Best Fleet Management Software

Best Fleet management software, a discipline of asset management, enables companies to manage the entire fleet operation, thus resulting in controlled costs, maximized profitability, improved fleet efficiency, and fleet-related risk mitigation and compliance with government regulations.

Top 10 Fleet Management Software in 2021

- TomTom NV Fleet Software

- Donlen Corporation Fleet Software

- Teletrac Navman Fleet Software

- Element Strategic Fleet Consulting

- Chevin Fleet Software

- Verizon Communications

- Trimble Fleet Software

- Emkay Fleet Software

- Leaseplan Fleet Software

- Merchants Fleet Management

Market Overview

The Best fleet management software market is expected to grow from USD 19,930 million in 2020 to USD 34,071 million by 2025, at a Compound Annual Growth Rate (CAGR) of 11.3% during the forecast period. Fleet management software is an approach that enables organizations to oversee the entire lifecycle of commercial vehicles and facilitates improved efficiency, increased productivity, reduction of costs and risks related to vehicle investment, and ensuring compliance with legislation. It also ensures effective management of fleets through the utilization of advanced technologies, such as Global Positioning System (GPS), communication sensors, and Radio-Frequency Identification (RFID) tags, to offer live monitoring of vehicles’ location, drivers’ behaviour, and fuel use. It also ensures compliance with the regulations by minimizing carbon dioxide (CO2) emissions, and ensuring driver and passenger safety while providing vehicle security.

Best fleet management software facilitates the fleet managers to store, send, and receive information to control distant objects, in particular vehicles in motion, owing to the integration of GPS technologies with the capabilities of mobile devices. It can assist in identifying a wide range of factors that contribute to increased cost efficiency from a driver’s behavior to vehicle maintenance needs. Some of the key benefits include increased visibility into vehicle location, idle time, speed, and fuel mileage and the ability to plan driver’s routes, establish territories, and identify the impact of a change in route to your business’ bottom line.

The fleet industry has been an early adopter of new technology, starting with card reader equipment in the 1950s. These card readers were used to record fleet data. Technological advancements led to the emergence of mainframe computers capable of storing bulk data and processing transactions. Furthermore, innovations brought personal computers and the internet, which increased the penetration of traditional fleet management software from government agencies to large and small-scale businesses. With enhancements in mobile devices, telecommunications, and modern sensors, data collection has now become easy and has transformed from a time-to-time basis activity into a real-time one. The increasing integration of ICT and the Internet of Things (IoT) into transportation, logistics, and automobiles has opened new opportunities for modern fleet management software with added features, such as GPS tracking and monitoring.

Primary driving factors for the Best fleet management software market include the increasing government regulations and the need for optimization of fleet operating expenses. The Electronic Logging Device (ELD) mandate in North America is among the major regulations to strengthen truck and bus drivers’ compliance with the Hours of Service (HOS) requirement. Similarly, the implementation of General Data Protection Regulation (GDPR) by the European Union requires multinational fleets to properly manage user data of its drivers in fleets who operate in Europe, thus driving the market toward growth. The other factors supporting the market growth include the decreasing hardware and software costs and the growing need for operational efficiency among fleet owners. During the forecast period, green fleet initiatives, electric vehicles, autonomous vehicles, and usage of telematics for data analytics are expected to provide significant opportunities for the growth of the Best fleet management software market.

Best fleet management software are used more extensively in North America and Europe as compared to other regions, where the adoption rate of fleet management software and services is slow. High initial costs and lack of awareness about fleet safety and security are factors responsible for slow growth in the emerging economies, such as MEA and Latin America. Some APAC countries, such as China, Japan, and India, have a high potential for implementing fleet management, due to the presence of a large number of commercial vehicles and passenger cars. Additionally, China accounts for more than 50% of the Electric Vehicles (EVs) sales complemented with a range of financial incentives and regulations that encourage buyers to choose EVs. This is also expected to boost the fleet management software market in APAC.

Major solutions in the best fleet management software market are operations management, vehicle maintenance and diagnostics, performance management, fleet analytics and reporting, and others (accident management and toll management). The operations management segment is expected to have the largest share in the fleet management software market during the forecast period. The key trend contributing to this market growth is the increased use of telematics and remote diagnostics to ensure operational efficiency and compliance management.

Amongst services, the professional services section is likely to have a bigger share in the Best fleet management software market. Severe regulatory instructions are the main drivers for the acceptance of professional services across North America and Europe, causing the augmented requirement for consulting, deployment, and integration services. The managed services section is likely to see a greater CAGR during the estimated period, due to the growing focus on primary operations by major companies.

By deployment type, the Best fleet management software market is segmented into the on-premises and cloud. The cloud section is likely to grow at a higher CAGR during the forecast period due to its cost-efficiency and hassle-free integration. Among fleet types, the passenger cars segment is expected to lead the fleet management software market in terms of market size during the forecast period.

