Drone Service Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

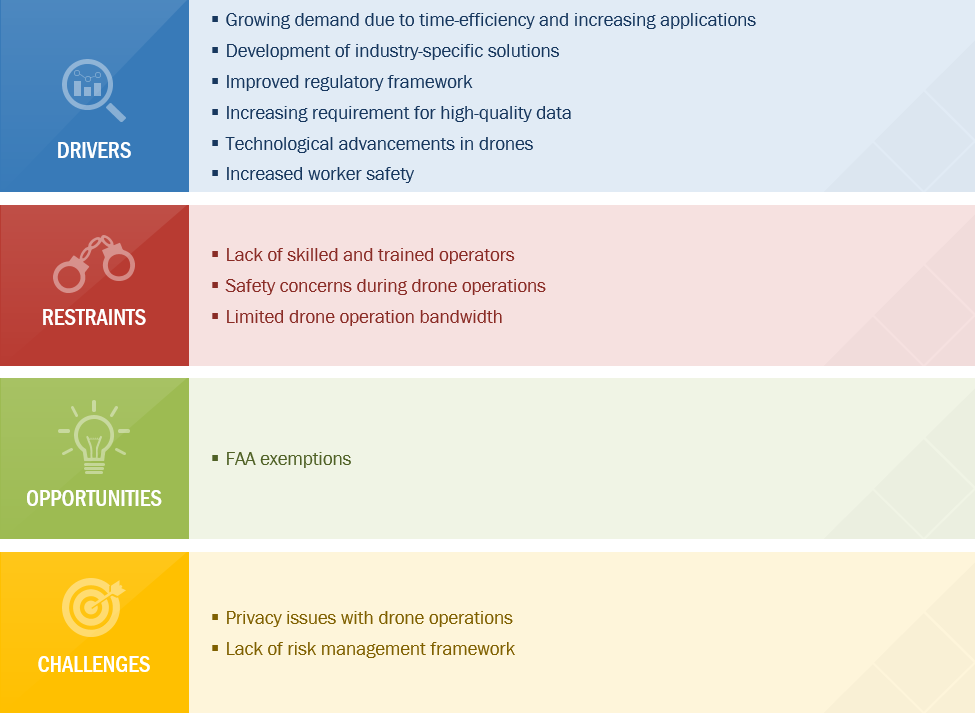

Figure 1 Dynamics of the Drone Services Market

2.2.1 Drivers

2.2.1.1 Growing Demand Due to Time-Efficiency and Increasing Applications

Figure 2 Present and Potential Commercial Applications of Drones

2.2.1.2 Development of Industry-Specific Solutions

2.2.1.3 Improved Regulatory Framework

2.2.1.4 Increasing Requirement for High-Quality Data

2.2.1.5 Technological Advancements in Drones

2.2.1.6 Increased Worker Safety

2.2.2 Restraints

2.2.2.1 Lack of Skilled and Trained Operators

2.2.2.2 Safety Concerns During Drone Operations

2.2.2.3 Limited Drone Operation Bandwidth

2.2.3 Opportunities

2.2.3.1 FAA Exemptions

Table 1 Industries Exempted By FAA (2015)

