Bike and Scooter Rental Service Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

2 Market Overview

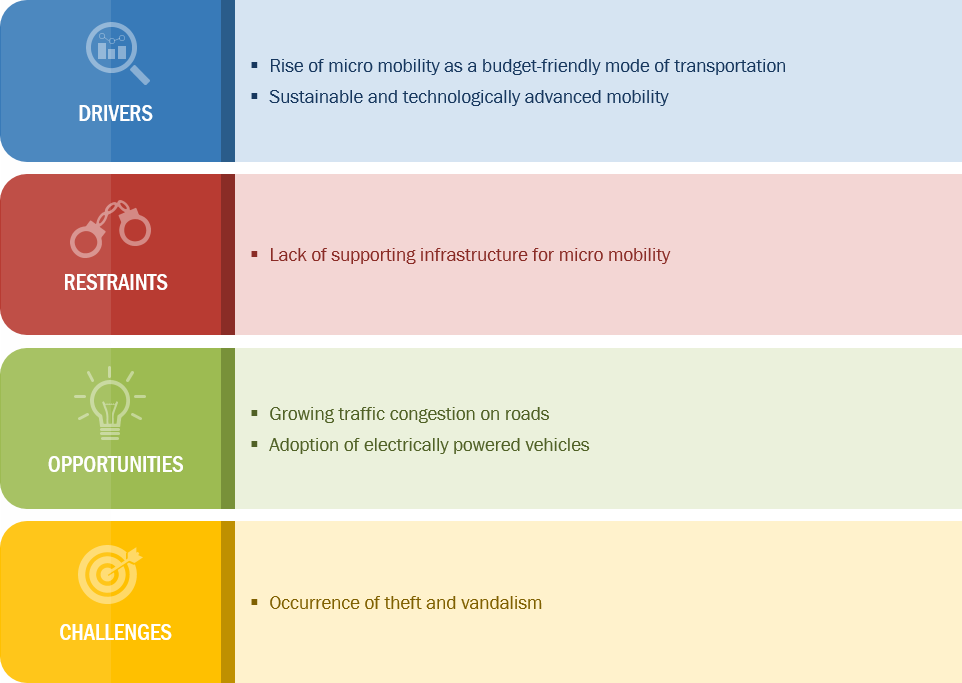

2.1 Market Dynamics

Figure 1 Bike and Scooter Rental: Market Dynamics

2.1.1 Drivers

2.1.1.1 Rise of Micromobility as a Budget-Friendly Mode of Transportation

Table 1 Average Rental Prices of Bikes and Scooters

2.1.1.2 Sustainable and Technologically Advanced Mobility

2.1.2 Restraints

2.1.2.1 Lack of Supporting Infrastructure for Micromobility

2.1.3 Opportunities

2.1.3.1 Growing Traffic Congestion on Roads

2.1.3.2 Adoption of Electrically Powered Vehicles

2.1.4 Challenges

2.1.4.1 Occurrence of Theft and Vandalism

Table 2 Impact of Market Dynamics

3 Company Evaluation Quadrant

3.1 Visionary Leaders

3.2 Innovators

3.3 Dynamic Differentiators

3.4 Emerging Companies

Figure 2 Bike and Scooter Rental Market (Global) Company Evaluation Quadrant

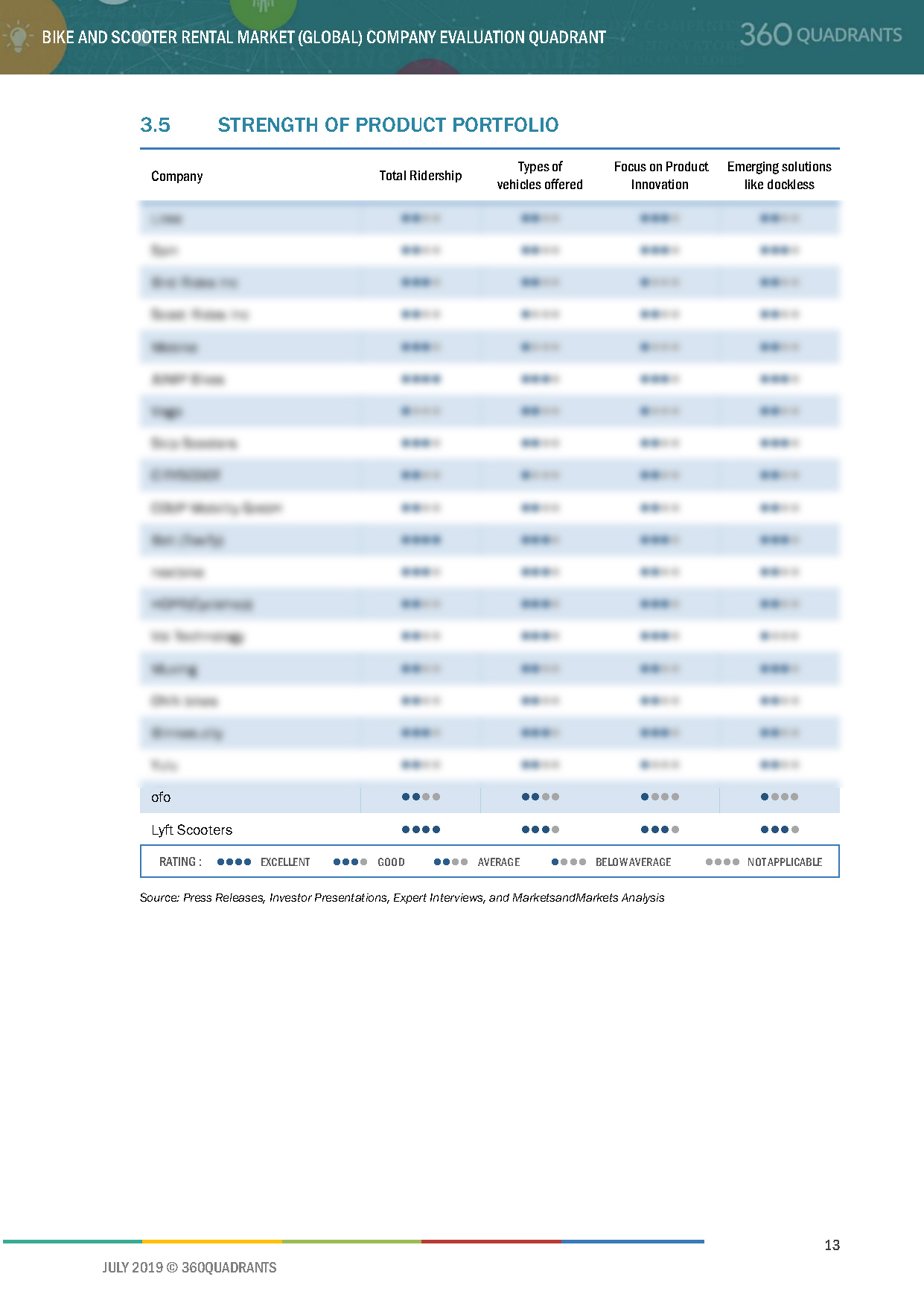

