTEK, INC. (US)

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 POSH SOCIETE SDN. BHD. (MALAYASIA)

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 VETNIQUE (US)

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 BIVETY BIOSCIENCES PRIVATE LIMITED (INDIA)

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments