Unmanned Aerial Vehicles Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

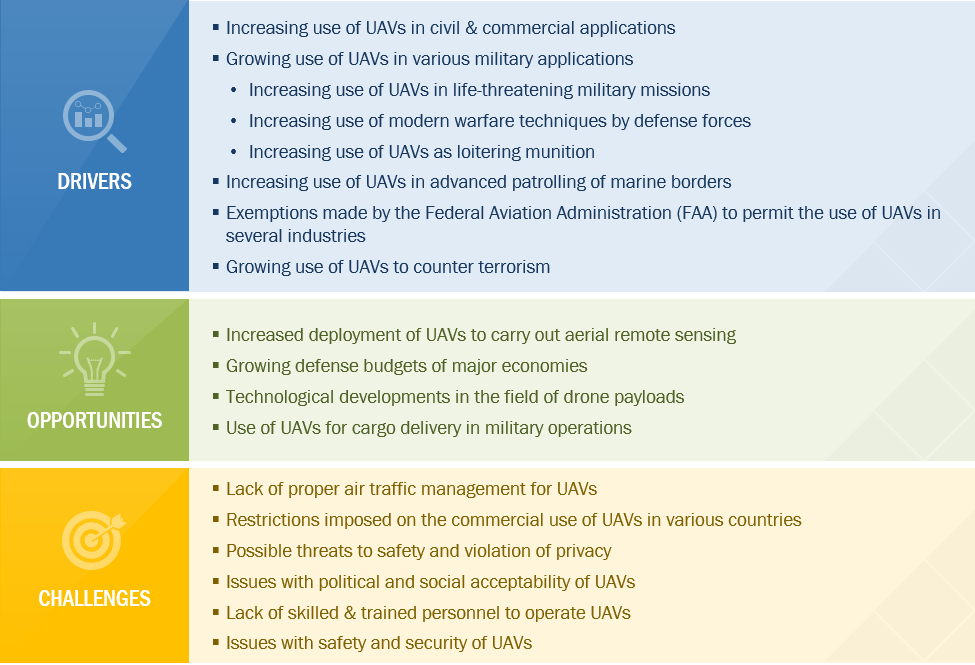

Figure 1 Market Dynamics of the UAV Market

2.2.1 Drivers

2.2.1.1 Increasing Use of UAVs in Civil & Commercial Applications

Figure 2 Roadmap of UAVs Used in Commercial Applications, 2013-2020

2.2.1.2 Growing Use of UAVs in Military Applications

Table 1 Countries Using Loitering Munition

2.2.1.3 Increasing Use of UAVs in Advanced Patrolling of Marine Borders

2.2.1.4 Exemptions Made By the Federal Aviation Administration (FAA) to Permit the Use of UAVs in Several Industries

Table 2 Commercial Industries Exempted By FAA in 2015

Figure 3 UAV Platforms Approved By the Federal Aviation Administration for Use in Various Industries in 2015

