Healthcare IT Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

Table 1 Market Dynamics: Market Impact

2.2.1 Key Market Drivers

2.2.1.1 Government Mandates & Support for Healthcare IT Solutions

Table 2 Key Government Initiatives for EMR

2.2.1.2 Rising Use of Big Data

2.2.1.3 High Returns on Investment for Healthcare IT Solutions

2.2.1.4 Need to Curtail Escalating Healthcare Costs

2.2.2 Key Market Restraints

2.2.2.1 IT Infrastructural Constraints in Developing Countries

2.2.3 Key Market Opportunities

2.2.3.1 Rising Use of Healthcare IT Solutions in Outpatient Care Facilities

2.2.3.2 Growing Mhealth, Telehealth, and Remote Patient Monitoring Markets

2.2.3.3 Cloud-Based EHR Solutions

2.2.3.4 Shift Towards Patient-Centric Healthcare Delivery

2.2.4 Key Market Challenges

2.2.4.1 Security Concerns

Figure 1 Number of Data Breaches in the US (2009–2018)

Table 3 Largest Healthcare Data Breaches in the US (2010–2018)

2.2.4.2 Interoperability Issues

Figure 2 Europe: Hospital EMR Adoption (Till September 2016)

3 Company Evaluation Quadrant

3.1 Visionary Leaders ( Healthcare IT Leaders )

3.2 Innovators

3.3 Dynamic Differentiators

3.4 Emerging Companies

Figure 3 Healthcare IT Market: Company Evaluation Quadrant

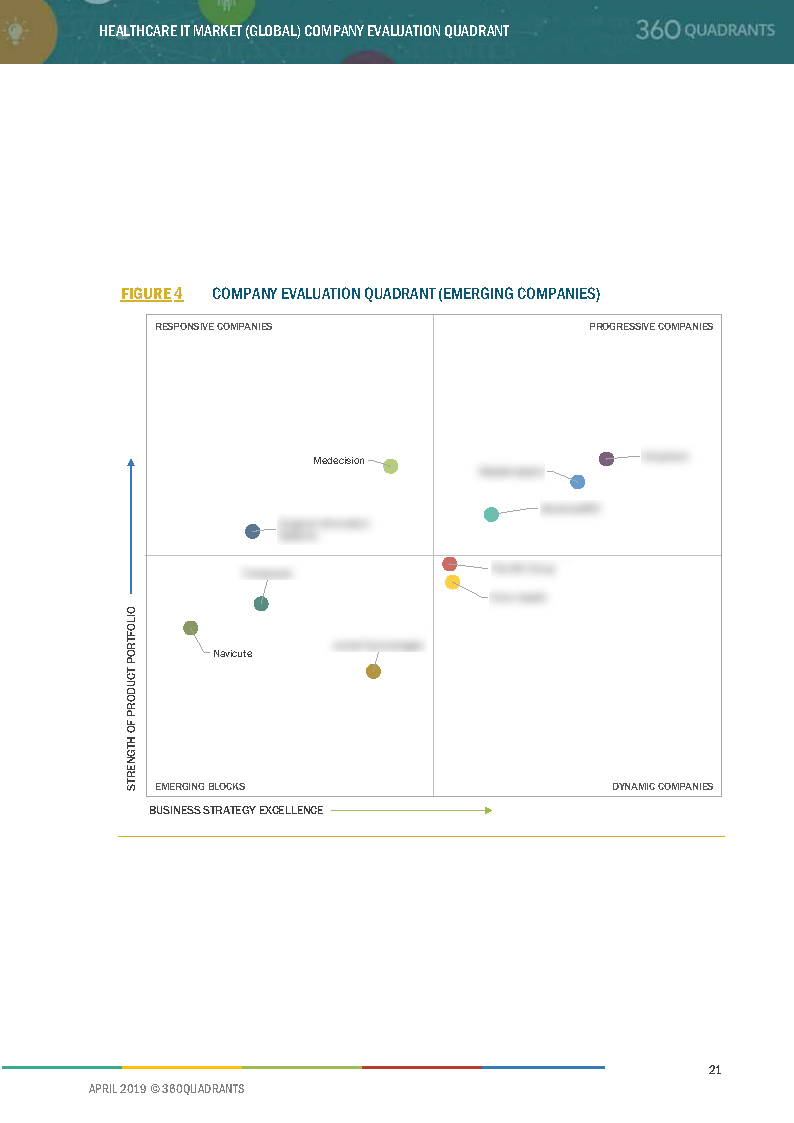

4 Company Evaluation Quadrant (Emerging Players)

4.1 Progressive Companies

4.2 Emerging Blocks

4.3 Responsive Companies

4.4 Dynamic Companies

Figure 4 Company Evaluation Quadrant (Emerging Companies)