The competitive landscape analyzes and provides an overview of the prevailing competitive scenario in the Best Fleet management software market. The market is growing at a rapid pace across all regions. It provides information about the major players in the Fleet management market. It outlines the findings and analysis of how well each vendor performs within the specified criteria. We have placed vendors into four categories based on their performance in each criterion: visionary leaders, innovators, emerging companies, and dynamic differentiators.

This category of best Fleet management software includes: Tomtom, Donlen, Teletrac Navman, Element strategic fleet management, Chevin fleet solutions, Verizon communications, Trimble, Emkay, ARI simulation, ID systems, and Leaseplan.

This category of best Fleet management software includes: Wabco Holdings, Mix telematics, Omnitracs, Isotrack, AT&T, and TrustTrack.

This category of best Fleet management software includes: Merchants Fleet management, Wheels, Masternaut, Transpoco Vehicle tracking, E-drive technology, FleetFactz, Cartrack, Imarda, and Zonar systems.

This category of best Fleet management software includes: Geotab, GPSTrackIt, Workwave GPS, and FleetLocate

Market Dynamics

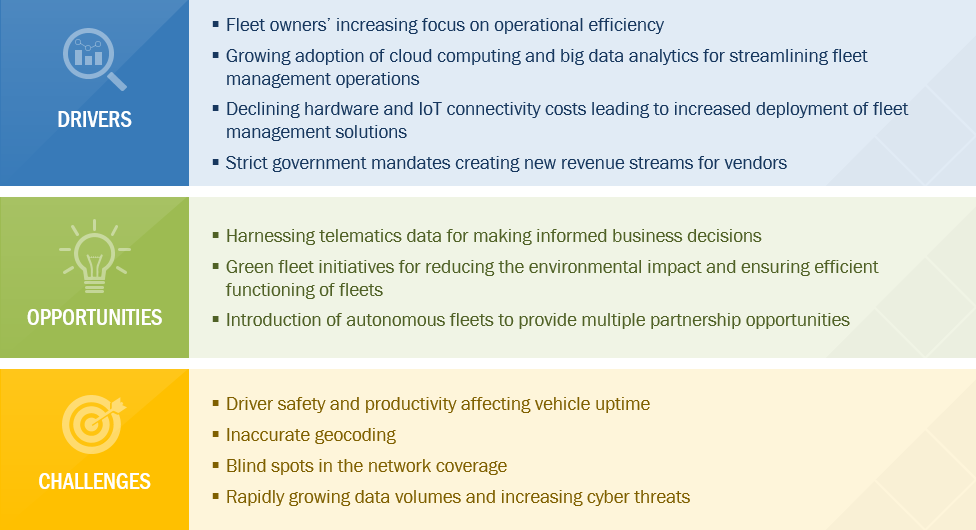

Drivers

Fleet owners increasing focus on operational efficiency

Every industry seeks maximum output at minimum cost. For fleet managers, the cost incurred on fleets holds a large portion of the company’s operating expenses. Fleet management software helps increase the profit for fleet owners by optimizing routing, ensuring vehicle security, increasing driver safety, and improving the performance and life cycle of fleet vehicles. Best fleet management software also helps visualize fleet performance and identify which drivers or savings categories should be targeted for improvement. Fleet management helps the managers in rightsizing fleet vehicles, maintenance management, reduce fuel cost and distance traveled, modify driver behavior, and lower overhead costs. The benefits boost the cost-effectiveness of business operations for fleet owners, providing them a competitive edge. The advantages have increased the business potential of fleet management software and enhanced the investment inflow in the fleet management market.

Growing adoption of cloud computing and big data analytics solutions for streamlining fleet management operations

The adoption of cloud computing provides much-needed benefits to fleet owners in terms of real-time fleet visibility, cost-effectiveness, improved vehicle uptime, and lower maintenance cost. On-premises fleet management solutions may not provide these advantages. Therefore, fleet management service providers are progressively leveraging cloud technologies to offer scalable solutions that cater to altering customer needs. Cloud-based solutions can be accessed from anywhere through multiple devices. Best fleet management software enables fleet managers and owners to easily monitor their fleets and make quicker and more informed decisions related to fleet operations.

Big data analytics is among the biggest drivers in fleet management. Speed, efficiency, and reliability are the factors that determine the success of the fleet business. With technology advancements and increasing digitization, organizations generate enormous amounts of data but struggle to gain significant benefits from them. Big data analytics brings the real value of data to improve operational efficiencies and customer satisfaction at reduced costs. The rapid increase in big data applications has led to the need for developing innovative technologies to optimize cost efficiency. Thus, these factors are expected to drive the demand for new analytics platforms and new data storage centers.

Declining hardware and IoT connectivity costs leading to increased deployment of fleet management software

Hardware and connectivity costs are steadily declining, which have enabled the rapid development and deployment of fleet management software. For instance, the decline in sensor cost has boosted the development of embedded telematics solutions. The decreasing connectivity cost has also enabled emerging vendors to leverage the benefits of telematics solutions and build embedded connectivity modules. Due to the decreasing connectivity cost, the adoption of telematics is increasing across commercial industries. Even small fleet owners are adopting new and advanced telematics technologies and applications to ensure the safety and security of their fleet vehicles and drivers.

