Non-Destructive Testing and Inspection Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

2 Market Overview

2.1 Introduction

2.2 Evolution of Non-Destructive Testing

Figure 1 Non-Destructive Testing Methods: Evolution

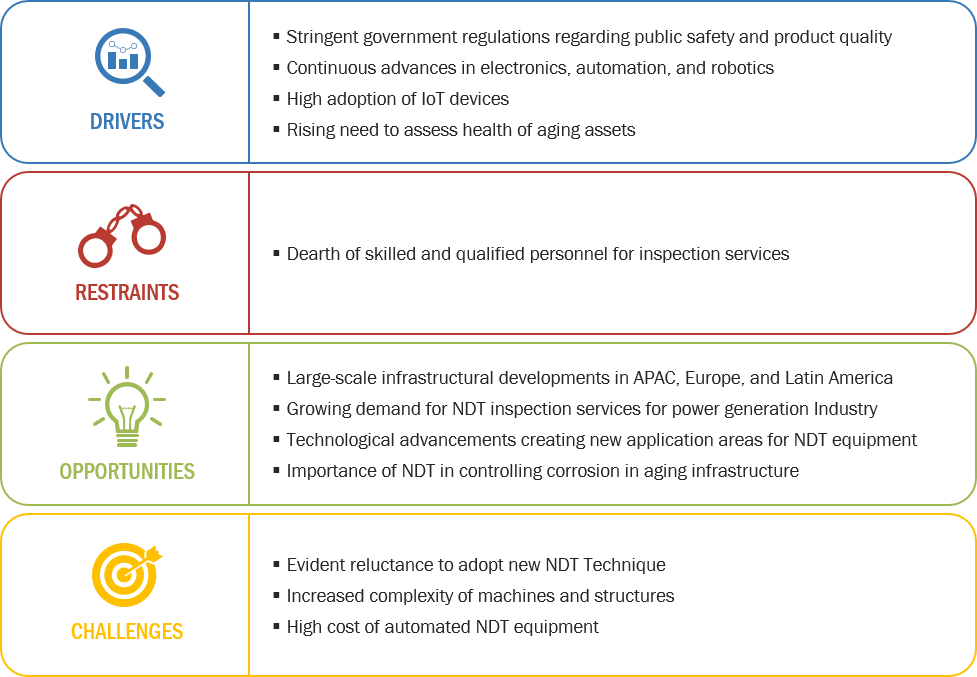

2.3 Market Dynamics

Figure 2 Stringent Government Regulations Regarding Public Safety and Product Quality to Drive NDT and Inspection Market During Forecast Period

2.3.1 Drivers

2.3.1.1 Stringent Government Regulations Regarding Public Safety and Product Quality

2.3.1.2 Continuous Advances in Electronics, Automation, and Robotics

2.3.1.3 High Adoption of IoT Devices

2.3.1.4 Rising Need to Assess Health of Aging Assets

2.3.2 Restraints

2.3.2.1 Dearth of Skilled and Qualified Personnel for Inspection Services

2.3.3 Opportunities

2.3.3.1 Large-Scale Infrastructural Developments in APAC, Europe, and Latin America

2.3.3.2 Growing Demand for NDT Inspection Services From Power Generation Industry

2.3.3.3 Technological Advancements Creating New Application Areas for NDT Equipment

2.3.3.4 Importance of NDT in Controlling Corrosion in Aging Infrastructure

2.3.4 Challenges

2.3.4.1 Evident Reluctance to Adopt New NDT Techniques

2.3.4.2 Increased Complexity of Machines and Structures

2.3.4.3 High Cost of Automated NDT Equipment

3 Industry Trends

3.1 Introduction

3.2 Value Chain Analysis

Figure 3 Value Chain: NDT and Inspection Market

4 Company Evaluation Quadrant

4.1 Visionary Leaders

4.2 Dynamic Differentiators

4.3 Innovators

4.4 Emerging Companies

Figure 4 Non-Destructive Testing and Inspection Market (Global) Company Evaluation Quadrant

