Smart Factory Solutions Quadrant Report

Table of Contents

1 Introduction

1.1 Definition

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

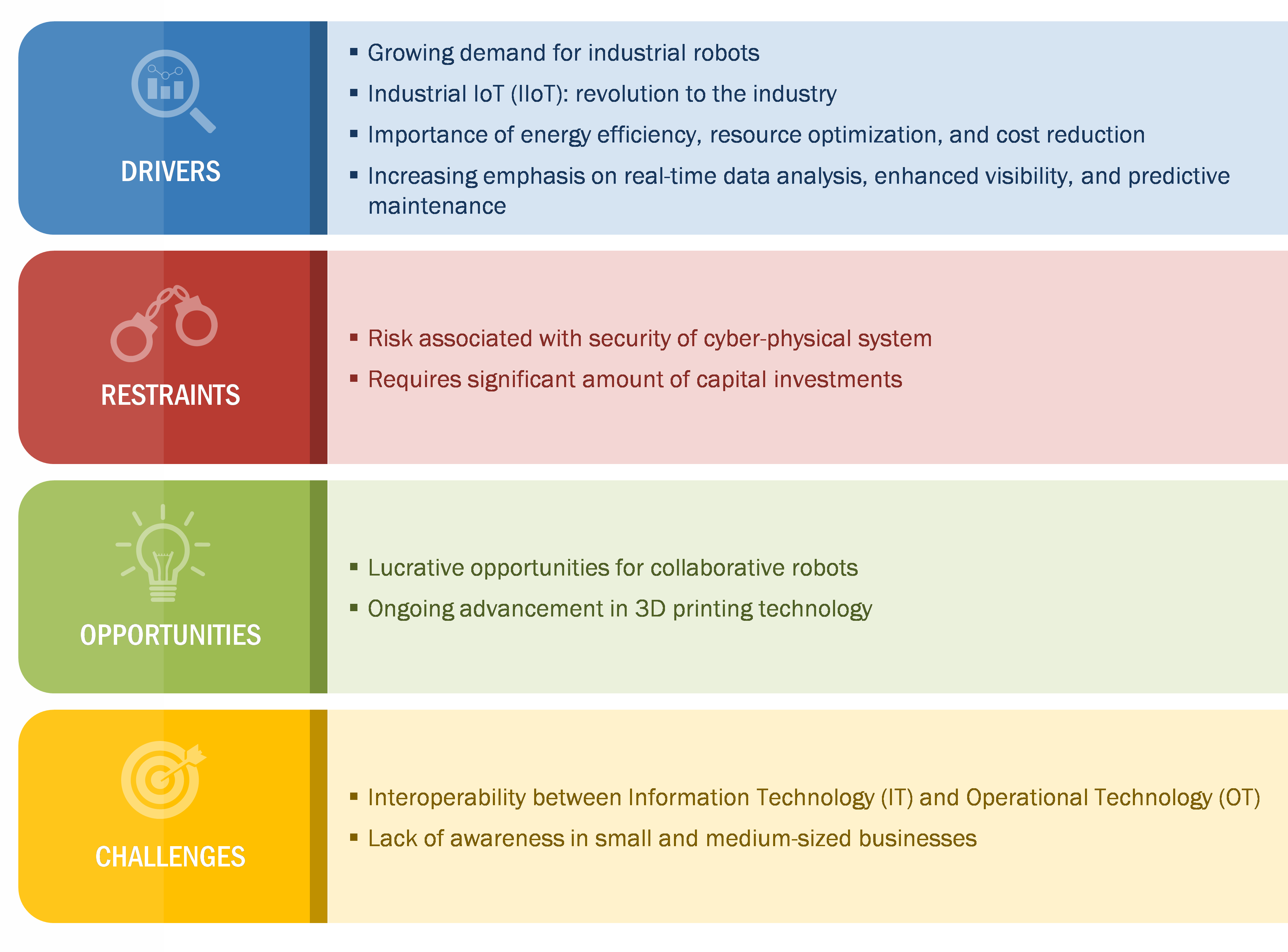

Figure 1 DROC: Smart Factory Market

2.2.1 Drivers

2.2.1.1 Growing Demand for Industrial Robots

2.2.1.2 Industrial IoT (IIoT): Revolution to the Industry

Figure 2 IoT Transforming the Smart Factory Ecosystem

2.2.1.3 Importance of Energy Efficiency, Resource Optimization, and Cost Reduction

Figure 3 Industrial Annual Energy Cost Saving

2.2.1.4 Increasing Emphasis on Real-Time Data Analysis, Enhanced Visibility, and Predictive Maintenance

2.2.2 Restraints

2.2.2.1 Risk Associated With Security of Cyber-Physical System

2.2.2.2 Requirement of A Significant Amount of Capital Investments

2.2.3 Opportunities

2.2.3.1 Lucrative Opportunities for Collaborative Robots

Figure 4 Revenue Performance of Universal Robots

2.2.3.2 Ongoing Advancements in 3D Printing Technology

2.2.4 Challenges

2.2.4.1 Interoperability Between Information Technology (IT) and Operational Technology (OT)

2.2.4.2 Lack of Awareness in Small and Medium-Sized Businesses

2.3 Enabling Technologies of Smart Factory Ecosystem

Figure 5 Key Enablers in Smart Factory Ecosystem

2.3.1 Artificial Intelligence

2.3.1.1 Importance of AI in Smart Factory

2.3.2 Augmented Reality (AR)

2.3.2.1 AR Enhancing the Smart Manufacturing Workforce

