Managed Services - Healthcare and Life Sciences

The developing IT infrastructure has empowered clients across different verticals by smoothening their business processes, thereby also improving their operational efficiencies. The healthcare vertical consists of a range of clientele from large hospitals, rural medical centers, blood & tissue processing organizations, and multi-location clinics and large hospitals. Managed service providers facilitate this vertical by offering managed services such as staff augmentation, server and application support, hosted communication services, remote and collocated infrastructure, and disaster recovery platforms. Managed service providers help this vertical by managing their IT and network needs, thereby providing the vertical time to focus on its core business. MSSPs take care of crucial patient data and offer simple and budget-friendly cyber security solutions to clients.

Converting discoveries and research to result in commercially viable products is a big challenge life sciences organizations face. At the same time, improving the IT efficiency of the organization to drive business innovation is a tedious task organizations face. Managed service providers empower life sciences organizations by managing their IT infrastructure, protecting crucial data, and leveraging organizations to become more agile to drive business innovation.

COMPETITIVE LEADERSHIP MAPPING TERMINOLOGY

21 companies offering Managed Services in Healthcare and Life Sciences were analyzed, shortlisted and categorized on a quadrant under Visionary Leaders, Innovators, Dynamic Differentiators, and Emerging Companies.

IBM, Cisco, Accenture, Fujitsu, Atos, Tata Consultancy Services, and HCL have been identified as visionary leaders as they have established product portfolios and a robust market presence and business strategy.

Dimension Data, Dataprise, and Netmagic (An NTT Communications Company) have been identified as innovators as these vendors have a very focused product portfolio. However, they do not have very strong growth strategies for their overall business.

OneNeck IT Solutions, Onepath, Calance, and Melbourne IT have been identified as emerging companies. They do not have very strong business strategies as compared to other established vendors. They might be new entrants and require some more time before gaining significant traction in the market. Atos, Unisys, and DXC Technology have been recognized as dynamic differentiators.

The competitive leadership mapping (Quadrant) showcased below provides information for 21 major players offering Managed Services. Vendor evaluations are based on two broad categories: product offering and business strategy. Each category carries various criteria, based on which vendors have been evaluated. The evaluation criteria considered under product offerings include breadth of offering, delivery (based on industries that the vendors cater to, deployment models, and subscriptions), features/functionality, delivery, product quality and reliability, and product differentiation. The evaluation criteria considered under business strategy include geographic footprint (on the basis of geographic presence), channel strategy and fit, vision alignment, and effectiveness of growth (on the basis of innovations, partnerships, collaborations, and acquisitions).

VISIONARY LEADERS

Visionary Leaders generally receive high scores for most evaluation criteria. They have a strong portfolio of managed services. IBM, Cisco, Accenture, Fujitsu, Atos, Tata Consultancy Services, and HCL are the leading players in the managed services market, and are recognized as leaders. These vendors are making their presence felt by offering services that are required by most organizations. They have a robust business strategy to achieve continued growth in the market.

INNOVATORS

Innovators demonstrate substantial product innovation as compared to their competitors. They have a wide portfolio of managed services and the potential to build strong business strategies for their business growth to be at par with the leaders. Dimension Data, Dataprise, and Netmagic (An NTT Communications Company)are recognized as innovators. These vendors have been providing managed services as per their customer demands. Innovators have been at the forefront in deploying their services based on the clients’ custom software requirements for the niche market.

DYNAMIC DIFFERENTIATORS

Dynamic Differentiators have a strong business strategy with an extensive channel network and reach. Over the years, the dynamic vendors have been consistently generating positive revenue growth in the managed services market with their service offerings. Moreover, their market position is enhanced by organic and inorganic strategies undertaken by them over the period. Atos, Unisys, and DXC Technology are recognized as dynamic differentiators.

EMERGING COMPANIES

OneNeck IT Solutions, Onepath, Calance, and Melbourne IT are recognized as emerging players in the managed services market. The emerging players are specialized in offering highly niche and tailor-made solutions and services to their clients. These companies enable enterprises to not only build and manage content-driven processes but also support new ways of working to drive business results.

Managed Service are also deployed in Media and Entertainment, BFSI, Consumer goods and Retail, Manufacturing, Education, Telecom and IT, Energy and Utilities and Government and Public.

Managed Services in Healthcare and Life Sciences

Melbourne IT Cloud Managed Services are modern systems, professional processes, and third-party tools that drive speed and efficiency in the service offering. Melbourne IT Cloud Management supports desk platforms, project management, and security software and provides ongoing management of digital solutions. The company is designed to make a positive impact on businesses, by increasing business efficiency, reducing costs and overheads and making data valuable for creating experiences that can retain customers, both internal and external.