2.2.1.5 Growing Use of UAVs to Counter Terrorism

2.2.2 Opportunities

2.2.2.1 Increased Deployment of UAVs to Carry Out Aerial Remote Sensing

2.2.2.2 Growing Defense Budgets of Major Economies

Table 3 Defense Spending of Major Economies

2.2.2.3 Technological Developments in the Field of Drone Payloads

2.2.2.4 Use of UAVs for Cargo Delivery in Military Operations

2.2.3 Challenges

2.2.3.1 Lack of Proper Air Traffic Management for UAVs

2.2.3.2 Restrictions Imposed on the Commercial Use of UAVs in Various Countries

Table 4 Restrictions Imposed on the Use of UAVs in Various Countries

2.2.3.3 Possible Threats to Safety and Violation of Privacy

2.2.3.4 Issues With Political and Social Acceptability of UAVs

2.2.3.5 Lack of Skilled & Trained Personnel to Operate UAVs

2.2.3.6 Issues With Safety and Security of UAVs

3 Industry Trends

3.1 Introduction

3.2 Product Innovations

3.2.1 Drone Taxies Or Passenger Drones

Table 5 Major Developments in the Field of Drone Taxies

3.2.2 Refueling Drones

3.2.3 Swarm Drones

3.2.4 Spy Drones

3.2.5 Combat Drones

3.2.6 Inflatable Drones

3.2.7 IoT Drones

Figure 4 Emerging Technological Trends in IoT Drones

Figure 5 IoT Drones Market Dynamics

3.2.8 VTOL UAVs

Table 6 Trends in VTOL UAVs

3.2.9 Thinking Drones

3.2.10 Anti-UAV Defense Systems

3.2.11 Tethered Drones

3.2.12 Fishing Drones

4 Company Evaluation Quadrant (OEM)

4.1 Visionary Leaders

4.2 Innovators

4.3 Dynamic Differentiators

4.4 Emerging Companies

Figure 6 UAV Market Company Evaluation Quadrant, 2019

5 Company Evaluation Quadrant (Startup)

5.1 Progressive Companies

5.2 Responsive Companies

5.3 Dynamic Companies

5.4 Starting Blocks

Figure 7 UAV Market Company Evaluation Quadrant, 2019

6 Competitive Landscape

6.1 Introduction

6.2 Competitive Analysis

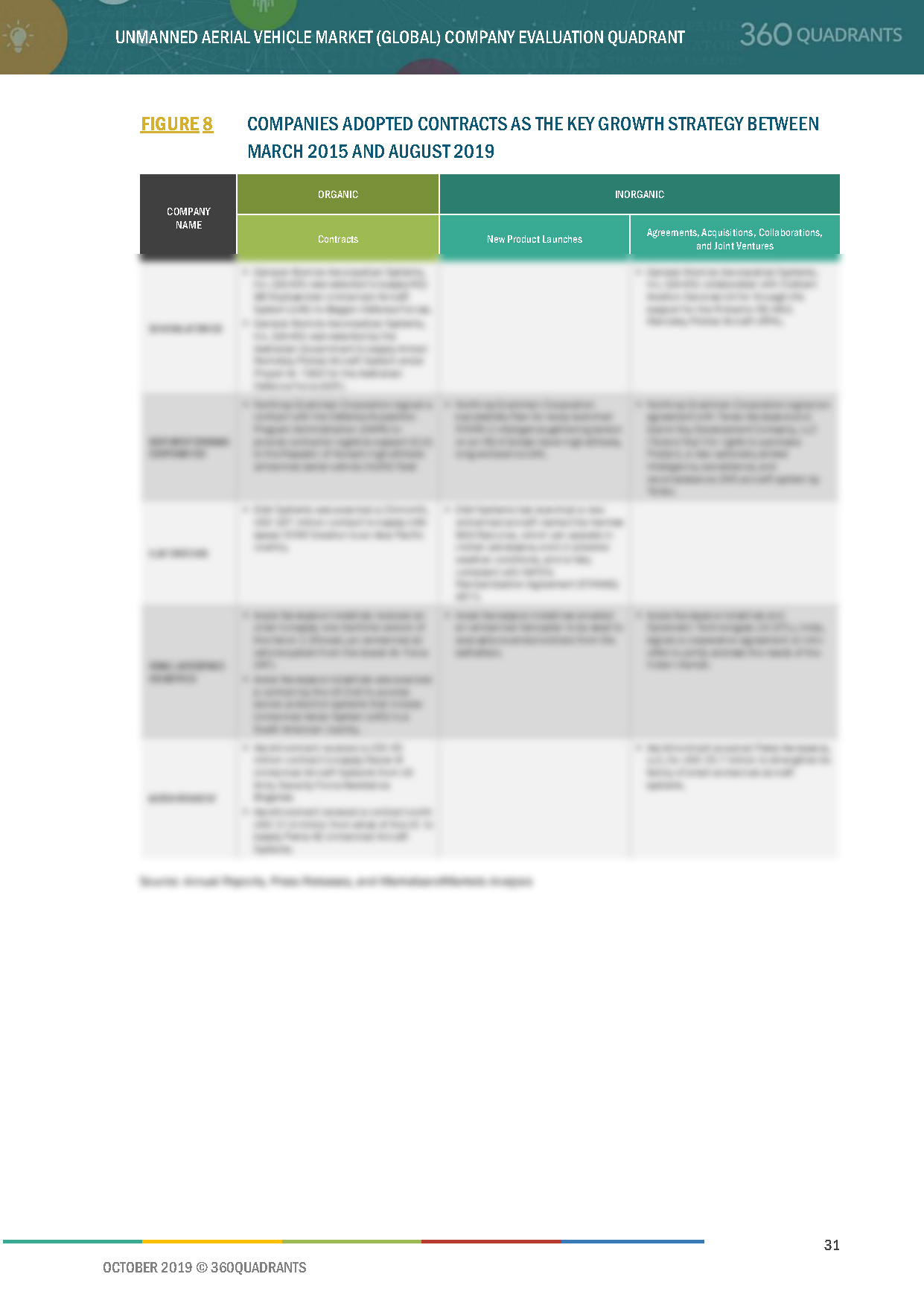

Figure 8 Companies Adopted Contracts as the Key Growth Strategy Between March 2015 and August 2019