Table 4 Growth Strategy Matrix

5 Competitive Landscape

5.1 Introduction

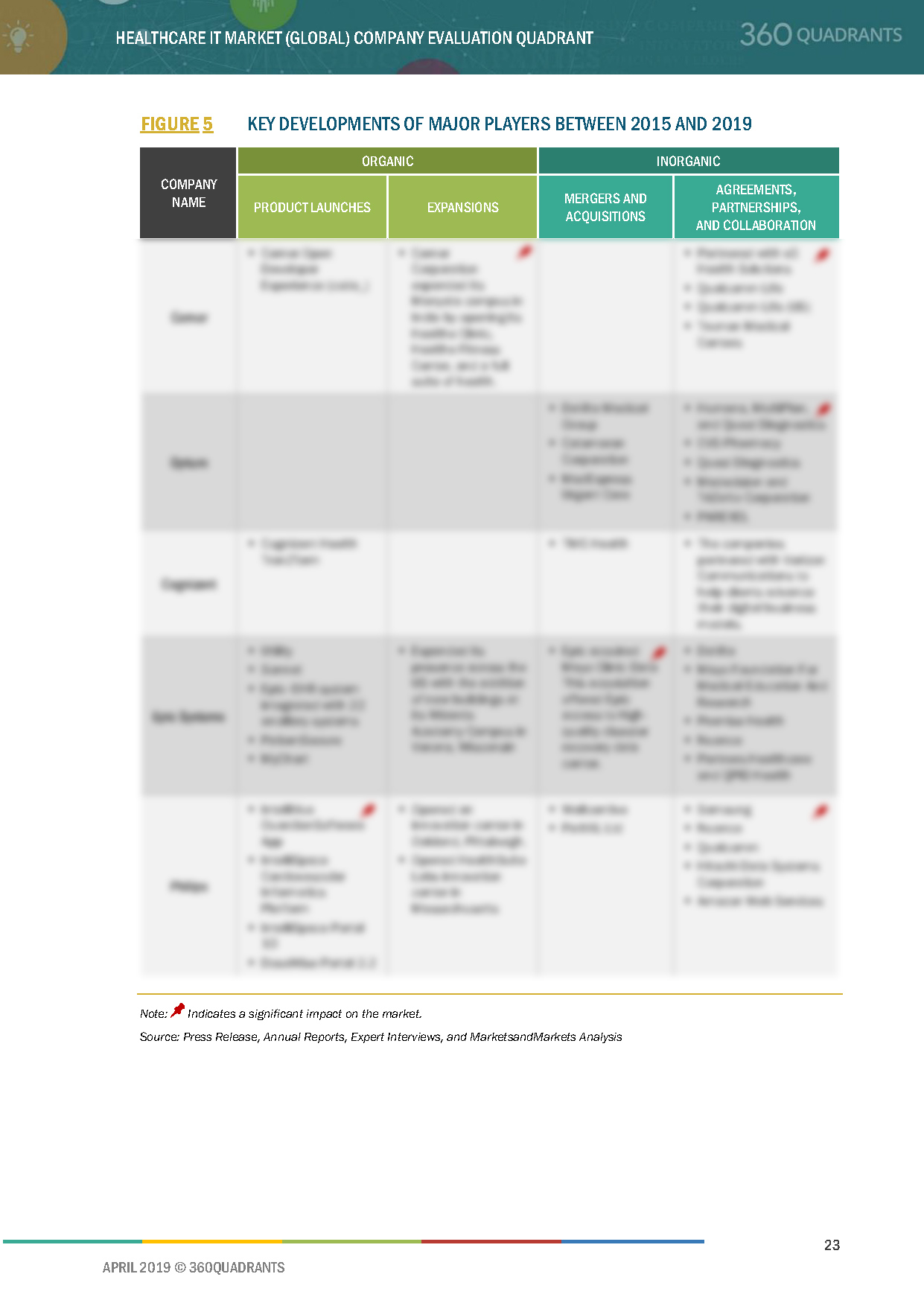

Figure 5 Key Developments of Major Players Between 2015 and 2019

5.2 Competitive Situation and Trends

5.2.1 Product Launches

Table 5 Product Launches (2016–2019)

5.2.2 Mergers and Acquisitions

Table 6 Acquisitions (2016–2019)

