Electric Ships Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

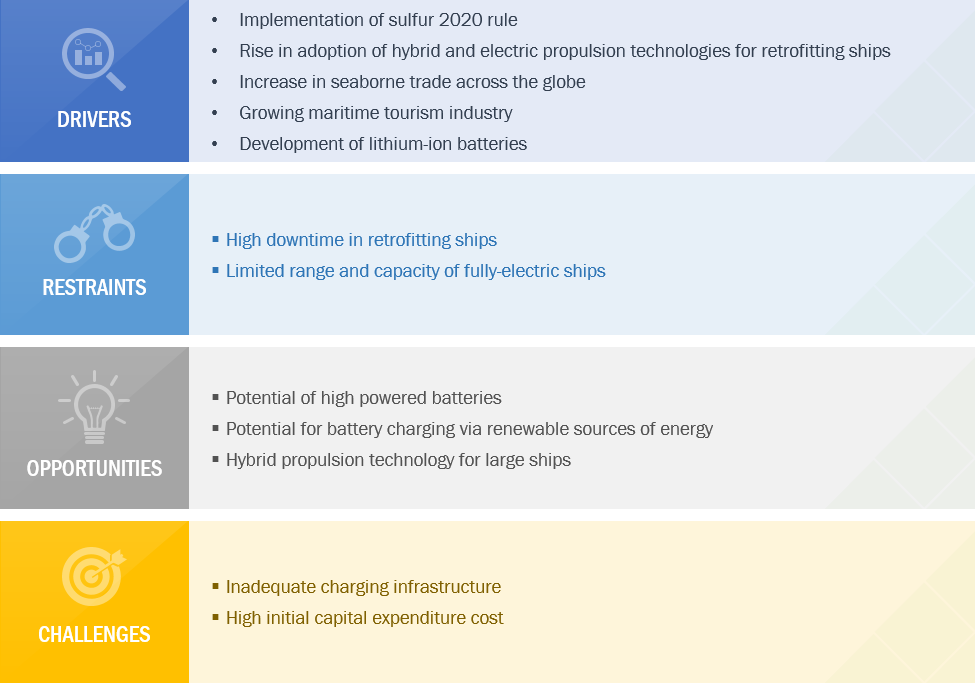

Figure 1 Electric Ships Market Dynamics: Drivers, Restraints, Opportunities & Challenges