2.3.3 Big Data and Analytics

2.3.3.1 Big Data and Analytics: Crucial Industrial Communication

2.3.4 Blockchain

2.3.4.1 Connecting Blockchain and IoT

2.3.5 Industrial Cybersecurity

2.3.5.1 Defense for Smart Manufacturing

2.3.6 5G

Figure 6 Developments Due to 5G Network Evolution

2.3.6.1 5G Technology to Drive Smart Factory Market

Figure 7 Various Test Cases and Use Cases of 5G Technology

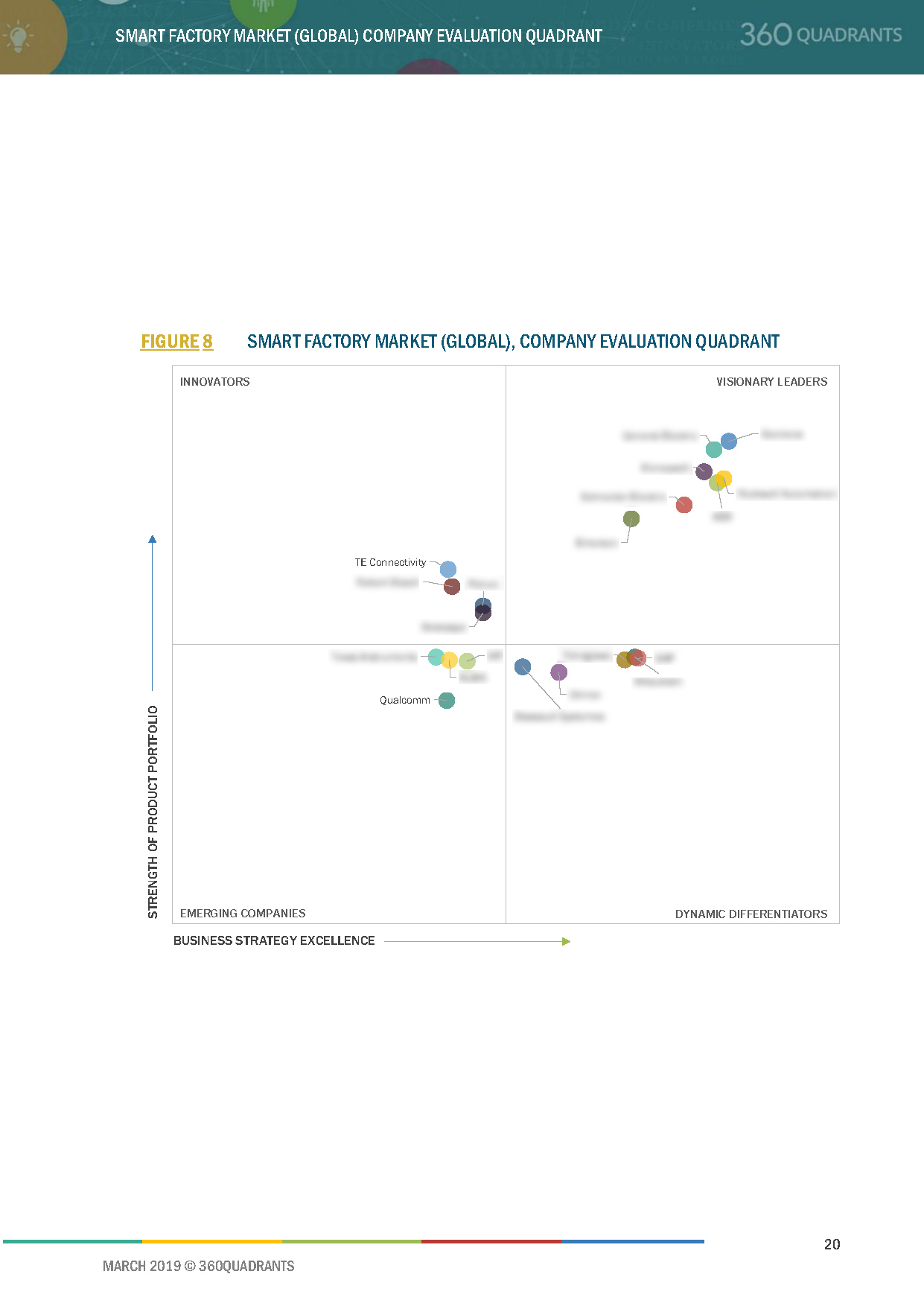

3 Company Evaluation Quadrant

3.1 Visionary Leaders

3.2 Dynamic Differentiators

3.3 Innovators

3.4 Emerging Companies

Figure 8 Smart Factory Market (Global), Company Evaluation Quadrant

4 Competitive Landscape

4.1 Overview

4.2 Competitive Analysis

4.2.1 Market Ranking Analysis: Smart Factory Market, 2017

Figure 9 Market Ranking of the Top 5 Players in the Smart Factory Market, 2017

4.3 Competitive Situation and Trends

4.3.1 Agreements, Contracts, Joint Ventures, Collaborations & Partnerships

Table 1 Agreements, Contracts, Joint Ventures, Collaborations & Partnerships 2017-2018

4.3.2 Product Launches and Developments

Table 2 Product Launches and Developments 2017-2018

4.3.3 Acquisitions and Expansions

Table 3 Acquisitions and Expansions 2017-2018

5 Company Profiles

5.1 Key Players

5.1.1 Siemens

5.1.1.1 Business Overview*

Figure 10 Siemens AG: Company Snapshot

5.1.1.2 Products Offered*

5.1.1.3 Recent Developments*

