Comparing 15 vendors in Industrial Fasteners Startups across 0 criteria.

Industrial fasteners are crucial components used to connect or secure multiple objects across various applications. Manufactured from materials such as steel, aluminum, and plastic, they provide varying degrees of strength and resistance to corrosion based on their intended use. Common types of fasteners include screws, bolts, nuts, washers, and rivets—each engineered to meet specific fastening requirements.

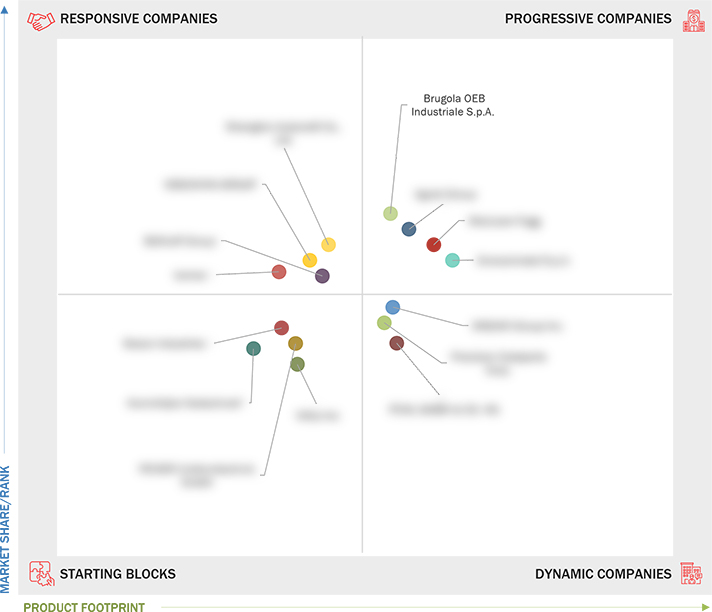

Market Leadership Quadrant

1.1 Study objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.3.5 Units Considered

1.4 Stakeholders

2.1 INTRODUCTION

2.2 MARKET DYNAMICS

2.3 DRIVERS

2.3.1 Increasing demand for fasteners from automotive sector

2.3.2 Growing infrastructure investments globally

2.3.3 Advancements in manufacturing technology

2.4 RESTRAINTS

2.4.1 Fluctuating raw material prices

2.4.2 Replacement by advanced joining technologies

2.5 OPPORTUNITIES

2.5.1 Rapid urbanization in Africa and Asia

2.5.2 Expansion in aerospace and renewable energy sectors

2.5.3 Development of smart fastening solutions

2.6 CHALLENGES

2.6.1 Counterfeiting and quality issues

2.6.2 Diverse regional regulations

2.7 VALUE CHAIN ANALYSIS

2.8 ECOSYSTEM ANALYSIS

2.9 INVESTMENT AND FUNDING SCENARIO

2.10 TECHNOLOGY ANALYSIS

2.10.1 KEY TECHNOLOGIES

2.10.2 COMPLEMENTARY TECHNOLOGIES

2.10.3 ADJACENT TECHNOLOGIES

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2020–2024

3.3 Market Share Analysis, 2024

3.4 Revenue Analysis, 2019–2023

3.5 Company Valuation and Financial Metrics, 2024

3.6 Brand Comparison

3.7 Company Evaluation Matrix: Key Players, 2024

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.8 Company Footprint: Key Players, 2024

3.8.1 Company Footprint

3.8.2 Region Footprint

3.8.3 Product type footprint

3.8.4 Customer interaction channel footprint

3.8.5 End User Footprint

3.9 Competitive Scenario

3.9.1 Product Launches & Enhancements

3.9.2 Deals

4.1 Illinois Tool Works, Inc.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.1.4 MnM view

4.2 Stanley Black & Decker, Inc.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 MnM view

4.3 LISI Group

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.3.4 MnM view

4.4 Bulten AB

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 MnM view

4.5 SFS Group AG

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 MnM view

4.6 Koelner Rawlplug IP

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 FONTANA GRUPPO

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.8 MW Industries, Inc.

4.8.1 Business overview

4.8.2 Recent developments

4.9 Birmingham Fastener and Supply Inc.

4.9.1 Business overview

4.9.2 Recent developments

4.10 Hilti Group

4.10.1 Business overview

4.10.2 Recent developments

ERP Today

ERP Today

Dec 2025

Dec 2025