2.2.1 Drivers

2.2.1.1 Implementation of Sulfur 2020 Rule

Table 1 Sulfur Content Regulations in Bunker Fuel

2.2.1.2 Rise in Adoption of Hybrid and Electric Propulsion Technologies for Retrofitting Ships

2.2.1.3 Increase in Seaborne Trade Across the Globe

Figure 2 Global Seaborne Trade, By Quantity Traded, 2005–2017

2.2.1.4 Growing Maritime Tourism Industry

Figure 3 Increase in Number of Cruise Passengers in Europe, 2007—2016

Figure 4 Global Cruise Industry Share, By Region, 2016

2.2.1.5 Development of Lithium-Ion Batteries

Figure 5 Most Common Lithium-Ion Batteries With Key Features

Table 2 Current Battery Capacity and Requirements of Ships

2.2.2 Restraints

2.2.2.1 High Downtime in Retrofitting Ships

2.2.2.2 Limited Range and Capacity of Fully-Electric Ships

2.2.3 Opportunities

2.2.3.1 Potential of High Powered Batteries

Figure 6 Relative Feasibility of Different Energy-Storage Technologies

2.2.3.2 Potential for Battery Charging Via Renewable Sources of Energy

2.2.3.3 Hybrid Propulsion Technology for Large Ships

2.2.4 Challenges

2.2.4.1 Inadequate Charging Infrastructure

2.2.4.2 High Initial Capital Expenditure Cost

Table 3 Capital Expenditure, Savings, and Payback

Table 4 Capital Expenditure, Savings, and Payback

Table 5 Capital Expenditure, Savings, and Payback

2.3 Key Autonomous Ships Development Projects

2.3.1 Rolls-Royce Marine – 2020

2.3.2 Kongsberg and Yara – 2020

2.3.3 Japanese Consortium – 2025