5.1.1.4 SWOT Analysis*

5.1.1.5 MnM View*

(*Above sections are present for all of below companies)

5.1.2 General Electric

Figure 11 General Electric: Company Snapshot

5.1.3 ABB

Figure 12 ABB Ltd.: Company Snapshot

5.1.4 Rockwell Automation

Figure 13 Rockwell Automation: Company Snapshot

5.1.5 Schneider Electric

Figure 14 Schneider Electric: Company Snapshot

5.1.6 Honeywell International

Figure 15 Honeywell International: Company Snapshot

5.1.7 FANUC

Figure 16 FANUC: Company Snapshot

5.1.8 Mitsubishi Electric

Figure 17 Mitsubishi Electric: Company Snapshot

5.1.9 Emerson Electric

Figure 18 Emerson Electric: Company Snapshot

5.1.10 Yokogawa Electric

Figure 19 Yokogawa Electric Corporation: Company Snapshot

5.1.11 Robert Bosch

Figure 20 Robert Bosch: Company Snapshot

5.1.12 Stratasys

Figure 21 Stratasys: Company Snapshot

6 Appendix

6.1 Other Significant Players

6.1.1 TE Connectivity

6.1.2 Texas Instruments

6.1.3 HP

6.1.4 KUKA

6.1.5 SAP

6.1.6 Omron

6.1.7 Dassault Systemes

6.1.8 Qualcomm

6.2 Methodology

This report identifies and benchmarks the best smart factory solution providers such as Siemens, General Electric, ABB, Honeywell International, Rockwell Automation, and evaluates them on the basis of business strategy excellence and strength of product portfolio within the Smart Factory ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More