- Enterprise

- SME

- Startups

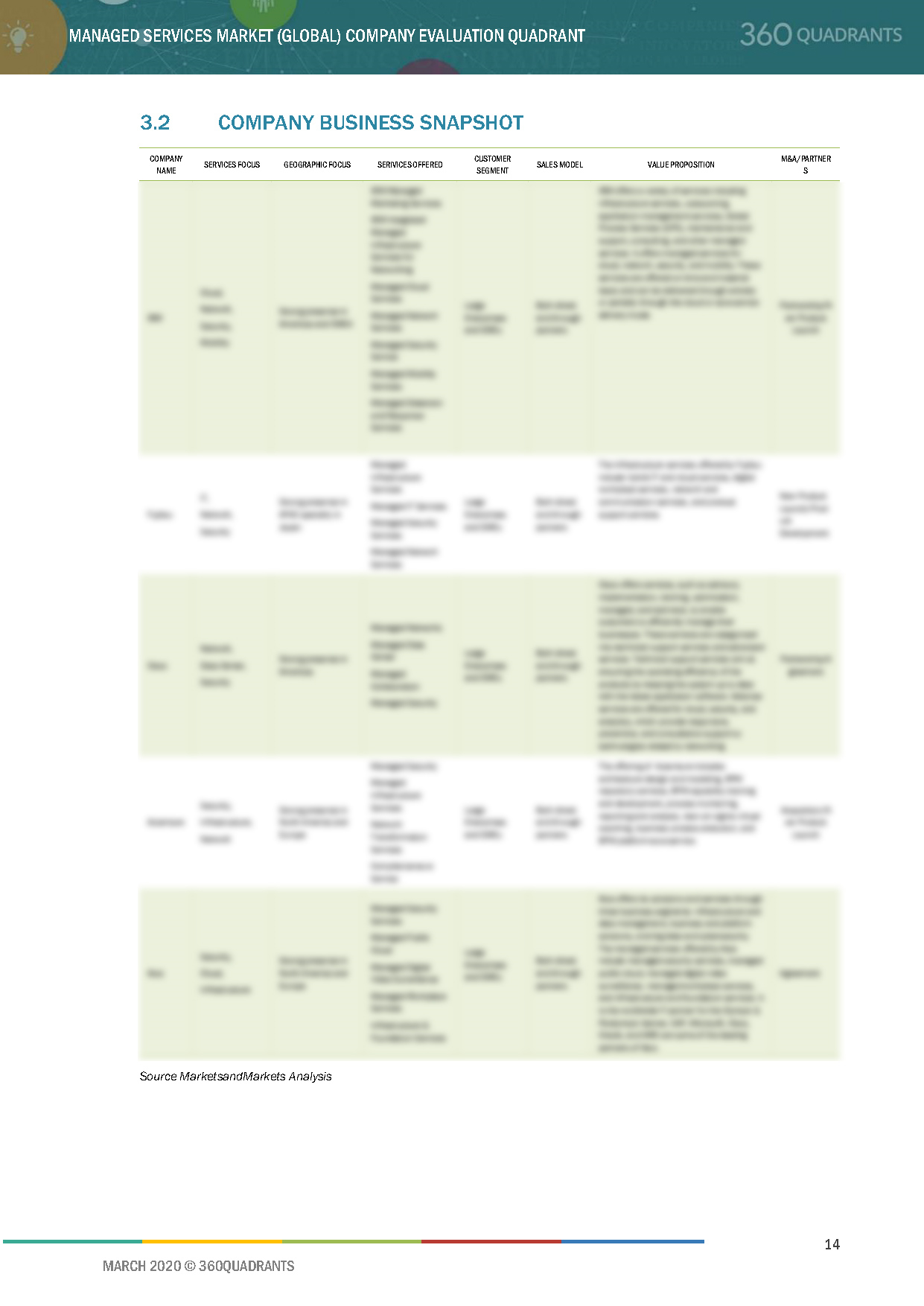

This report identifies and benchmarks world’s best Managed Services vendors such as IBM (US), Cisco (US), Fujitsu (Japan), Accenture (Ireland), Atos (France), DXC Technology (US) and evaluates them based on business strategy excellence and strength of product portfolio within the Managed Services ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders (top companies), Dynamic Differentiators, Innovators, or Emerging companies.

This report identifies and benchmarks world’s best Managed Services vendors such as IBM (US), Cisco (US), Fujitsu (Japan), Accenture (Ireland), Atos (France), DXC Technology (US) and evaluates them based on business strategy excellence and strength of product portfolio within the Managed Services ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders (top companies), Dynamic Differentiators, Innovators, or Emerging companies.

