Infection Control Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

Table 1 Infection Control Market: Drivers, Restraints, Opportunities, and Challenges

2.2.1 Drivers

2.2.1.1 High Incidence of Hospital-Acquired Infections

2.2.1.2 Increasing Number of Surgical Procedures

Table 2 Number of Procedures in OECD Countries, 2016

2.2.1.3 Growing Geriatric Population and Increasing Incidence of Chronic Diseases

Figure 1 Geriatric Population as a Percentage of the Total Population, By Country (2001 Vs. 2017)

2.2.1.4 Growing Focus on Food Sterilization and Disinfection

2.2.1.5 Technological Advancements in Sterilization Equipment

2.2.1.6 Increasing Outsourcing of Sterilization Services Among Pharmaceutical Companies, Hospitals, and Medical Device Manufacturers

2.2.2 Restraints

2.2.2.1 Concerns Regarding the Safety of Reprocessed Instruments

2.2.3 Opportunities

2.2.3.1 Growing Medical Device and Pharmaceutical Industries in Emerging Economies

2.2.3.2 Increasing Use of E-Beam Sterilization

2.2.3.3 Rising Importance of Single-Use Medical Nonwovens and Medical Devices

2.2.4 Challenges

2.2.4.1 Sterilization and Disinfection of Advanced Medical Instruments

2.2.4.2 End-User Noncompliance With Sterilization Standards

Table 3 IC.02.02.01 Noncompliance Rate Among End Users in the US, 2012–2016

3 Company Evaluation Quadrant

3.1 Visionary Leaders

3.2 Innovators

3.3 Dynamic Differentiators

3.4 Emerging Companies

Figure 2 Infection Control Market (Global) Company Evaluation Quadrant, 2019

3.5 Vendor Benchmarking

Table 4 Vendor Benchmarking By Growth Strategy

4 Competitive Landscape

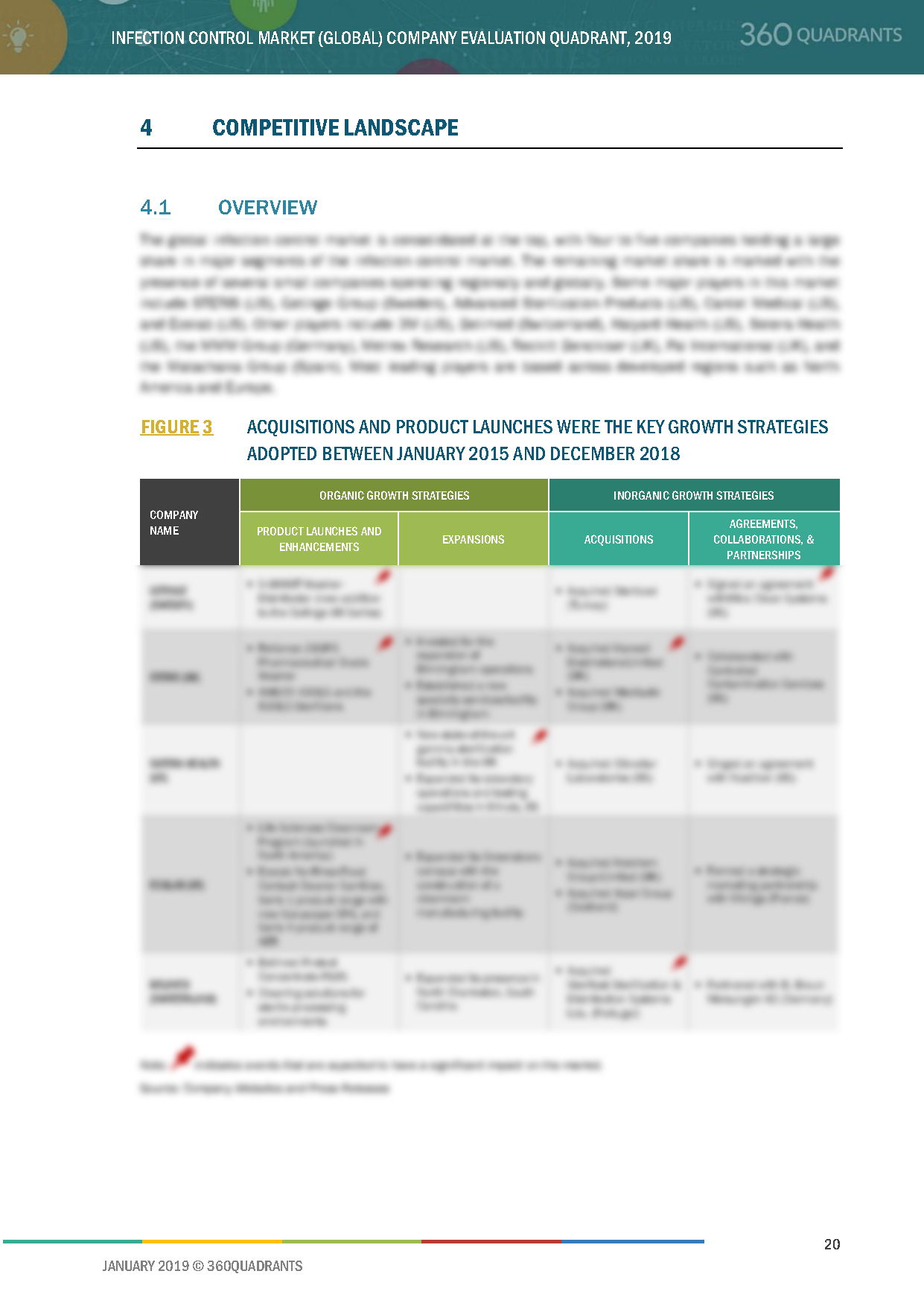

4.1 Overview

Figure 3 Acquisitions and Product Launches Were the Key Growth Strategies Adopted Between January 2015 and December 2018

4.2 Market Share/Ranking Analysis, 2018

4.2.1 Sterilization Products and Services: Market Share Analysis