2.2.4 Challenges

2.2.4.1 Privacy Issues With Drone Operations

2.2.4.2 Lack of Risk Management Framework

3 Industry Trends

3.1 Introduction

3.2 Industry Use Cases

3.2.1 Video and Filmmaking

3.2.2 Inspection of Inaccessible Project Sites

3.2.3 Continuous Data Sharing for Development of Digital Twin Technology

3.2.4 Identification of Anomalous Events Through Predictive Maintenance

3.2.5 High Accuracy Data for Detection of Changes in Volumetrics

3.2.6 Classification and Identification of Objects of Insurance Industry

3.2.7 Improvised Payload Capabilities for Mapping & Surveying Industry

3.2.8 Aviation Mro Assistance By External Inspection of Aircraft

3.2.9 Urbanization, Crowd Control, and Traffic Assistance Through Real-Time Data Exchange

3.2.10 Disease Control and Prevention

3.3 Patent Analysis

Table 2 Patents Related to Drones Granted Between 2011 and 2016

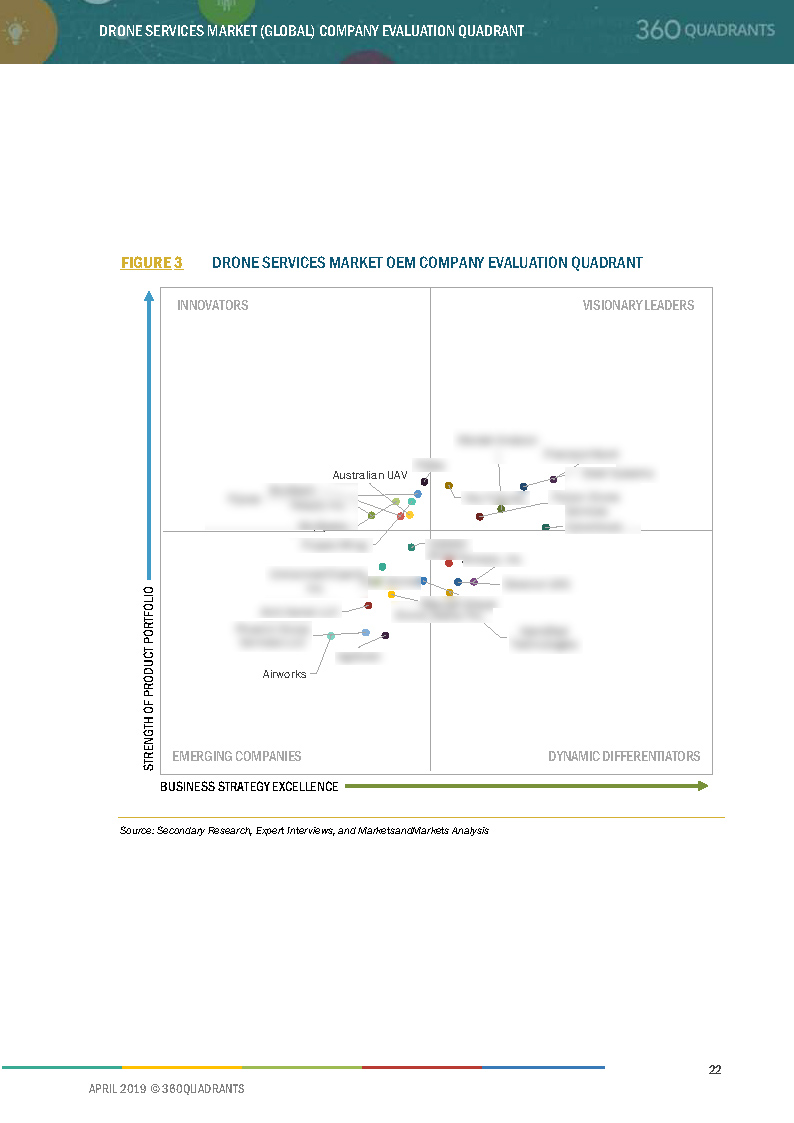

4 Company Evaluation Quadrant (OEM)

4.1 Visionary Leaders

4.2 Innovators

4.3 Dynamic Differentiators

4.4 Emerging Companies

Figure 3 Drone Services Market OEM Company Evaluation Quadrant

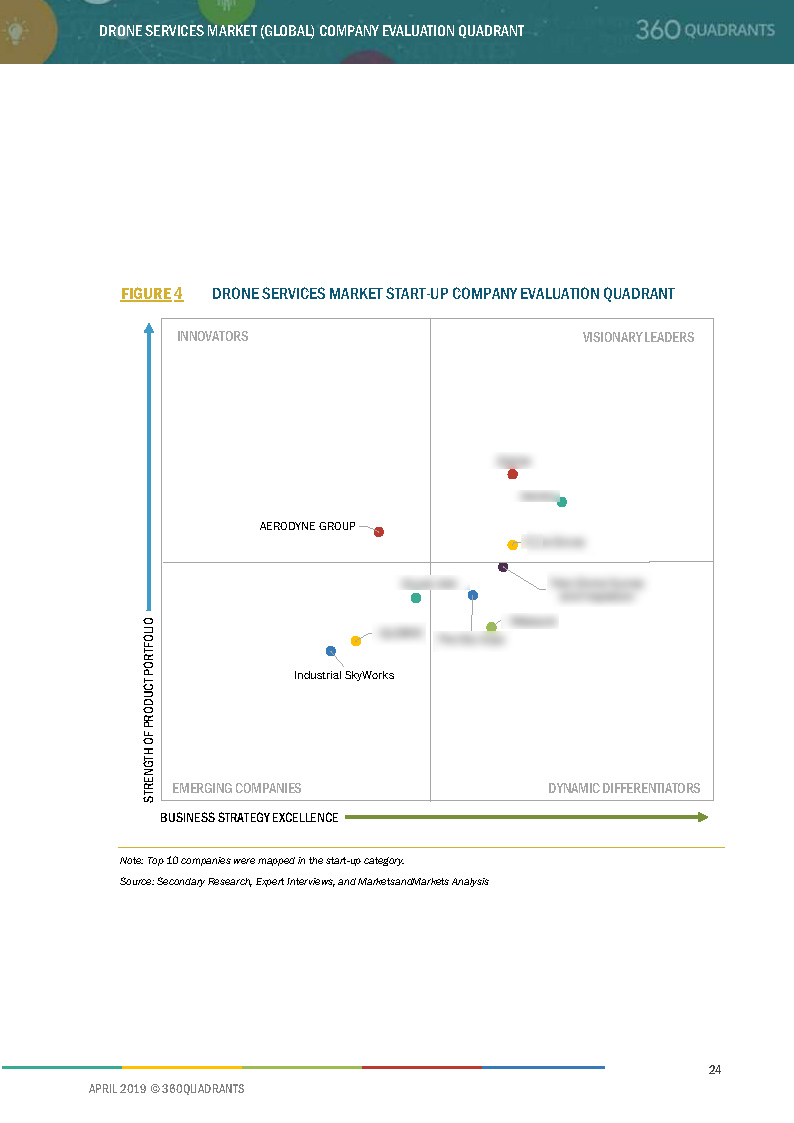

5 Company Evaluation Quadrant (Start Up)

5.1 Progressive Companies

5.2 Responsive Companies

5.3 Dynamic Companies

5.4 Starting Blocks

Figure 4 Drone Services Market Start-Up Company Evaluation Quadrant

6 Competitive Landscape

6.1 Overview

Figure 5 Key Developments By Leading Players in the Drone Services Market Between 2016 and 2018

6.2 Company Ranking Analysis: 2018

6.3 Competitive Scenario

6.3.1 New Service Launches

Table 3 New Service Launches, 2016-2018