3.5 Strength of Product Portfolio

3.6 Business Strategy Excellence

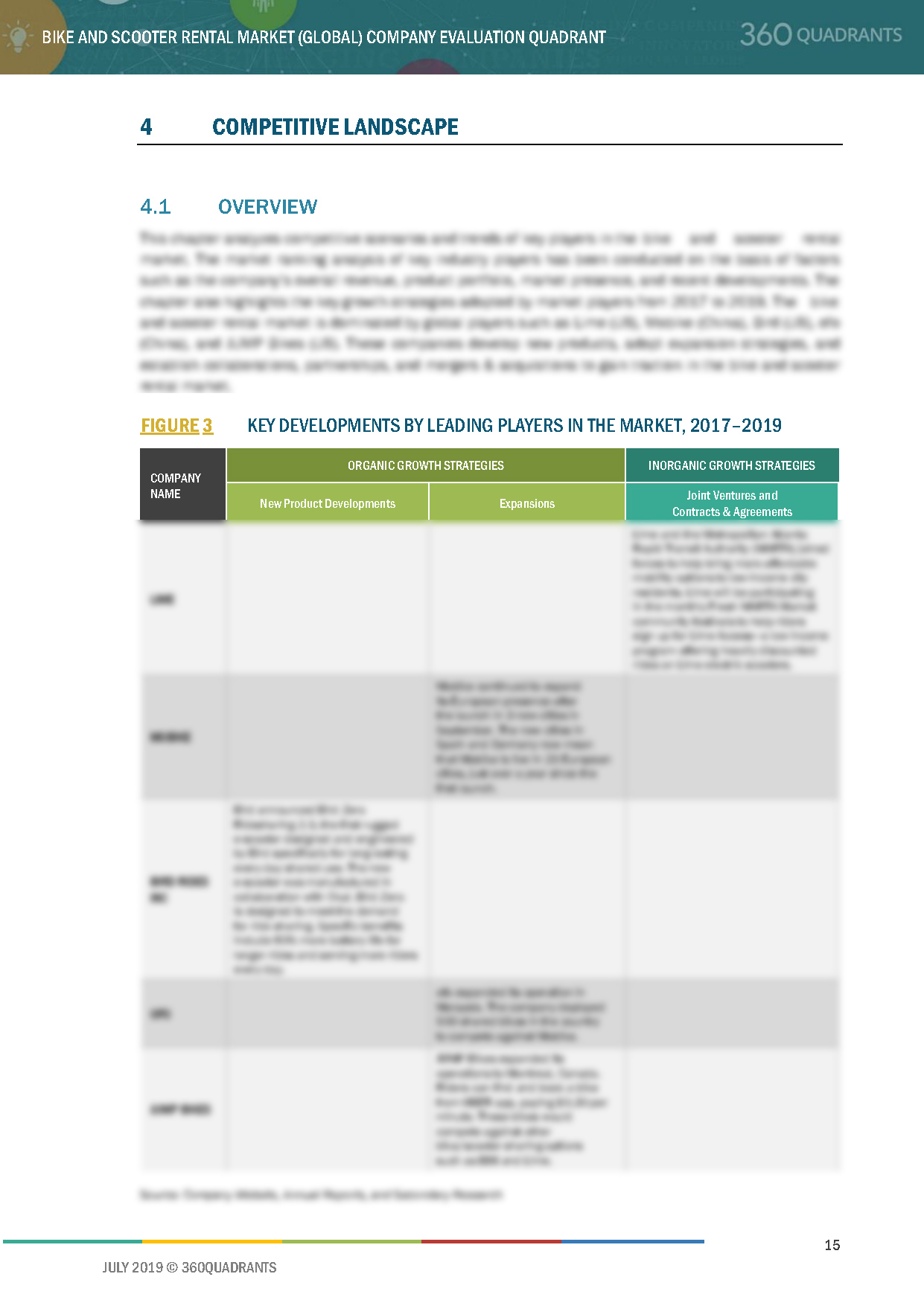

4 Competitive Landscape

4.1 Overview

Figure 3 Key Developments By Leading Players in the Market, 2017–2019

4.2 Market Ranking Analysis

4.3 Competitive Scenario

4.3.1 New Product Developments

Table 3 New Product Developments, 2017–2019

4.3.2 Collaborations/Joint Ventures/Supply Contracts/ Partnerships/Agreements

Table 4 Collaborations/Joint Ventures/Supply Contracts/Partnerships/ Agreements, 2017–2019

4.3.3 Expansions, 2017–2019

5 Company Profiles

5.1 Lime

5.1.1 Business Overview*

5.1.2 Products Offered*

5.1.3 Recent Developments*

5.1.4 SWOT Analysis*

Figure 4 Lime: SWOT Analysis

(*Above sections are present for all of below companies)

5.2 Bird

Figure 5 Bird: SWOT Analysis

5.3 Nextbike

Figure 6 Nextbike: SWOT Analysis

5.4 Cityscoot

Figure 7 Cityscoot: SWOT Analysis

5.5 Mobike

Figure 8 Mobike: SWOT Analysis

5.6 Spin

5.7 Scoot

5.8 Ecooltra

5.9 Lyft

Figure 9 Lyft: Company Snapshot

5.10 Skip

5.11 COUP

5.12 Bolt

5.13 Hopr

6 Appendix

6.1 Other Significant Players

6.1.1 Asia Pacific

6.1.1.1 Yulu

6.1.1.2 Mobycy

6.1.1.3 Onn Bikes

6.1.1.4 Vogo

6.1.1.5 OFO

6.1.1.6 Beam

6.1.2 Europe

6.1.2.1 Yego

6.1.2.2 Muving

6.1.2.3 Blinkee.City

6.1.2.4 Voi Technology

6.1.2.5 Emmy

6.1.3 North America

6.1.3.1 Jump

6.1.3.2 Spinlister

6.2 Methodology

This report identifies and benchmarks best bike and scooter rental vendors in the Bike and Scooter Rental market such as Lime (US), Mobike (China), Bird (US), ofo (China), and JUMP Bikes (US) and evaluates them on the basis of business strategy excellence and strength of product portfolio within the Bike and Scooter Rental ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. These best vendors are rated and positioned on a 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More