Figure 4 Sterilization Products and Services: Market Share Analysis

4.2.2 Disinfectors Market Ranking Analysis

Table 5 Disinfectors: Market Ranking Analysis

4.3 Competitive Scenarios and Trends

4.3.1 Acquisitions

Table 6 Key Acquisitions, 2017-2018

4.3.2 Product Launches

Table 7 Top Product Launches/Approvals, 2017-2018

4.3.3 Partnerships, Agreements & Collaborations

Table 8 Key Partnerships, Agreements & Collaborations, 2017-2018

4.3.4 Expansions

Table 9 Key Expansions, 2017-2018

5 Company Profiles

5.1 STERIS

5.1.1 Business Overview*

Figure 5 STERIS: Company Snapshot (2017)

5.1.2 Products & Services Offered*

5.1.3 Recent Developments*

5.1.4 SWOT Analysis*

5.1.5 MnM View*

(*Above sections are present for all of below companies)

5.2 Getinge

Figure 6 Getinge: Company Snapshot (2017)

5.3 Cantel Medical

Figure 7 Cantel Medical: Company Snapshot (2018)

5.4 Ecolab

Figure 8 Ecolab: Company Snapshot (2017)

5.5 3M

Figure 9 3M: Company Snapshot (2017)

5.6 Advanced Sterilization Products

5.7 Sotera Health LLC

5.8 MMM Group

5.9 Matachana

5.10 Belimed AG (Subsidiary of Metall Zug Group)

5.11 Metrex Research (Subsidiary of the Danaher Corporation)

5.12 Reckitt Benckiser

Figure 10 Reckitt Benckiser: Company Snapshot (2017)

5.13 Pal International

5.14 Melag Medizintechnik OHG

5.15 The Miele Group

Figure 11 The Miele Group: Company Snapshot (2018)

6 Appendix

6.1 Methodology

The report identifies and benchmarks key market players in the Infection Control Market such as Getinge Group (Sweden), STERIS Corporation (US), Advanced Sterilization Products (US), Cantel Medical Corporation (US), 3M (US), and evaluates them on the basis of business strategy excellence and strength of product portfolio within the infection control market ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More