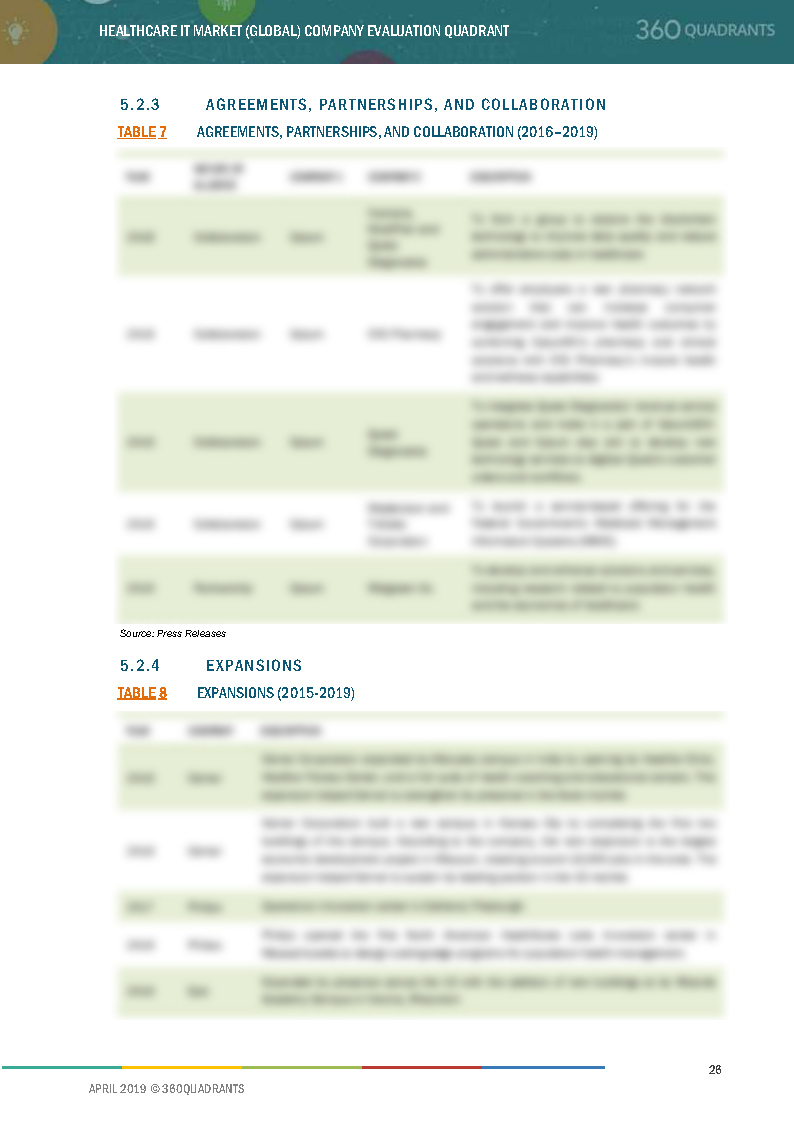

5.2.3 Agreements, Partnerships, and Collaboration

Table 7 Agreements, Partnerships, and Collaboration (2016–2019)

5.2.4 Expansions

Table 8 Expansions (2015-2019)

6 Company Profiles

6.1 Optum (A Part of Unitedhealth Group)

6.1.1 Business Overview*

Figure 6 Optum: Company Snapshot (2017)

6.1.2 Solutions and Services Offered*

6.1.3 Recent Developments*

6.1.4 SWOT Analysis*

6.1.5 MnM View*

(*Above sections are present for all of below companies)

6.2 Cerner Corporation

Figure 7 Cerner Corporation: Company Snapshot (2017)

6.3 Cognizant

Figure 8 Cognizant: Company Snapshot (2017)

6.4 Change Healthcare

6.5 Philips

Figure 9 Philips: Company Snapshot (2017)

6.6 EPIC Systems Corporation

6.7 Dell Technologies

Figure 10 Dell Technologies: Company Snapshot (2017)

6.8 Allscripts

Figure 11 Allscripts: Company Snapshot (2017)

6.9 Athenahealth (Part of Veritas Capital)

Figure 12 Athenahealth, Inc.: Company Snapshot (2017)

6.10 General Electric

Figure 13 General Electric: Company Snapshot (2017)

7 Appendix

7.1 Other Major Companies

7.1.1 Conduent

7.1.2 Conifer

7.1.3 Nuance

7.1.4 3M

7.1.5 Oracle

7.1.6 IBM

7.1.7 Inovalon

7.1.8 Infor

7.1.9 Intersystems

7.1.10 Tata Consultancy Services

7.2 Methodology

This report identifies and benchmarks the Top Healthcare IT Companies such as Cognex Corporation (US), Basler AG (Germany), Omron Corporation (Japan), Keyence (Japan), National Instruments (US), and evaluates them on the basis of business strategy excellence and strength of product portfolio within the Healthcare IT ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. Healthcare IT solution providers are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders ( Best Healthcare IT Companies ), Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More