The IoT technology has enabled the ubiquitous presence of RFID and GPS sensors and detectors on vehicles and infrastructures. It enables the collection, transmission, and analysis of multiple attributes, such as temperature, heat, pressure, condition, and location. It also helps improve the maintenance cycle of vehicles, and the data from vehicles can be used by fleet managers to optimize the vehicle presence in different routes. IoT enables scheduled maintenance of vehicles and connects assets to reduce resource intensities and costs.

Severe government guidelines creating fresh revenue streams for vendors

Governments around the world are emphasizing on making vehicles effective. As of now, many regional governments are focusing on deploying vehicle tracking in commercial vehicles. For instance, in May 2016, the Ministry of Road Transport & Highways, Government of India, issued a notification for all transport vehicles to be equipped with vehicle location tracking device, Closed-Circuit Television (CCTV)-based surveillance system, and one or more panic/emergency buttons, which would be fitted by the manufacturer or their dealer or the respective operator. The major factor behind this mandate is safety. As remote tracking enables the authorities to track any vehicle that deviates from its route, it helps the authorities to take corrective actions.

Opportunities

Harnessing telematics data for making informed business decisions

Telematics data can be defined as any data transferred between a telematics system and the central point of collection. It can be drivers’ personal data, inspection data, or diagnostic data. Using analytics, the data can be harnessed to gain valuable insights into the driving patterns, fuel levels, engine health, and route deviations. Insurance companies are early adopters of telematics solutions for risk assessment. In the current market scenario, the data sharing regulation and data security are hindering the use of telematics data. However, in the near future, Fleet management software vendors are expected to leverage telematics data for devising new revenue generation streams.

The advancements in V2X communications would trigger the generation of enormous amounts of data, which can be leveraged in real time to identify the best possible routes, road conditions, traffic, as well as weather conditions. It opens up a significant opportunity for data management and analytics providers who, in turn, can benefit by gaining actionable insights from the unstructured data.

Green fleet initiatives for reducing the environmental impact and ensuring efficient functioning of fleets

Fleet operators are increasingly adopting green practices that mutually benefit the environment and enterprises’ fleet operations. The prevalent approach of implementing green technology involves scaling down vehicle weight, using lower-carbon fuels, and regular maintenance of fleets, but these approaches are cost-prohibitive and time-consuming. As fleets’ contributions to harmful greenhouse emissions continue to rise, there is a growing need to find solutions that offer both fiscal and environmental benefits. To support the need, governments are now incentivizing fleet owners on every purchase of fuel-efficient fleets or the use of alternate fuels. The rewards can be offered as low-cost loans, tax credits, and vouchers. The incentives comprise green bank loans, green insurance plans, attractive electric vehicle prices, and green registration of vehicles.

Introduction of autonomous fleets to provide multiple partnerships opportunities

The investments in autonomous vehicles have witnessed a huge upsurge over the past three years, where many vehicle manufacturers are collaborating with technology vendors to gain the early mover advantage. Many organizations have increased their investments to get a competitive edge in this stream. Forecast to a multi-billion dollar opportunity, autonomous fleets are inviting automakers, ride-hailing firms, and technology providers to collaborate in order to gain maximum share in the self-driving technology.

Challenges

Driver safety and productivity affecting vehicle uptime

Driver safety and productivity are the two vital aspects on which fleet efficiency largely depends. The driving pattern affects engine performance, with driver productivity directly affecting the overall cost and fleet efficiency. Driver safety, if compromised, can lead to accidents and to associated repair and downtime costs. Lowering the accident rates is likely to automatically lower insurance costs, which can help fleet owners qualify for better insurance rates. Driver retention and lack of drivers are the constant challenges for fleet owners. Moreover, drivers are less aware of safety procedures, and they may be exploited by excess driving hours and lower incentives. It leads to high driver attrition rates. Companies are introducing driver training sessions to reduce the number of accidents. Third-party service providers are also developing safety training modules and programs. Moreover, the government HOS command has caused an increased driver satisfaction, which is likely to lower attrition rates.

Inaccurate geocoding

Accurate geocoding is a must feature in fleet routing. Every route optimization algorithm works with an inbuilt geocoding functionality. However, converting addresses into a particular point on the map to precise latitude and longitude coordinates is not an easy task. Understanding ambiguous addresses and comprehending local contexts are key processes for accurate geocoding, coupled with a robust database of local addresses and apartment locations. Without an accurate address to geocode lookup, the best route optimization algorithms cannot work efficiently and might lead to non-desired locations along with time and fuel wastage.

