Comparing 12 vendors in Refrigerants Startups across 0 criteria.

The global refrigerants market is a dynamic and evolving sector characterized by a significant shift towards sustainable practices and technologies. Refrigerants are integral to the functioning of air conditioning systems and refrigeration units, playing a crucial role in various domestic, commercial, and industrial applications. The market's growth is primarily driven by the rising demand for consumer appliances and the expanding pharmaceutical industry, particularly in emerging markets like Asia Pacific. This region, with its growing population, rapid urbanization, and increasing disposable income, is expected to continue its dominance in the refrigerants market.

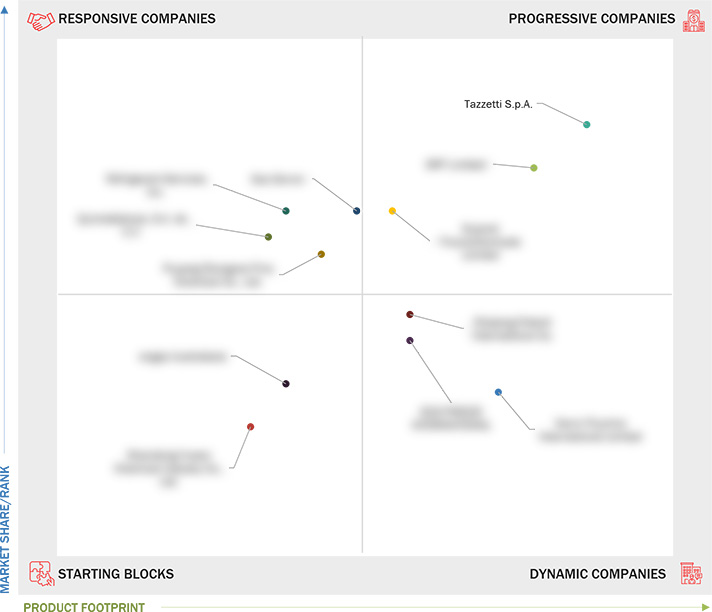

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.3.5 Unit Considered

1.4 Stakeholders

1.5 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing demand for consumer appliances

2.2.1.2 Growing pharmaceutical industry

2.2.2 Restraints

2.2.2.1 Stringent regulations against fluorocarbon refrigerants

2.2.2.2 Flammability and toxicity issues

2.2.3 Opportunities

2.2.3.1 Increasing demand for natural refrigerants

2.2.4 Challenges

2.2.4.1 Illegal trade of refrigerants

2.3 Porter’s Five Forces Analysis

2.3.1 Threat of New Entrants

2.3.2 Threat of Substitutes

2.3.3 Bargaining Power of Suppliers

2.3.4 Bargaining Power of Buyers

2.3.5 Intensity of Competitive Rivalry

2.4 Macroeconomic Indicators

2.4.1 GDP Trends and Forecast

2.5 Supply Chain Analysis

2.6 Trends/Disruptions Impacting Customer Business

2.7 Ecosystem Analysis

2.8 Technology Analysis

2.8.1 Key Technologies

2.8.1.1 Not-in-kind cooling technology

2.8.2 Complementary Technologies

2.8.2.1 Magnetic refrigeration

2.9 Trade Analysis

2.9.1 Import Scenario (HS Code 290317)

2.9.2 Export Scenario (HS Code 290317)

2.10 Key Conferences and Events, 2025

2.11 Investment and Funding Scenario

2.12 Patent Analysis

2.12.1 Methodology

2.12.2 Document Types

2.12.3 Top Applicants

2.12.4 Jurisdiction Analysis

2.13 Impact of AI/Gen AI on Refrigerants Market

3.1 Overview

3.2 Key Player Strategies/Right to Win

3.3 Market Share Analysis

3.4 Revenue Analysis

3.5 Company Evaluation Matrix: Key Players, 2023

3.5.1 Stars

3.5.2 Emerging Leaders

3.5.3 Pervasive Players

3.5.4 Participants

3.6 Company Evaluation Matrix: Startups/SMEs, 2023

3.6.1 Progressive Companies

3.6.2 Responsive Companies

3.6.3 Dynamic Companies

3.6.4 Starting Blocks

3.6.5 Competitive Benchmarking: Startups/SMEs, 2023

3.6.5.1 Detailed list of key startups/SMEs

3.6.5.2 Competitive benchmarking of key startups/SMEs

3.7 Brand/Product Comparison Analysis

3.8 Company Valuation and Financial Metrics

3.9 Competitive Scenario

3.9.1 Product Launches

3.9.2 Deals

3.9.3 Expansions

3.9.4 Others

4.1 SRF LIMITED

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 GUJARAT FLUOROCHEMICALS LIMITED

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 NAVIN FLUORINE INTERNATIONAL LIMITED

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 SHANDONG YUEAN CHEMICAL INDUSTRY CO., LTD.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 QUIMOBÁSICOS, S.A. DE C.V.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 TAZZETTI S.P.A.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 GAS SERVEI

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 ZHEJIANG FOTECH INTERNATIONAL CO.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 REFRIGERANT SERVICES INC.

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 ECO-FREEZE INTERNATIONAL

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 ENGAS AUSTRALASIA

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

Mint

Mint

Sep 2025

Sep 2025