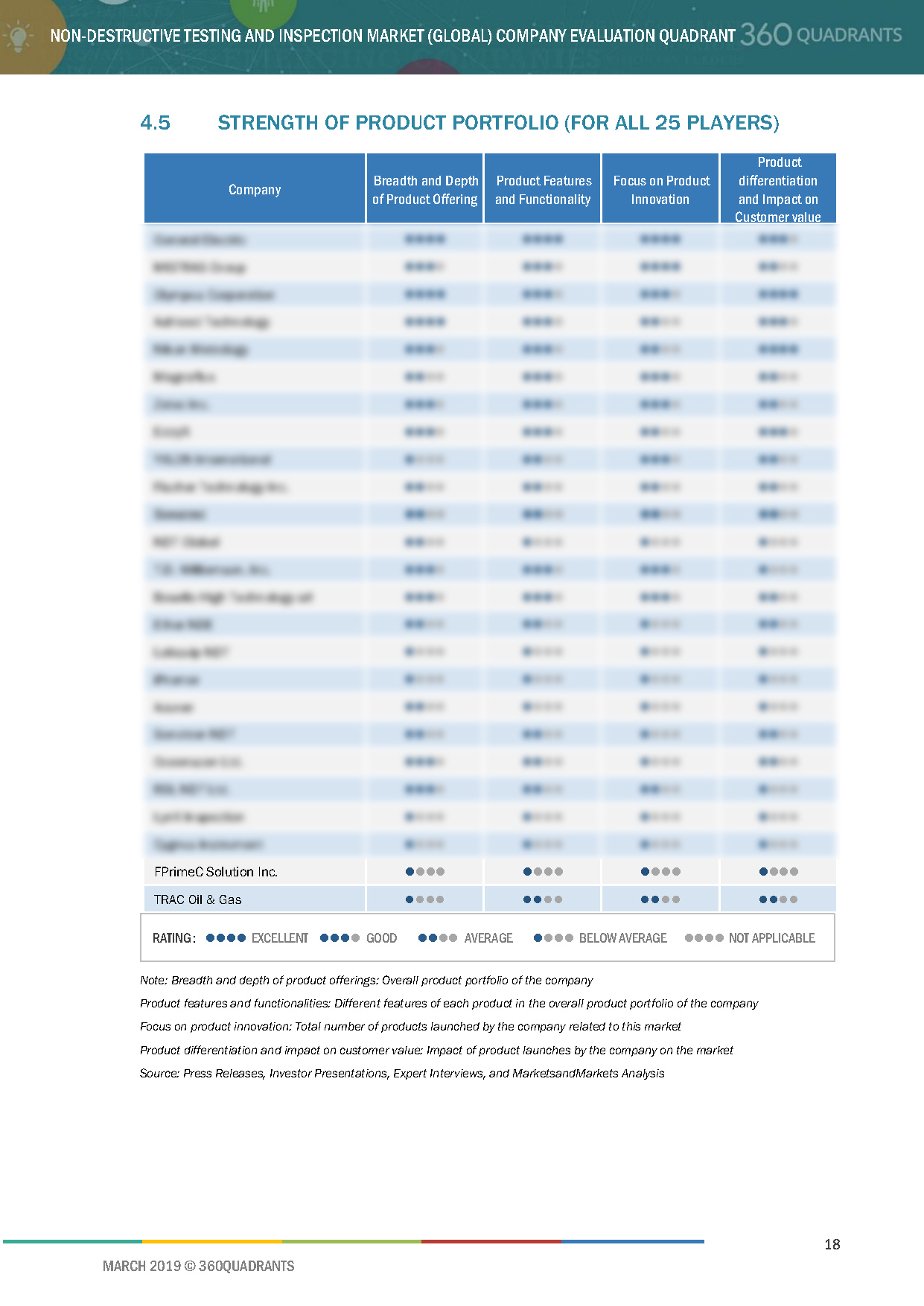

4.5 Strength of Product Portfolio (For All 25 Players)

4.6 Business Strategy Excellence (For All 25 Players)

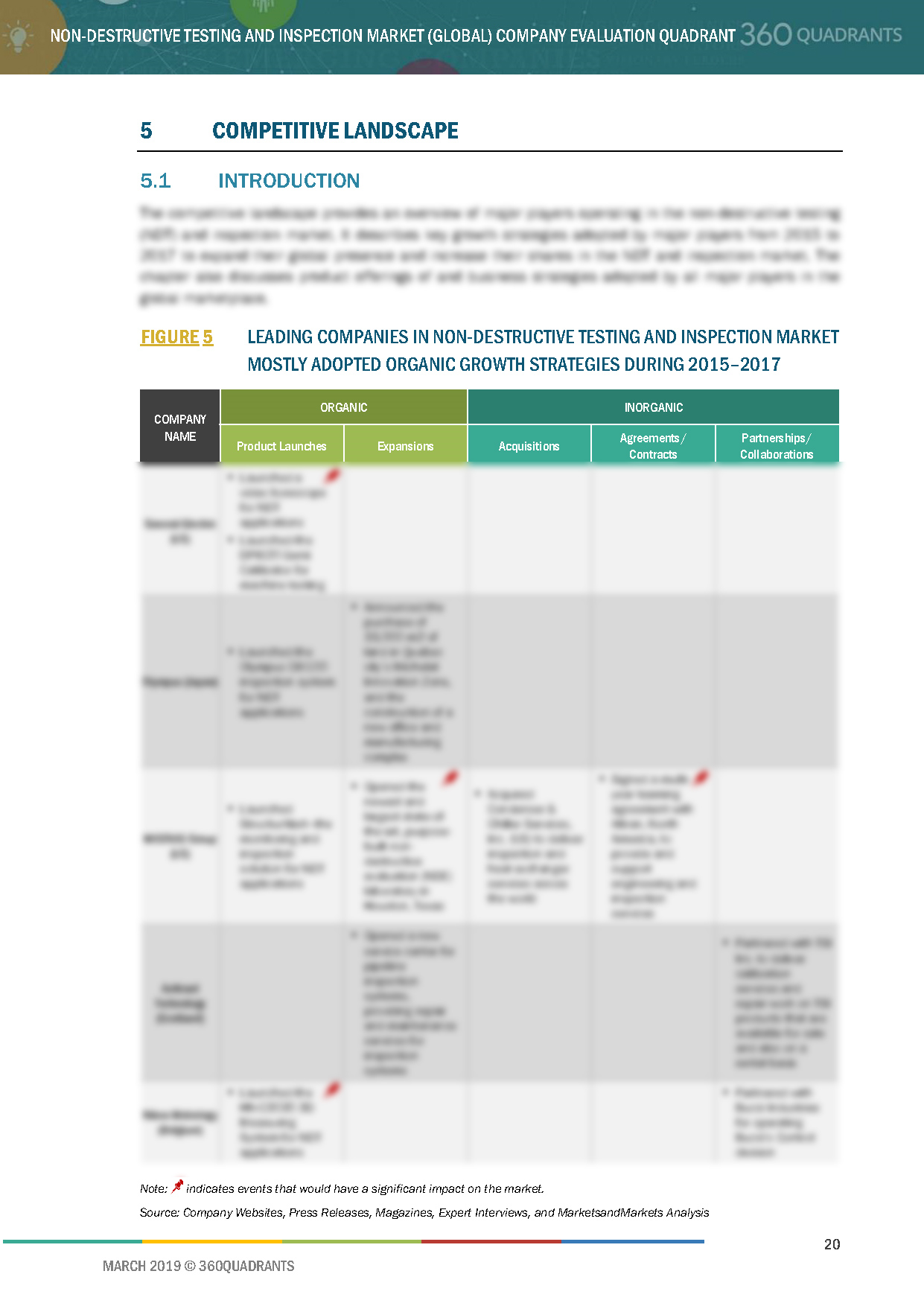

5 Competitive Landscape

5.1 Introduction

Figure 5 Leading Companies in Non-Destructive Testing and Inspection Market Mostly Adopted Organic Growth Strategies During 2015–2017

5.2 Ranking Analysis of Market Players, 2017

Figure 6 NDT and Inspection Market Player Ranking, 2017

5.3 Competitive Situations and Trends

Figure 7 Market Players Adopted Product Launches as Key Business Strategy During 2015–2017