Blind spots in the network coverage

Fleet management software and services require a network or satellite coverage to function at high efficiency. The coverage is provided either through relay towers or satellite networking. However, various spots and locations have not yet been tapped by the network coverage. Such locations or patches are known as blind spots. When vehicles pass through these patches, communication is hampered due to inconsistent network coverage, thus hampering the overall efficiency for some period. It is a major challenge for the fleet management market, as the emerging economies in APAC, MEA, and Latin America constitute a major part of their landmasses, which are blind spots for network coverage. Addressing the blind spot challenge will help boost the growth of not only the telematics industry, but also the overall network-based solutions and systems industries, such as telecom, networking, and IT, in these regions.

Rapidly growing data volumes and increasing cyber threats

The introduction of telematics in fleets has triggered the generation of large volumes of data. It opens a window for hackers and cybercriminals. Data related to fleets contains sensitive information, such as the vehicle make, drivers’ personal details, and routes traversed. The data can be exploited for carrying out malicious or criminal activities, including vehicle robberies and planned crime. Data privacy infringement is a major reason discouraging end-customers from using telematics solutions, especially in North American countries and China, where regulations are stringent. The issue is currently being observed by countries, and several data-related laws and regulations are being gradually rolled out. However, currently, a uniform global standard has not been implemented to address the data breach issue.

Best Fleet Management Software, By component

Best fleet management software is broadly classified into solutions and services. The solutions segment is further categorized into operations management, vehicle maintenance and diagnostics, performance management, fleet analytics and reporting, and others (accident management and toll management). The services segment is bifurcated into professional services and managed services. The professional services segment is further sub-segmented into consulting, implementation, and support and maintenance.

Solutions

The aim of Best fleet management software is to reduce risks, improve safety & security, monitor the fleet, and optimize fleet operations. It helps reduce the total cost of ownership, protect investments in assets, assist in asset inventory management, facilitate preventative maintenance in compliance with the vehicles’ OEM guidelines, and reduce repair costs by improving fleet safety. Besides, these solutions can lead to optimizations that increase productivity, mitigate risks, retain drivers, and lower costs over the long term.

Solutions: Market Drivers

Rising need for increased operational efficiency is driving the solutions segment.

Cloud-based fleet management software are expected to drive the segment growth as SMEs would be the major adopters of these solutions.

Telematics-based solutions are expected to drive the solutions market as telematics is being increasingly used for improving driver and vehicle performance and maintenance management, apart from asset tracking purposes.

Services

Services play a vital part in the overall process of implementation and maintenance of fleet management software. Knowing the installation and maintenance details before deploying fleet management software is very crucial for determining the exact time and cost investments required. For instance, some solutions installations may take months and can affect IT staff productivity. Best Fleet management software need to be integrated with the existing IT infrastructure of transportation companies and, therefore, the demand for shorter installation times is high. The services associated with fleet management software are essential for optimum operation. The overall cost of the installation depends on the complexity of the fleet management software and the integration requirements.

Services: Market Drivers

Growing demand for optimal fleet operations is driving the services segment.

Consulting services help remove glitches and reintegrate functions in a by fulfilling clients’ business needs.

MSPs handle end-to-end deployment and after sales services for the solutions, which would drive the growth of the services segment in the market.

Best Fleet Management Software, By solution

The solutions segment in the Best fleet management software market comprises five major solutions – operations management, vehicle maintenance and diagnostics, performance management, fleet analytics and reporting, and others (accident management and toll management).

Operations Management

Operations management deals with the fleet’s operational efficiency. The major solutions such as location tracking and geofencing, and routing and dispatching aim at providing real-time location information of fleets and routes that result in increased visibility into the fleet operations. The data generated from the tracking of vehicles, drivers, and routes is used for analysis and reporting. This can yield improved efficiency across various aspects of operations, such as unsafe driving habits and identification and addressal of problematic routes.

Operations Management: Market Drivers

Increasing demand for route optimizations solutions is driving the adoption of operations management segment.

Need for real-time monitoring is pushing the fleet managers to opt for fleet tracking and geofencing solutions.

- Fleet tracking and geofencing

The fleet tracking solution sends the vehicles’ real-time location data to the operating fleet managers at the back end. This data offers vital information, such as anomalies, the locations covered, number of halts, and the vehicle location history and previous destinations. This solution generally uses the GPS installed in vehicles. GPS sends location data at regular intervals to central servers. Fleet managers have access to these servers, thus are well-equipped with information to make informed decisions and manage vehicles easily. Governments are increasingly focusing on deploying vehicle tracking systems to safeguard citizens from mishaps.

The geofencing technology uses GPS-enabled mobile devices to set up a virtual fence or boundary around designated areas. This technology enables the fleet managers or owners to perform several functions, such as monitoring the driver entry and exit from authorized areas, tracking unauthorized fleet vehicle use, and limiting vehicle use to specific areas. This solution helps in improving the efficiency of the fleet services by assisting in managing and tracking fleets that have many vehicles. It enables organizations to set up a series of geographic zones with time-based rules. The geofencing solution also helps in monitoring the idle time of the drivers, thereby increasing productivity. Furthermore, it helps in improving safety by monitoring vehicle speed, turns, breaks, and seat belt issues.