6.3.2 Contracts, Partnerships, and Agreements

Table 4 Contracts, Partnerships, and Agreements, 2016-2018

7 Company Profiles

7.1 Introduction

7.2 Edall Systems

7.2.1 Business Overview*

7.2.2 Services Offered*

7.2.3 Recent Developments*

7.2.4 MnM View*

(*Above sections are present for all of below companies)

7.3 Precision Hawk

7.4 Martek Aviation

7.5 Aerobo

7.6 Cyberhawk Innovations

7.7 Measure

7.8 Sky-Futures

7.9 SenseFly

7.10 Sharper Shape

7.11 DroneDeploy

7.12 Phoenix Drone Services

7.13 Airware

7.14 Unmanned Experts

7.15 Prioria Robotics

7.16 Identified Technologies

7.17 Terra Drone

7.18 The Sky Guys

7.19 Deveron UAS

8 Appendix

8.1 Methodology

8.2 List of Abbreviations

This report identifies and benchmarks the world's best drone service companies such as Airware (US), Cyberhawk (UK), Deveron UAS (Canada), DroneDeploy (US), Identified Technologies (US), , Phoenix Drone Services (US), SenseFly (Switzerland), and evaluates them on the basis of business strategy excellence and strength of product portfolio within the drone services ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders (top companies), Dynamic Differentiators, Innovators, or Emerging companies.

The report also identifies and benchmarks start ups in the drone service market such as Zipline, Aerobo, Terra Drone, Measure (US). They are rated and positioned on a separate 2x2 matrix (Company Evaluation Quadrant) for start ups , and identified as Progressive companies, Responsive companies, Dynamic companies and Starting Blocks.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More