Access Control Solutions Quadrant Report

Table of Contents

1 Introduction

1.1 Definition

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

Figure 1 High Adoption of Access Control Solutions Owing to Increasing Crime Rates Driving Growth of Access Control Market

2.2.1 Drivers

2.2.1.1 High Adoption of Access Control Solutions Owing to Increasing Crime Rates Globally

Table 1 Top 10 Countries With Highest Number of Terror Attacks and Fatalities, 2016

2.2.1.2 Technological Advancements and Deployment of Wireless Technology in Security Systems

2.2.1.3 Adoption of IoT-Based Security Systems With Cloud Computing Platforms

2.2.2 Restraints

2.2.2.1 High Cost and Perception of Unreliability

2.2.2.2 Less Awareness Among Users About Advanced Security Solutions

2.2.3 Opportunities

2.2.3.1 Adoption of Access Control as A Service (ACaaS)

2.2.3.2 Implementation of Mobile-Based Access Control

2.2.3.3 Increasing Urbanization in Emerging Countries

2.2.4 Challenges

2.2.4.1 Security Concerns Related to Unauthorized Access and Data Breach in Access Control Environment

2.3 Value Chain Analysis

Figure 2 Major Value Added By Original Equipment Manufacturers and Security and Management Software Providers

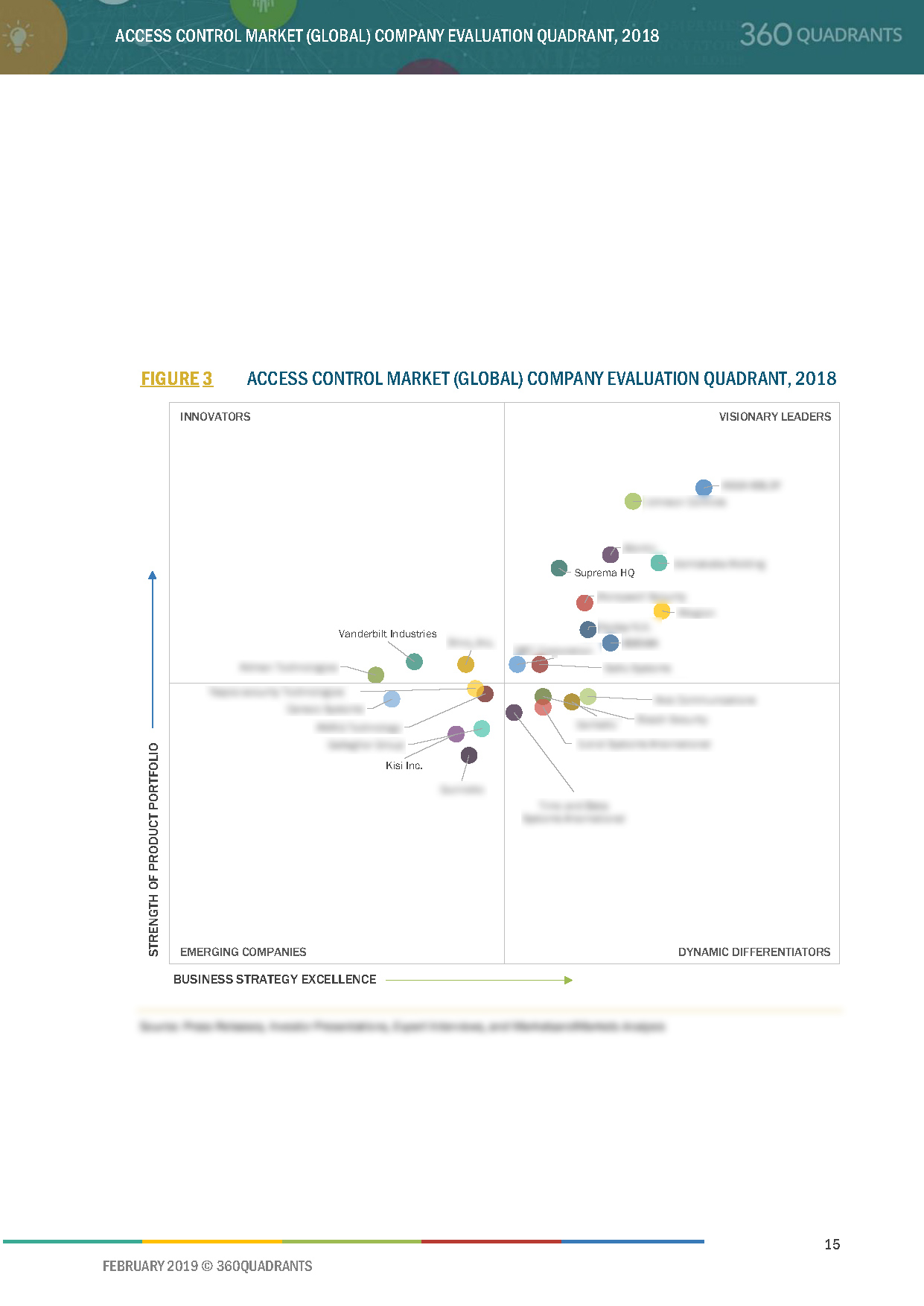

3 Company Evaluation Quadrant

3.1 Company Evaluation Quadrant

3.1.1 Visionary Leaders ( Access Control Leaders )

3.1.2 Innovators

3.1.3 Dynamic Differentiators

3.1.4 Emerging Companies

Figure 3 Access Control Market (Global) Company Evaluation Quadrant, 2018

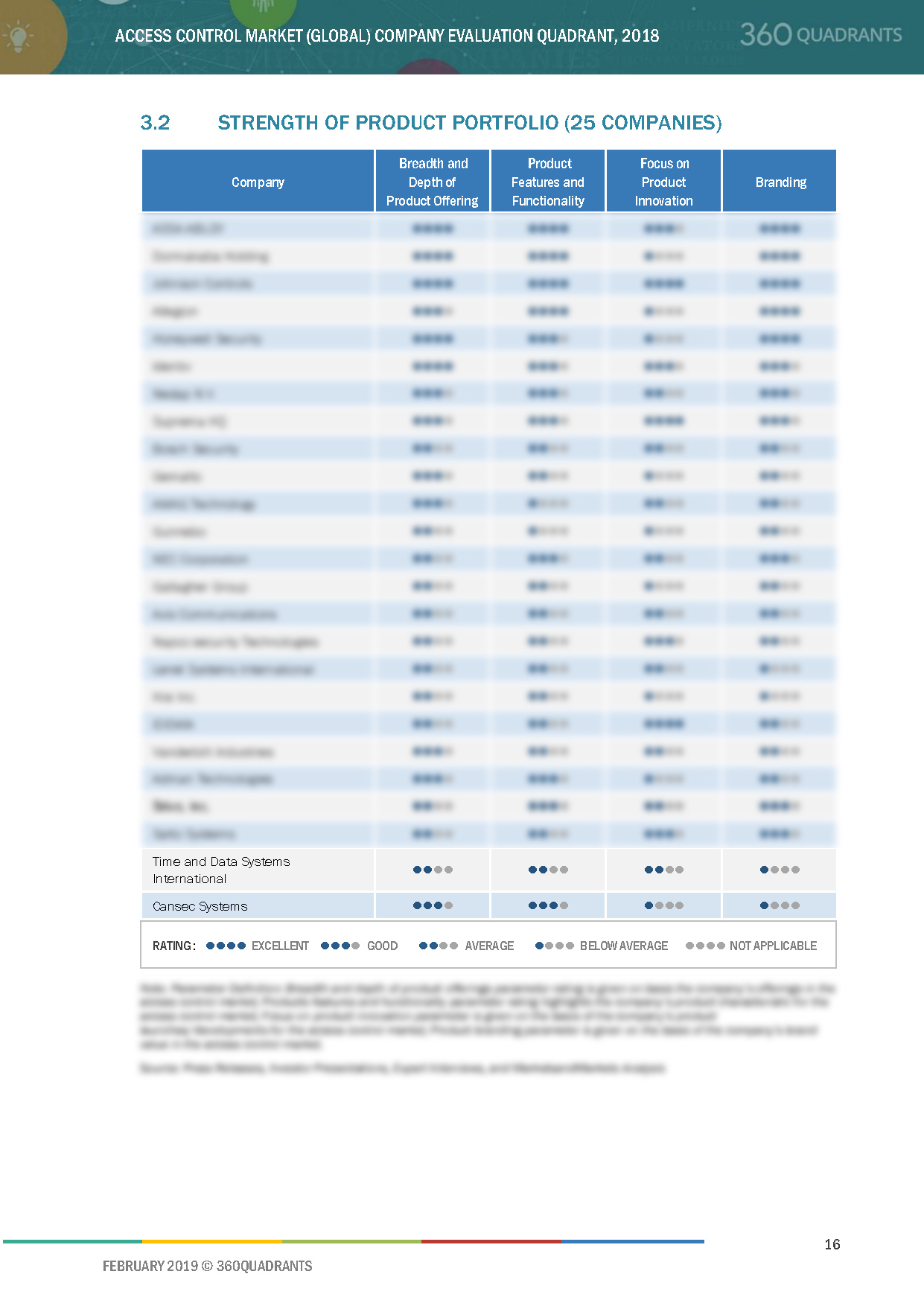

3.2 Strength of Product Portfolio (25 Companies)

3.3 Business Strategy Excellence (25 Companies)

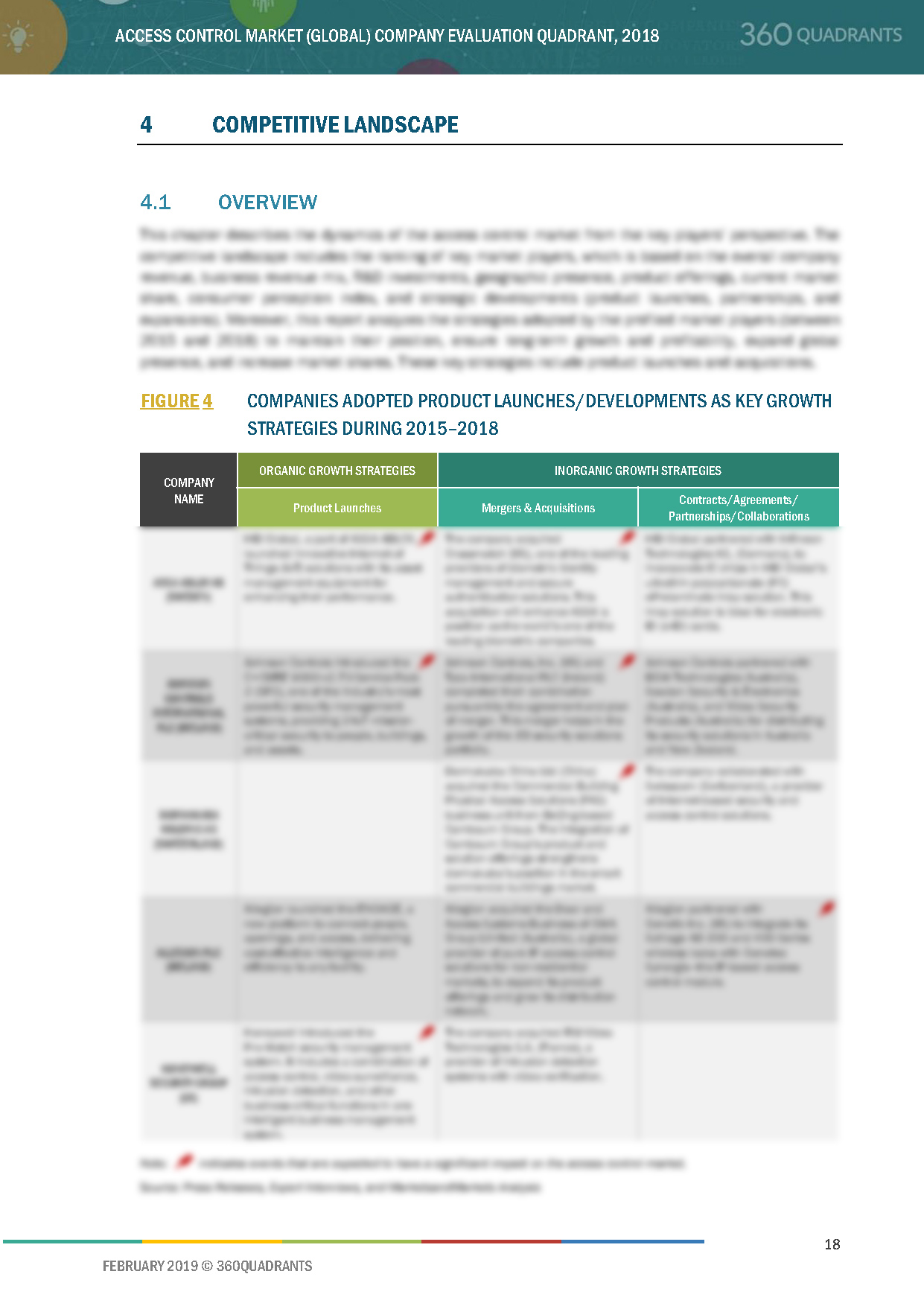

4 Competitive Landscape

4.1 Overview

Figure 4 Companies Adopted Product Launches/Developments as Key Growth Strategies During 2015–2018

4.2 Market Player Ranking Analysis

Figure 5 Assa Abloy AB (Sweden) Lead Access Control Market in 2018

4.3 Competitive Scenario

Figure 6 Evaluation Framework: Access Control Market

4.4 Competitive Situations & Trends

4.4.1 Product Launches/Developments