- Routing and scheduling

The routing and scheduling solution enables route construction, taking into account the hours allocated, pickup and delivery schedules, vehicle size constraints, vehicle-product compatibility, vehicle-loading dock compatibility, route restrictions, equipment availability, daily and multi-day route planning, reservations, and deadhead mileage. An active RFID system is also widely used with this solution, which consists of a reader, tag, and antenna to give freight managers an extra insight, thereby enabling them to make important adjustments in routing, re-routing, and scheduling. Best fleet management software also helps ensure accurate pickup and delivery, improve driver efficiency and dispatcher productivity, and reduce fuel costs. An inefficiency in fleet operations can increase fuel consumption and operational costs, resulting in decreased revenues. Hence, the routing and scheduling solution enables fleet management professionals to maximize and utilize fleet and mobile resources efficiently.

Vehicle maintenance and diagnostics

The vehicle maintenance solution comprises maintenance planning, preventive maintenance, and routine maintenance. It eliminates downtime in fleet operations by enabling schedule maintenance for brake inspections, transmission oil changes, engine oil changes, insurance renewals, or any other maintenance procedures. The solution also monitors in-house repairs and makes it easy to document and analyze vehicles that are performing and the ones affecting the overall fleet operational efficiency.

Fleet diagnostics is a vital element for monitoring the health of fleets, owing to the extensive distance coverage and high travel time. The solution integrates hardware and software technologies to extract fault codes and other required information from the Electronic Control Unit (ECU). The error or fault code is stored in the ECU memory and aids in fault identification to a certain extent.

The key challenge of OEMs is to provide after-sales support, as they have limited access to vehicles. Any maintenance activities can be performed only when the vehicle is brought to the service center, but using telematics, OEMs can get real-time access to the vehicle and are hence better informed and equipped to diagnose the problem beforehand. Benefits of OEM include proactive repairs and maintenance planning, increased vehicle uptime, and reduced maintenance costs and service time.

Vehicle maintenance and diagnostics: Market Drivers

The cost-saving capability of predictive maintenance is driving the demand for advanced vehicle maintenance and diagnostics solutions.

Advanced maintenance management solutions also help in minimizing the downtime caused due to unscheduled maintenance.

Performance Management

The performance management aims at driver and vehicle performance monitoring by tracking critical behaviors of drivers and vehicles that affect fuel consumption. The performance management provides fleet managers with actionable insights into their vehicles and drivers from the available fleet data, which can be capitalized to make better-informed decisions. It includes two major solutions, namely, driver management and fuel management.

Performance Management: Market Drivers

Increasing safety concerns demand for proper driver behavior monitoring which is also a primary factor in obtaining fuel efficiency.

The performance management solution is also gaining traction in developing regions, especially for commercial vehicles, due to the lack of adequate road infrastructure, inconsistent driving patterns, and less technological investments on vehicles.

- Driver Management

The key to managing a successful fleet is to invest in hiring, retaining, and managing drivers. Monitoring drivers’ behavior may result in substantial operational savings and enhanced fleet safety. The driver management solution deals with driver identification, driver performance and coaching, and driver support. The solution stores all vital driver information, such as profile pictures, license details, certificates, insurance, contact information, and more for secure and paperless management of records. The solution helps drivers obtain the best possible route to traverse and push notifications of new assignments. Moreover, it facilitates in-cab coaching that continually provides information to the driver for maintaining or improving driving skills, which reduces the operating costs and positively impacts both profitability and availability. On the other hand, it notifies fleet managers about the real-time location of the driver that helps them for better fleet allocation and driver safety. It also creates real-time driver performance scorecards and develops high-impact training programs based on an individual’s driving behavior.

The solution results in improved turnaround times, faster delivery authentication, reduction in detention times, and improved vehicle or driver utilization. Telematics plays a major role in driver management, as monitoring devices installed in vehicles can easily measure parameters, such as acceleration, deceleration, fuel consumption, and idle time in real time. Fleet operators leverage this data to frame certain policies for drivers, thereby reducing the possibility of rash driving. Technological advancements in sensors and telematics, and the integration of ICT into transportation act as significant factors influencing the growth of the driver management segment.

- Fuel Management

Monitoring and optimizing fuel consumption are crucial in the fleet management market, due to fluctuations in fuel costs, supplemented by the pressure of environmental sustainability. The fuel management solution imparts the ability to several fleet companies to gather fuel data and compare it with industry benchmarks. This solution also helps analyze fleet performance and discover ways to improve the fleet management process. The fuel management solution indicates the mileage related data, such as vehicle speed, braking patterns, vehicular halts, and routes taken. The fuel management solution is a vital area of focus in developing regions, especially for commercial vehicles, due to the lack of adequate road infrastructure, inconsistent driving patterns, and less technological investments on vehicles.