6.3 Major Players in the UAV Market

Figure 9 Major Players of the UAV Market in Military Vertical in 2018

Figure 10 Major Players in the UAV Market in Consumer and Commercial Vertical in 2018

6.4 Brand Analysis

Table 7 Brand Analysis: UAV Market

6.5 Competitive Scenario

6.6 Investment Analysis

Table 8 Analysis of Investments Made By Venture Capitalists

6.7 Leading/Emerging Drone Manufacturing Companies, By Area of Expertise

6.7.1 Next-Generation Drone Chip Manufacturers

Table 9 Next-Generation Drone Chip Manufacturers

6.7.2 Manufacturers of Drones That Capture Aerial Videos, Data, and Imagery

Table 10 Manufacturers of Drones That Capture Aerial Videos, Data, and Imagery

6.7.3 Manufacturers of Delivery Drones

Table 11 Manufacturers of Delivery Drones

6.7.4 Drone and Pilot Rental Service Providers

Table 12 Drone and Pilot Rental Service Providers

6.7.5 Manufacturers of UAV Hardware

Table 13 Manufacturers of UAV Hardware

6.7.6 Manufacturers of Commercial Drones

Table 14 Manufacturers of Commercial Drones

6.7.7 Manufacturers of Drones and UAV Software

Table 15 Manufacturers of Drones and UAV Software

6.7.8 UAV Training & Support Service Providers

Table 16 UAV Training & Support Service Providers

6.7.9 New Product Launches

Table 17 New Product Launches, March 2015 - June 2019

6.7.10 Contracts

Table 18 Contracts: January 2016 – August 2019

6.7.11 Agreements, Acquisitions, Collaborations, and Joint Ventures

Table 19 Agreements, Acquisitions, Collaborations, and Joint Ventures: April 2015-July 2019

7 Company Profiles

7.1 Introduction

7.2 General Atomics

7.2.1 Business Overview*

7.2.2 Products & Services Offered*

7.2.3 Recent Developments*

7.2.4 MnM View*

(*Above sections are present for all of below companies)

7.3 Northrop Grumman Corporation

Figure 11 Northrop Grumman Corporation: Company Snapshot

7.4 Elbit Systems

Figure 12 Elbit Systems: Company Snapshot

7.5 Israel Aerospace Industries

7.6 Aerovironment

Figure 13 Aerovironment: Company Snapshot

7.7 Lockheed Martin

Figure 14 Lockheed Martin: Company Snapshot

7.8 Boeing

Figure 15 Boeing: Company Snapshot

7.9 Aeronautics

7.10 Saab

Figure 16 Saab: Company Snapshot

7.11 Thales

Figure 17 Thales: Company Snapshot

7.12 DJI

7.13 Parrot

Figure 18 Parrot: Company Snapshot

7.14 3D Robotics

7.15 Textron

Figure 19 Textron: Company Snapshot

7.16 BAE Systems

Figure 20 BAE Systems: Company Snapshot

7.17 Raytheon

7.18 Ehang

7.19 ECA Group

7.20 Turkish Aerospace Industry

7.21 Yuneec

7.22 Microdrones

7.23 Precisionhawk

7.24 Flir Systems Inc.

7.25 Airbus

8 Appendix

8.1 Research Methodology

8.2 List of Abbreviations

Best UAV companies in military UAV market are General Atomics (US), Northrop Grumman (US), Textron Inc. (US), and Boeing (US) while SZ DJI (China), Parrot (France), 3D Robotics (US), Aeryon Labs (Canada) are major players of commercial UAVs.

Unmanned Aerial Vehicles quadrant report evaluates best UAV companies on the basis of business strategy excellence and strength of product portfolio within the UAV ecosystem, combining inputs from various industry experts, buyers, and UAV Manufacturers, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders ( best UAV companies ), Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More

Unmanned Aerial Vehicles (UAVs) are remotely piloted aerial vehicles. An unmanned aerial vehicle (UAV) may operate with various degrees of autonomy ranging from the use of remote control by a human or completely autonomous by onboard computers. UAVs are used for different applications depending on their operational parameters, such as endurance, range, and altitude. The UAV market is estimated to reach USD 45 billion by 2025, at a CAGR of 16% by 2025 driven majorly by UAV leaders.

Unmanned Aerial Vehicles (UAVs) are remotely piloted aerial vehicles. An unmanned aerial vehicle (UAV) may operate with various degrees of autonomy ranging from the use of remote control by a human or completely autonomous by onboard computers. UAVs are used for different applications depending on their operational parameters, such as endurance, range, and altitude. The UAV market is estimated to reach USD 45 billion by 2025, at a CAGR of 16% by 2025 driven majorly by UAV leaders.