2.4 Innovations & Patent Registrations

Table 6 Innovations & Patent Registrations, 2011–2017

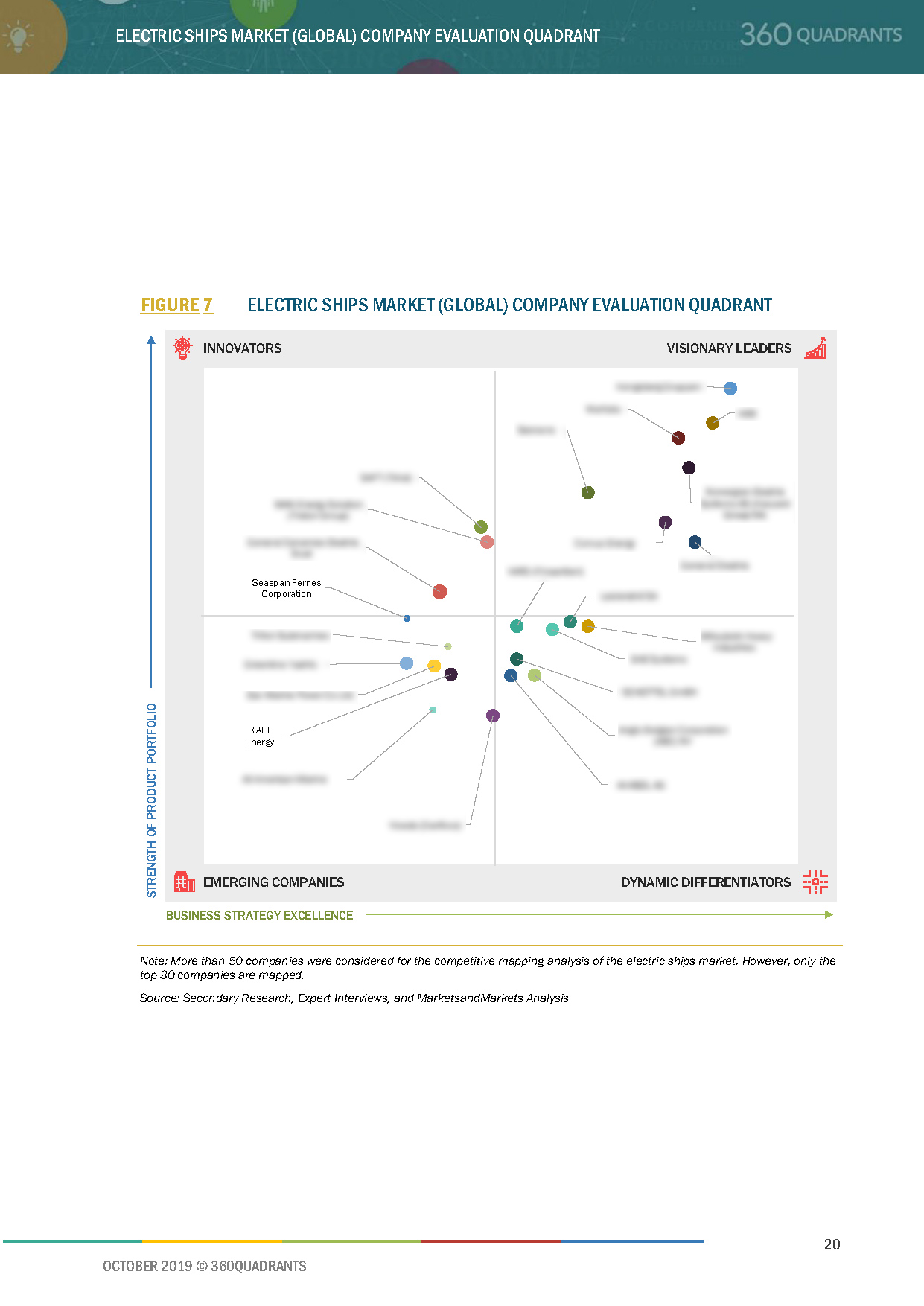

3 Company Evaluation Quadrant

3.1 Visionary Leaders

3.2 Innovators

3.3 Dynamic Differentiators

3.4 Emerging Companies

Figure 7 Electric Ships Market (Global) Company Evaluation Quadrant

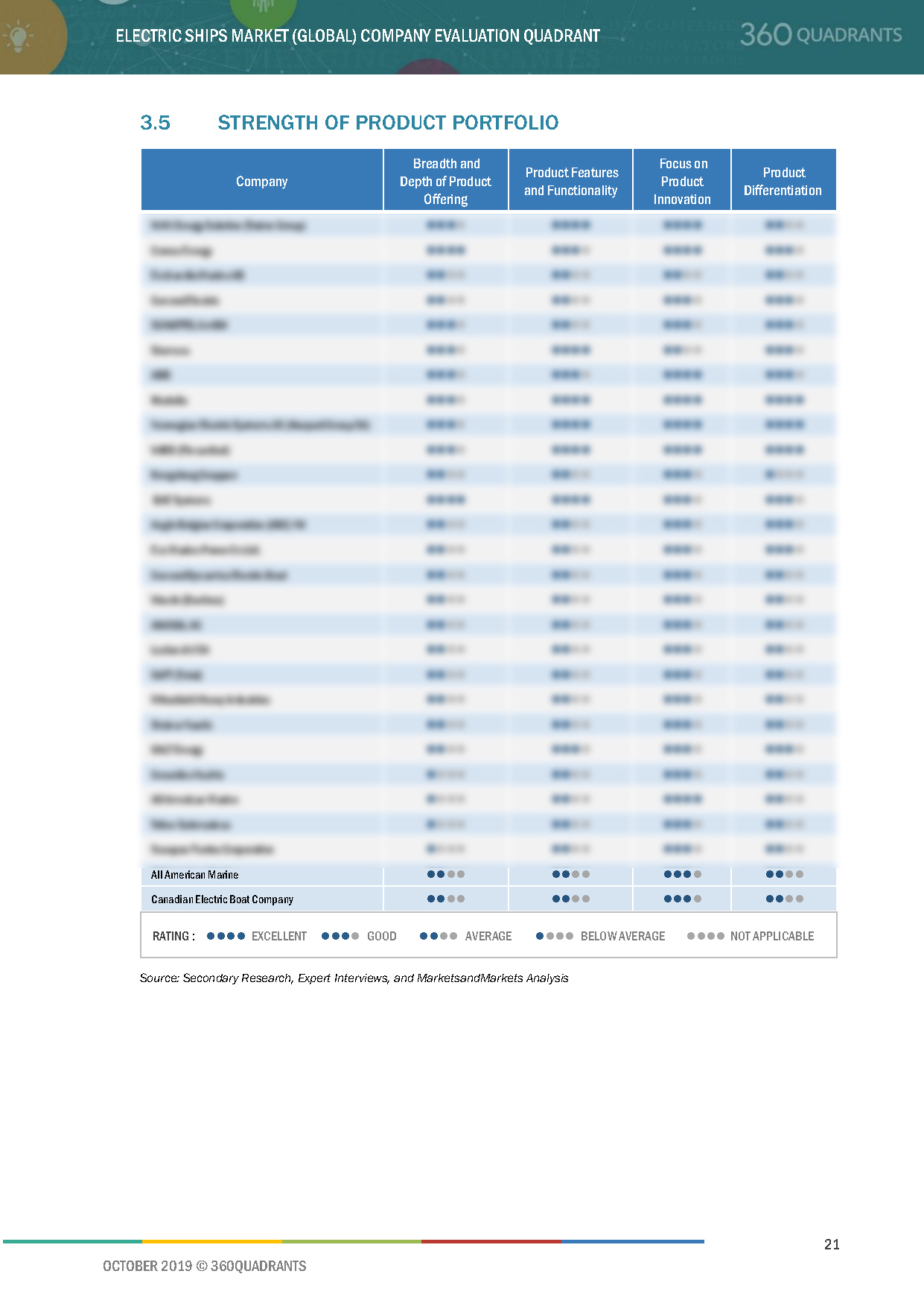

3.5 Strength of Product Portfolio

3.6 Business Strategy Excellence

4 Competitive Landscape

4.1 Introduction

4.2 Major Players, 2018

Figure 8 Major Players in Electric Ships Market, 2018

4.3 Competitive Scenario

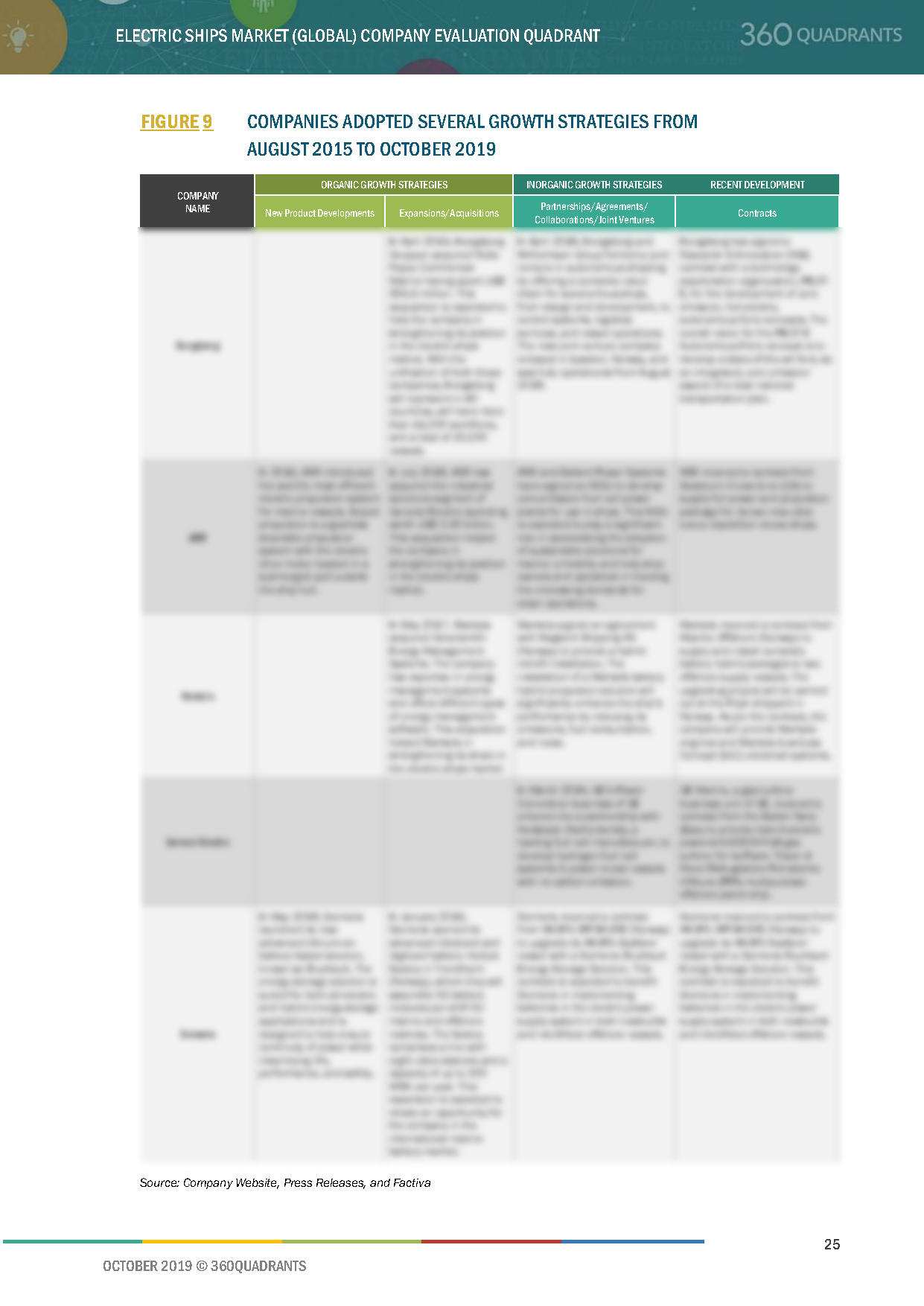

Figure 9 Companies Adopted Several Growth Strategies From

August 2015 to October 2019

4.4 Competitive Scenario

4.4.1 New Product Launches

Table 7 New Product Launches, August 2015– May 2019

4.4.2 Contracts

Table 8 Contracts, 2015 - 2019

4.4.3 Expansions & Acquisitions

Table 9 Expansions and Acquisitions, 2015–2019

4.4.4 Partnerships, Agreements, Joint Ventures, and Collaborations

Table 10 Partnerships, Agreements, Joint Ventures, and Collaborations, 2015 –2019

5 Company Profiles

5.1 ABB

5.1.1 Business Overview*

Figure 10 ABB: Company Snapshot

5.1.2 Products/Solutions/Services Offered*

5.1.3 Customers and Application Areas

5.1.4 Unique Value Proposition and Right to Win

5.1.5 ABB’s Right to Win (Company Business Snapshot)

5.1.6 Growth Strategy

5.1.7 SWOT Analysis*

Table 11 ABB: SWOT Analysis