Fleet Analytics and reporting

The fleet analytics solution assists fleet companies to make smarter decisions by unlocking the business value of information hidden within massive amounts of fleet data. Using real-time analytics and predictive modeling techniques, unstructured data can be converted into actionable data. Accurate real-time information and predictive analysis help optimize fleet management operations to increase revenue by decreasing vehicle downtime and reducing fuel costs. Analytics in Best fleet management software also optimizes various functions, such as vehicle maintenance, vehicle telematics, vehicle tracking and diagnostics, driver management, vehicle fuel, and health and safety management. The predictive analytics and real-time analytics tools help meet the dynamically changing targets in the fleet management ecosystem that consists of dynamic customer needs, real-time vehicle state, and varying driver attributes.

Fleet Analytics and reporting: Market Drivers

Rise in the deployment of IoT sensors has led to a massive increase in the data generation, resulting into a huge growth in the demand for analytics solutions.

Organizations, in order to maintain the effective run time and reduction of downtime, are increasingly focusing of the data flow from vehicle sensors.

Others

The others segment includes accident management and toll management. The accident management solution helps reduce repair costs, insurance premiums, and production downtime by capping repair costs, making sure drivers get back on the road, and helping fleet managers identify the drivers who need further training. Accident management companies provide a cost-effective solution that can not only save the company’s additional costs but also reduce the number of accidents on the roads. The toll management solution comprises several features, such as centralized controls, reporting, and payment processing.

Best Fleet Management Software, By service

The Best fleet management software services segment is broadly divided into professional services and managed services. The professional services division comprises consulting, implementation, and support and maintenance. Fleet management software providers offer professional and managed services to plan, design, implement, and deploy the solutions in various fleets.

Professional Services

Professional services are required during and after the implementation of fleet management software. These services include planning, designing, consulting services, support services, IT maintenance, repairs, and upgrades. Companies offering professional services encompass consultants, fleet management experts, and dedicated project management teams that specialize in the design and delivery of critical decision support software, tools, services, and expertise.

Professional service providers study the fleet operations of logistics companies, thereby comprehending business constraints, providing major insights that help these companies optimally utilize all available resources, and make the most of their technological investments. Major professional service vendors include Donlen, Masternaut, and Verizon Connect. The growth in the professional services segment is mainly governed by the complexity of operations and the deployment of fleet management software.

Professional Services: Market Drivers

Rise in the demand for fleet tracking solutions has enhanced the requirement of implementation services in the developing economies.

As the market is attaining maturity in the developed economies, the demand for maintenance and upgrades for solutions is increasing.

- Consulting

Consulting primarily focuses on managing the operations’ resolution programs and the latest technology updates to help clients achieve their strategic business goals through technical and business improvements. Technology consulting helps clients achieve a strong business mechanism and powerful decision-making capacities. It ensures increased realization of benefits and proactive risk management associated with the implementation of fleet management software.

Consulting service providers analyze the entire system, its subsystems, and their relationships. Additionally, they provide recommendations for implementing newer technologies, such as integrating fleet management software tems, enhance security, reduce operational costs, and save energy. Consulting includes the processing of financial and business models of newly introduced fleet management services, fleet management software implementation, project management, and process analysis and optimization.

- Implementation

The fleet management software is an integration of several interdependent systems. As fleet management software is highly scalable, there is an increasing need for communication between the sub-systems of fleet solutions. This implies that there should be consistent coordination and communication among external software suppliers, internal IT departments, and external supply chain partners. Integration services help fleet management companies to collect and analyze data about operations, enhance the decision-making process, increase efficiency, and reduce costs. These services also enable measurement, monitoring, and management of all fleet operations in real-time. Moreover, these services help connect several applications of fleet systems, such as security applications, monitoring, alarms, and notification systems.

- Support and Maintenance

Support and maintenance services involve the assistance provided for installed solutions. These services include 24/7 troubleshooting assistance, upgrading of existing software, problem-solving, repairs, replacing failure types, emergency response management, field maintenance, proactive services, technical support by technicians, and test scenario management. Support and maintenance monitors the health of devices deployed inside fleets. It also includes regular system check-ups, backup support, and hardware and software maintenance to provide security and minimize losses due to threats. Support and maintenance helps improve operations and assists in gaining control over the existing systems.

Managed Services

Managed services are crucial, as they are directly related to customer experience. Companies cannot afford to compromise on this factor, as it helps them sustain their positions in the market. Moreover, it has become difficult for companies to focus on core business processes and support various other functions, which increases the significance of managed services. These services offer technical skills that are required to maintain and update the software in the fleet management ecosystem. All pre- and post-deployment queries and needs of customers are addressed under managed services. Companies mainly outsource such services to offer customers on-time delivery. Integrated facility management, consultancy, and round-the-clock helpdesk are some upcoming managed services fleet operators require. The managed services segment is mainly driven by the increasing adoption of outsourced managed services across fleets.

Managed Services: Market Drivers

The requirement for managed services is increasing due to cost-efficiency capabilities. Managed services also provide a hassle-free experience and helps organizations focus on core operations.