Table 2 Product Launches/Developments (2015–2018)

4.4.2 Mergers and Acquisitions

Table 3 Mergers and Acquisitions (2015–2018)

4.4.3 Collaborations/ Contracts/ Agreements/ Partnerships

Table 4 Collaborations/ Contracts/ Agreements/ Partnerships (2015–2018)

4.4.4 Expansions

Table 5 Expansions (2016–2018)

5 Company Profiles

5.1 Introduction

Figure 7 Geographic Revenue Mix of Leading Players

5.2 Key Players

5.2.1 Assa Abloy AB

5.2.1.1 Business Overview*

Figure 8 Assa Abloy AB: Company Snapshot

5.2.1.2 Products Offered*

5.2.1.3 Recent Developments*

5.2.1.4 SWOT Analysis*

5.2.1.5 MnM View*

(*Above sections are present for all of below companies)

5.2.2 Dormakaba Holding AG

Figure 9 Dormakaba Holding AG: Company Snapshot

5.2.3 Johnson Controls International PLC

Figure 10 Johnson Controls International PLC: Company Snapshot

5.2.4 Allegion PLC

Figure 11 Allegion PLC: Company Snapshot

5.2.5 Honeywell Security Group

Figure 12 Honeywell International Inc.: Company Snapshot

5.2.6 Identiv, Inc.

Figure 13 Identiv, Inc.: Company Snapshot

5.2.7 Nedap N.V.

Figure 14 Nedap N.V.: Company Snapshot

5.2.8 Suprema HQ Inc.

Figure 15 Suprema HQ Inc.: Company Snapshot

5.2.9 Bosch Security Systems Inc.

5.2.10 Gemalto N.V.

Figure 16 Gemalto N.V.: Company Snapshot

6 Appendix

6.1 Other Companies

6.1.1 Amag Technology, Inc.

6.1.2 Axis Communications AB

6.1.3 Gunnebo AB

6.1.4 NEC Corporation

6.1.5 Gallagher Group Limited

6.1.6 Adman Technologies Pvt. Ltd

6.1.7 Brivo, Inc.

6.1.8 Salto Systems S.L.

6.1.9 Idemia

6.1.10 Vanderbilt Industries

6.2 Methodology

This report identifies and benchmarks Top Access Control Companies such as ASSA ABLOY AB (Sweden), Johnson Controls International plc (Ireland), dormakaba Holding AG (Switzerland), Allegion plc (Ireland), Honeywell Security Group (US), and evaluates them on the basis of business strategy excellence and strength of product portfolio within the access control ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders ( Best Access Control Companies ), Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More