5.1.8 MnM View*

(*Above sections are present for all of below companies)

5.2 Wartsila

Figure 11 Wartsila: Company Snapshot

Table 12 Wartsila: SWOT Analysis

5.3 Kongsberg Gruppen

Figure 12 Kongsberg Gruppen: Company Snapshot

Table 13 Kongsberg: SWOT Analysis

5.4 General Electric (GE)

Figure 13 General Electric: Company Snapshot

Table 14 GE: SWOT Analysis

5.5 Vard

Figure 14 Vard: Company Snapshot

5.6 Siemens

Figure 15 Siemens: Company Snapshot

Table 15 Siemens: SWOT Analysis

5.7 Leclanché SA

Figure 16 Leclanche SA: Company Snapshot

5.8 BAE Systems

Figure 17 BAE Systems: Company Snapshot

5.9 Norwegian Electric Systems

5.10 MAN Energy Solutions SE

5.11 Corvus Energy

5.12 Echandia Marine AB

5.13 General Dynamics Electric Boat

5.14 Anglo Belgian Corporation (ABC) NV

5.15 SCHOTTEL Gmbh

5.16 Visedo

5.17 ECO Marine Power Co Ltd.

5.18 Akasol AG

5.19 EST Floattech

5.20 Saft (Total)

Figure 18 Saft: Company Snapshot

6 Appendix

6.1 Methodology

This report identifies and benchmarks the best Electric Ship manufacturers such as Kongsberg (Norway), ABB (Switzerland), Wartsila (Finland), Norwegian Electric Systems AS (Norway), Corvus Energy (Canada), and evaluates them on the basis of business strategy excellence and strength of product portfolio within the electric ships ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders (top companies), Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More