Best Fleet Management software, By deployment type

The deployment type in the Best fleet management software market comprises two major types: on-premises and cloud. The decision with respect to deploying fleet management software on-premises or on cloud entirely depends on an organization’s structure, such as its size, the number of employees, and, most importantly, its financial capabilities. The deployment types have certain advantages and disadvantages, depending on which, organizations select the ones that suit their needs. Companies are now showing a significant shift in changing their corporate operations and offerings to match the increasing need for the subscription-based pricing model for delivering SaaS solutions. The growth of cloud-based fleet management software deployment is expected to rise, as it is less expensive than on-premises deployment.

On-premises

Enterprises largely adopt on-premises-based solutions to have full control over their infrastructure and assets, along with being able to ensure robust security. Moreover, this deployment type involves competent management from the IT department, which the large enterprises already have, along with enough capital, to expand their IT infrastructure. Furthermore, on-premises-based fleet management software easily integrate with the existing workflow systems, such as the Customer Relationship Management (CRM), Digital Asset Management (DAM), and Enterprise Content Management (ECM). However, the large costs associated with on-premises-based implementation, along with the expenses involved for the expansion of IT, hinders the adoption of this type in Small and Medium-sized Enterprises (SMEs).

On-premises: Market Drivers

Data security and maintenance to sustain the growth of on-premises fleet management software deployment would drive the growth of the segment.

Data protection centric regulations, such as General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA) are also boosting the on-premises deployment mode, which is expected to drive the growth of the segment in the market.

On-Cloud

The prevalent use of the internet, along with the large-scale adoption of diverse technologies, such as mobile, web, and social media, have aided the growth of digital content. Organizations demand solutions to better manage and repurpose their native and web-based content, along with integrating it with other systems in fleet management, such as the CRM and marketing resource management, to fortify their marketing endeavors and enable real-time content collaboration among employees cost-effectively for analysis and other purposes. However, such solutions are expensive and offer limited scalability. This, in turn, encourages companies to adopt cloud-based fleet management software. These solutions deliver all the benefits at reduced costs, as they do not involve high upfront costs. In addition, they facilitate organizations with scalability and the ease of accessibility of organizational content, regardless of the employee location, thereby helping business continuity.

Though apprehensions are prevalent about security in the cloud, the adoption of cloud-based fleet management software is significantly gaining momentum. SMEs significantly consider and prefer cloud-based fleet management software, as cloud-based deployment requires less capital investment, decreases operational and maintenance costs, and reduces the management effort. However, large enterprises prefer on-premises-based solutions that can easily integrate with their ongoing workflows, while also offering direct control of their infrastructure for augmented security.

On-Cloud: Market Drivers

Performance and cost-efficiency are expected to drive cloud deployments of loyalty management solutions.

Cost-effectiveness and flexibility provided by cloud-based deployment to drive the adoption of cloud-based fleet management software and services.

Low set-up costs for running cloud-based fleet management software is driving the adoption of cloud deployment type.

The ease of customization offered by cloud-based fleet management software would boost the demand for cloud-based deployment type.

Best Fleet Management Software, By fleet type

The Best fleet management software market caters to various fleets, primarily in the commercial sector. In the report, the market is segmented under two major fleet types: commercial fleets and passenger cars. These fleets are increasingly deploying advanced fleet management software to achieve better operational efficiency, reduce costs, and improve the vehicle’s lifecycle.

Commercial Fleets

The commercial vehicle sector can be broadly classified into LCV and M&HCV, based on the Gross Vehicle Weight (GVW) of the vehicle. The commercial fleet includes city buses, motor coaches, ambulances, and long-haul delivery trucks. Fleet management software help manage commercial vehicles efficiently by providing real-time vehicle monitoring and data transmission for faster response and delivery. Additionally, they provide GPS tracking to provide safety, more efficient navigation, and manage drivers and their schedules to comply with regulations. The trends that are shaping the commercial fleet industry include the rapid urbanization and improvement of road infrastructure and regulatory policies influencing commercial vehicle buyers. Suppliers focus on improving the local capacity and investing in R&D, thereby improving the operational efficiency and developing unique selling propositions of commercial fleets.

- Light commercial vehicles

LCVs include pickup trucks, vans, and all commercial goods or carriers. The LCV category was introduced with the compact truck design in mind. It is usually optimized to be ruggedly built, with lower operating costs and powerful yet fuel-efficient engines, for utilization in intra-city operations. These small fleets are also adopting telematics as a tracking solution. However, they have been slow in adopting fleet management software, thus making fleet managers seek fuel-efficient vehicles and the options to monitor and track vehicles, and the driver’s behavior. Fleets consider using Total Cost of Ownership (TCO) as an important procurement and fleet management trend.

- Medium and heavy commercial vehicles

The M&HCV segment includes passenger and goods carriers, and medium and heavy trucks, which include trailer trucks, super heavy/special duty trucks. Buses are passenger carriers and trucks are goods carriers, along with specialized vehicles, such as dumpers and tractor-trailers. Vendors catering to the M&HCV segment are geared up to meet and provide solutions ranging from highly demanding transport applications for inner-city and regional distribution to long-distance trips.