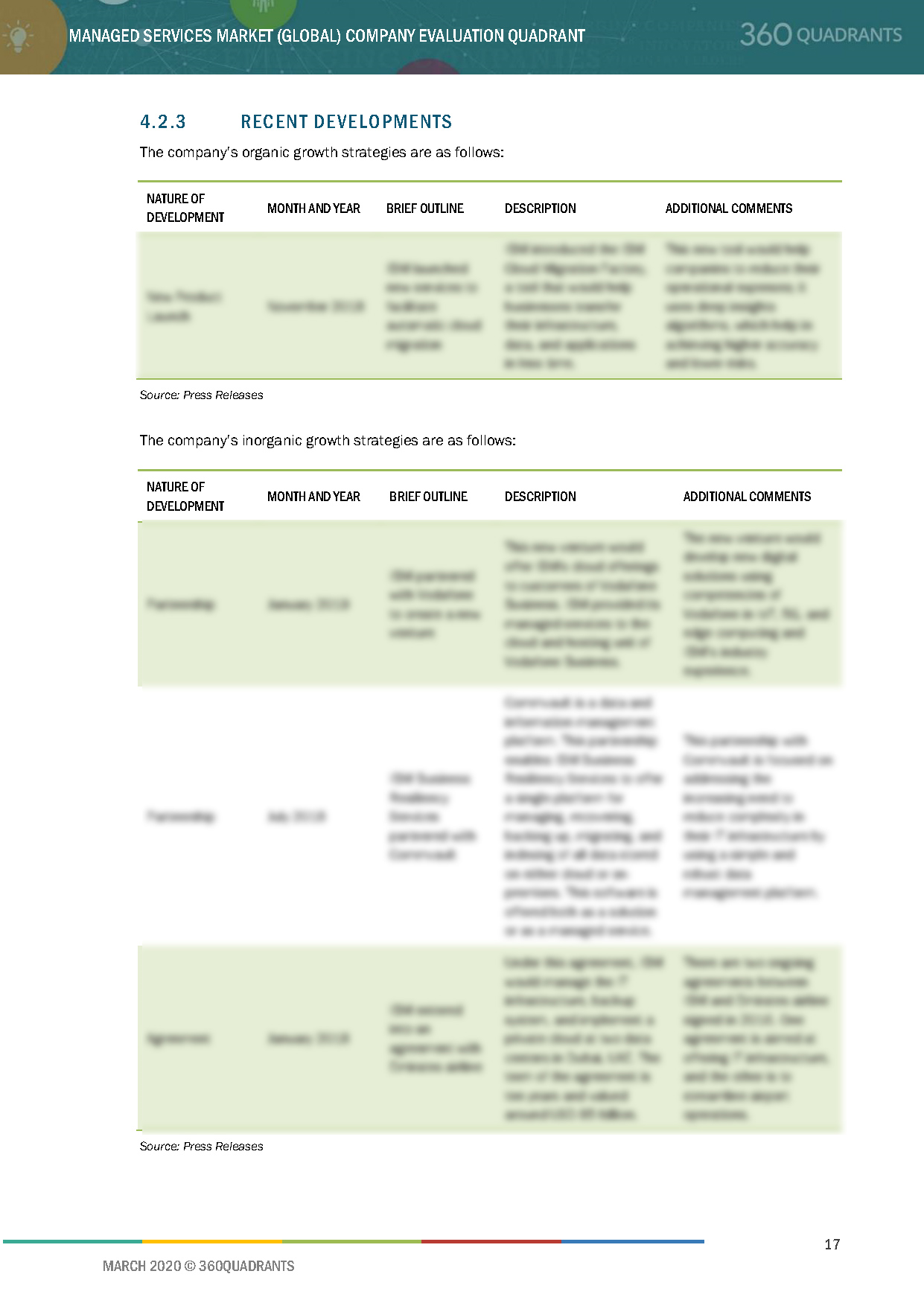

The report includes market specific company profiles of all 20 players and assesses the recent developments that shape the competitive landscape of this highly fragmented market.

Lack of IT skilled professionals, and cost reduction and lower IT budgets to force enterprises to leverage managed services to drive Managed Services market

Managed services facilitate enterprises in managing their IT system requirements on a regular basis to improve users’ IT operations. Enterprises focus on their core business competencies, while Managed Service Providers (MSPs) take care of their IT infrastructure and IT functions related to network, security, data center and IT infrastructure, communication and collaboration, business operations, and mobility. Managed services enable enterprises to improve their business productivity, end-user productivity, and reduce their IT infrastructure cost.

The global managed services market is expected to grow to USD 329 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 8.1%. Factors such as high cloud adoption and increase in the automation in IT environments and continuously growth in the demand for managed services among Small and Medium-sized Enterprises (SMEs) are expected to create ample opportunities for managed services vendors.

Managed Services : Market Dynamics

This report identifies and benchmarks world’s best Managed services vendors such as IBM (US), Cisco (US), Fujitsu (Japan), Accenture (Ireland), Atos (France), DXC Technology (US) and evaluates them based on business strategy excellence and strength of product portfolio within the Managed Services ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders (top companies), Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More