5.3.1 Product Launches

Table 1 Product Launches, 2015–2017

5.3.2 Partnerships and Collaborations

Table 2 Partnerships and Collaborations, 2015–2017

5.3.3 Expansions

Table 3 Expansions, 2015

5.3.4 Contracts and Agreements

Table 4 Contracts and Agreements, 2015–2016

5.3.5 Acquisitions

Table 5 Acquisitions, 2016–2017

6 Company Profiles

6.1 Key Players

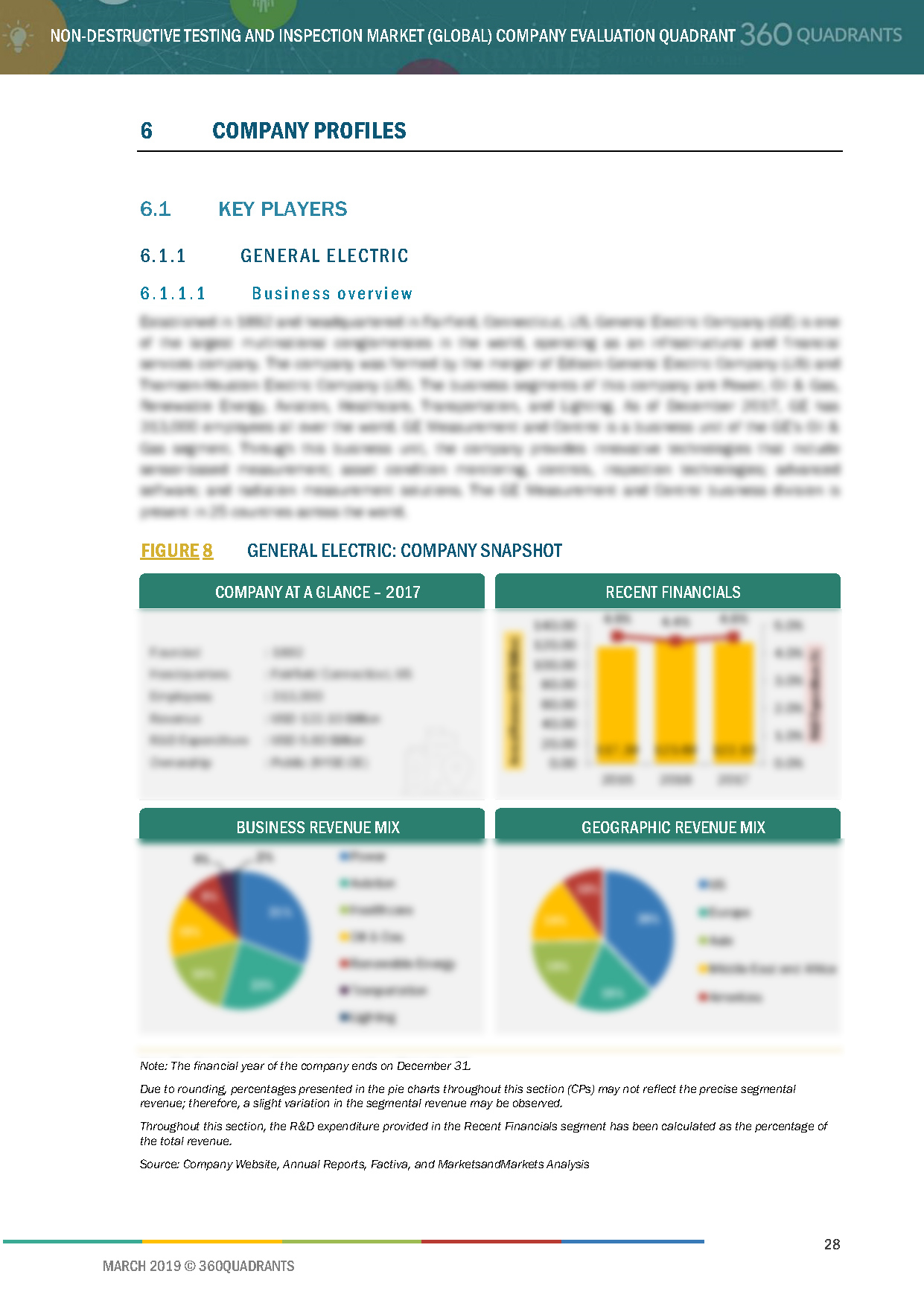

6.1.1 General Electric

6.1.1.1 Business Overview*

Figure 8 General Electric: Company Snapshot

6.1.1.2 Products Offered*

6.1.1.3 Recent Developments*

6.1.1.4 SWOT Analysis*

6.1.1.5 MnM View*

(*Above sections are present for all of below companies)

6.1.2 MISTRAS Group

Figure 9 MISTRAS Group: Company Snapshot

6.1.3 Olympus Corporation

Figure 10 Olympus Corporation: Company Snapshot

6.1.4 Ashtead Technology.

6.1.5 Nikon Metrology

6.1.6 Magnaflux Corporation

6.1.7 Zetec Inc.

6.1.8 Eddyfi

6.1.9 YXLON International GmbH

6.1.10 Sonatest Ltd.

7 Appendix

7.1 Other Significant Players

7.1.1 Fischer Technology Inc.

7.1.2 NDT Global GmbH & Co. Kg

7.1.3 TD Williamson, Inc.

7.1.4 Bosello High Technology srl

7.1.5 Labquip NDT Limited

7.1.6 Ipromar Pte Ltd

7.1.7 Fprimec Solutions Inc.

7.1.8 LynX Inspection

7.1.9 Cygnus Instruments Ltd

7.1.10 Acuren Inspection Inc.

7.2 Methodology

7.3 List of Abbreviations

This report identifies and benchmarks the best Non-Destructive Testing and Inspection system providers such as General Electric (US), Olympus Corporation (Japan), MISTRAS Group (US), Nikon Metrology (Belgium), Ashtead Technology (Scotland), and evaluates them on the basis of business strategy excellence and strength of product portfolio within the Non-Destructive Testing and Inspection ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on a 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders (top companies), Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More