Passenger cars

Passenger cars are vehicles with a seating capacity of up to 6 persons, excluding the driver. In line with the agreed categories of sub-classification, passenger cars are further classified into the following segments: mini cars, compact cars, midsize cars, executive cars, premium cars, and luxury cars. Leasing a small fleet of cars, minivans, or pickups is easier and more advantageous than ever. The associated services include supply chain management, maintenance, licensing and compliance, fuel management, and accident claims for keeping the vehicles well maintained.

- Internal combustion engine

ICE has been in the adoption for quite a long time. It includes vehicles with diesel, petrol, and gas-based combustion, which contributes to a share of around 95% in total vehicles. The growth of ICE is relatively stagnant due to an increased focus on green fleets. It is expected that over time, the adoption of ICE would decline, leading to a rise in the number of Electronic Vehicles (EVs) in fleet management. Regulations in China and some countries of Europe are highly supportive of EVs, and several logistics companies are updating their ICE fleets to electric fleets. However, the adoption of ICE would witness a gradual fall and would not decline at a fast pace as several fleet management customers still prefer ICE, considering them more reliable. In addition, there is a huge need for infrastructure support, such as charging stations for EVs to function properly, which again would require a huge amount of time to be set up at a global level.

- Electric vehicles

The transportation sector across regions is witnessing increased adoption of EVs. EVs include Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs). The factors, such as the rise in the need for fuel efficiency and environmental concerns, are contributing to the growth in the adoption of EVs. In addition, there is a strong push from governments and regulatory bodies across regions to curb fuel consumption and pollution, which is expected to enhance the adoption of EV fleets.

Best Fleet Management Software

WABCO’s unique mixture of industry-leading technology united with the unconventional functionality of Fleet Management Solutions is serving fleets to access new heights of operating efficiency and safety. WABCO assists fleets of all sizes with info on truck, trailer and driving routine, and assimilates this into one FMS desktop application. WABCO is also employed at every stage in the value chain to help maximize the vehicle's productive time.

The softwaare is one of the most thriving cloud-based solutions for fleet management and field services. The solution can be used for planning the delivery routes and optimizing the routes for faster delivery using the shortest and fastest routes. The solution eliminates the unprofitable time in the field. The software is a mobile-based and convenient field service software which sync with both computer and smartphones. The integrated GPS (Global Positioning System) offers complete visibility and points down the exact location of the delivery vehicle. Given the fact that it could be used for various services – food delivery, grocery delivery, logistics, field service, pest control service, and much more – the software is a fast-growing solution that connects with several business aspects and insights and provides outstanding customer service. This is achieved through its integrated set of software solutions – PestPac, WorkWave Service, WorkWave Route Manager, and WorkWave GPS.

- Enterprise

- SME

- Startups

Fleet management, a discipline of asset management, enables companies to manage the entire fleet operation, thus resulting in controlled costs, maximized profitability, improved fleet efficiency, and fleet-related risk mitigation and compliance with government regulations. The fleet management market is highly competitive due to the presence of many market players, including top-tier and mid-tier companies. The fleet management industry is gradually adopting advanced technologies, and various fleet organizations are undertaking green initiatives to reduce environmental impact and increase the overall fleet efficiency.

Fleet management, a discipline of asset management, enables companies to manage the entire fleet operation, thus resulting in controlled costs, maximized profitability, improved fleet efficiency, and fleet-related risk mitigation and compliance with government regulations. The fleet management market is highly competitive due to the presence of many market players, including top-tier and mid-tier companies. The fleet management industry is gradually adopting advanced technologies, and various fleet organizations are undertaking green initiatives to reduce environmental impact and increase the overall fleet efficiency.

The global fleet management market size is expected to grow to USD 34 billion by 2025, at a CAGR of 11%. The growth of the market can be attributed to the cost benefits versus Software-as-a-Service (SaaS) and cloud-based deployments of fleet management solutions.

Growing adoption of cloud computing and analytics is driving the growth in the Fleet Management Market

This report identifies and benchmarks the best fleet management software vendors such as ARI Fleet Management (US), Azuga (US), Chevin Fleet Solutions (Australia), Inseego (US) and Donlen Corporation (US), and evaluates them on the basis of business strategy excellence and strength of product portfolio within the Fleet Management ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. Best fleet management software vendors are rated and positioned on 2x2 matrix, called ‘Company Evaluation Quadrant’, and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies. This report also identifies and benchmarks the top fleet management solution start-ups, positioned on the 2x2 matrix, and identified as Progressive Companies, Starting Blocks, Responsive Companies, or Dynamic Companies.

The report includes market-specific company profiles of all 26 players and assesses the recent developments that shape the competitive landscape of this highly fragmented market.

This report identifies and benchmarks the best Fleet Management software vendors such as ARI Fleet Management (US), Azuga (US), Chevin Fleet Solutions (Australia), Inseego (US) and Donlen Corporation (US), and evaluates them on the basis of business strategy excellence and strength of product portfolio within the Fleet Management ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More